FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

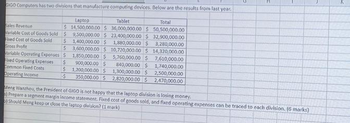

Transcribed Image Text:GIGO Computers has two divisions that manufacture computing devices. Below are the results from last year.

Sales Revenue

Variable Cost of Goods Sold

Fixed Cost of Goods Sold

Gross Profit

Laptop

Tablet

Total

$ 14,500,000.00 $ 36,000,000.00 $ 50,500,000.00

$9,500,000.00 $ 23,400,000.00 $ 32,900,000.00

$ 1,400,000.00 $ 1,880,000.00 $ 3,280,000.00

3,600,000.00 $ 10,720,000.00 $ 14,320,000.00

1,850,000.00 $ 5,760,000.00 $ 7,610,000.00

840,000.00 $ 1,740,000.00

1,300,000.00 $

2,500,000.00

2,820,000.00 $ 2,470,000.00

Variable Operating Expenses $

bed Operating Expenses $

Common Fixed Costs

$

Operating Income

-$

900,000.00 $

1,200,000.00 $

350,000.00 $

G

MED

Meng Wanzhou, the President of GIGO is not happy that the laptop division is losing money.

a) Prepare a segment margin income statement. Fixed cost of goods sold, and fixed operating expenses can be traced to each division. (6 marks)

b) Should Meng keep or close the laptop division? (1 mark)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lita company has two divisions: Division A and division B. Last month the company's income before teax was $2000 and common fixed expenses were $800. division B's segmend profit margin was $1100. Divisions A's traceable fixed expenses were $300. How much was Divisions A's segment contribution margin? $1000 $400 $2000 $1400 None of thosearrow_forward1. Aladin Company Manufactures small battery that is used in clocks, toys and some other electronic devices. The last month's income statement of Aladin is given below: Sales (30,000 batteries) Less variable expenses Contribution Margin Fixed expenses Net operating income Total $300,000 $180,000 $120,000 $100,000 $20,000 Per Unit $10 $6 $4 Required: Prepare Aladin's new income statement under each of the following conditions: 1. The sales colume increase by 15%. 2. The selling price decreases by 20% per unit, and the sales volume increase by 30%. 3. The selling price increases by 50% per unit, fixed expenses increase by $20,000 and the sales volume decreases by 5%. 4. Variable expenses increases by 20% per unit, the selling price increase by 12%, and the sales volume decrease by 10%.arrow_forwardDavenport Incorporated has two divisions, Howard and Jones. The following is the segmented income statement for the past month: Howard Jones Total Sales revenue $ 800,000 $ 600,000 $ 1,400,000 Variable costs 400,000 480,000 880,000 Contribution margin $ 400,000 $ 120,000 $ 520,000 Direct fixed costs 200,000 100,000 300,000 Segment margin $ 200,000 $ 20,000 $ 220,000 Fixed costs (allocated) 150,000 150,000 300,000 Net operating income (loss) $ 50,000 $ (130,000) $ (80,000) What would Davenport's income (loss) be if the Jones Division was dropped?arrow_forward

- The centralized computer technology department of Hardy Company has expenses of $320,000. The department has provided a total of 4,000 hours of service for the period. The Retail Division has used 2,750 hours of computer technology service during the period, and the Commercial Division has used 1,250 hours of computer technology service. Additional data for the two divisions is following below: Retail Division Commercial Division Sales $2,150,000 $1,200,000 Cost of goods sold 1,300,000 800,000 Selling expenses 150,000 175,000 Determine the divisional income from operations for the Retail Division and the Commercial Division. Do not round interim calculations. Hardy Company Divisional Income from Operations blank Retail Division Commercial Division $- Select - $- Select - - Select - - Select - $- Select - $- Select - - Select - - Select - $- Select - $- Select - - Select - - Select - Income from operations $fill in the blank 19 $fill in the blank 20 Check My Work PreviousNextarrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Fixed expenses Contribution margin Net operating income (loss) 1,307,000 Department Total $ 4,210,000 Hardware $ 3,040,000 Linens $ 1,170,000 403,000 767,000 840,000 $ (73,000) 2,903,000 2,290,000 $ 613,000 904,000 2,136,000 1,450,000 $ 686,000 A study indicates that $379,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 15% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forwardRobinson Products Company has two service departments (S1 and S2) and two production departments (P1 and P2). The distribution of each service department's efforts (in percentages) to the other departments is: From S1 S2 S1 S2 To P1 10% 20% ? 10% S1 S2 P1 P2 – P2 $225,000 75,000 62,000 180,000 ?% The direct operating costs of the departments (including both variable and fixed costs) are: 30 Required: 1. Determine the total cost of P1 and P2 using the direct method. 2. Determine the total cost of P1 and P2 using the step method. 3. Determine the total cost of P1 and P2 using the reciprocal method.arrow_forward

