Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

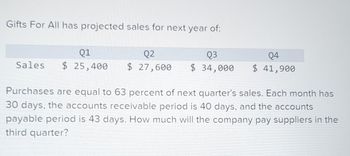

Transcribed Image Text:Gifts For All has projected sales for next year of:

Sales

Q1

Q2

Q3

Q4

$ 25,400 $ 27,600 $ 34,000 $ 41,900

Purchases are equal to 63 percent of next quarter's sales. Each month has

30 days, the accounts receivable period is 40 days, and the accounts

payable period is 43 days. How much will the company pay suppliers in the

third quarter?

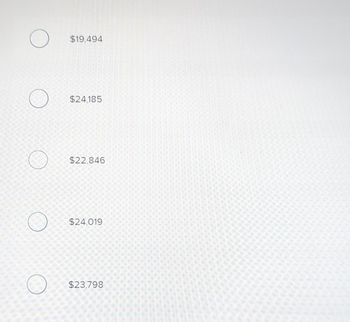

Transcribed Image Text:$19,494

$24,185

$22,846

$24,019

$23,798

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Receivables Investment Snider Industries sells on terms of 2/10, net 35. Total sales for the year are $1,400,000. Thirty percent of customers pay on the 10th day and take discounts; the other 70% pay, on average, 40 days after their purchases. Assume a 365-day year. What is the days sales outstanding? Do not round intermediate calculations. Round your answer to the nearest whole number. days What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What would happen to average receivables if Snider toughened its collection