- Wyrich Corporation has two divisions: Blue Division and Gold Division. The following report is for the most recent operating period: Total Company Blue Division Gold Division Sales $ 522,000 $ 391,000 $ 131,000 Variable expenses 160,670 89,930 70,740 Contribution margin 361,330 301,070 60,260 Traceable fixed expenses 286,000 239,000 47,000 Segment margin 75,330 $ 62,070 $ 13,260 Common fixed expenses 73,080 Net operating income $ 2,250 The Gold Division's break-even sales is closest to: $102,174 $261,043 $142,043 $518,750arrow_forwardOscar Clemente is the manager of Forbes Division of Pitt, Inc., a manufacturer of biotech products. Forbes Division, which has $4.18 million in assets, manufactures a special testing device. At the beginning of the current year, Forbes invested $5.05 million in automated equipment for test machine assembly. The division 's expected income statement at the beginning of the year was as follows. Sales revenue $ 16,080,000 Operating costs Variable 2,040, 000 Fixed (all cash) 7,600,000 Depreciation New equipment 1,610,000 Other 1,350,000 Division operating profit $ 3,480,000A sales representative from LSI Machine Company approached Oscar in October. LSI has for $5.85 million a new assembly machine that offers significant improvements over the equipment Oscar bought at the beginning of the year. The new equipment would expand division output by 10 percent while reducing cash fixed costs by 5 percent. It would be depreciated for accounting purposes over a three-year life. Depreciation would…arrow_forwardBed & Bath, a retailing company, has two departments-Hardware and Linens. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income (loss) Total $ 4,310,000 1,313,000 2,997,000 2,200,000 $ 797,000 Department Hardware $ 3,130,000 901,000 2,229,000 1,360,000 $ 869,000 Linens $ 1,180,000 412,000 768,000 840,000 $ (72,000) A study indicates that $377,000 of the fixed expenses being charged to Linens are sunk costs or allocated costs that will continue even if the Linens Department is dropped. In addition, the elimination of the Linens Department will result in a 11% decrease in the sales of the Hardware Department. Required: What is the financial advantage (disadvantage) of discontinuing the Linens Department? Financial (disadvantage)arrow_forward

- Indigo Chance Co. sells computers and video game systems. The business is divided into two divisions along product lines. Variable costing income statements for the current year are presented below: Computers VG Systems Total Sales $720,000 $480,000 $1,200,000 Variable costs 504,000 384,000 888,000 Contribution margin $216,000 $96,000 312,000 Fixed costs 255,060 Net income $56,940 (a) Determine the sales mix and contribution margin ratio for each division. Sales mix Computers VG Systemsarrow_forwardThe Carlsbad Corporation produces and markets two types of electronic calculators: Model 4A and Model 5A. The following data were gathered on activities during the third quarter: Sales in units Sales price per unit Variable production costs per unit Traceable fixed production costs Variable selling expenses per unit Traceable fixed selling expenses Allocated portion of corporate expenses Model 4A 5,500 $ 141 $ 30 $ 205,000 Model 5A MAN 3,250 $ 250 $ 55 $ 305,000 $ 15 $ 17 $ 12,500 $ 126,000 $ 17,500 $ 130,000 Required: Prepare a segmented income statement for last quarter. The statement should provide sufficient detail to allow the company to evaluate the performance of the manager of each product line.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education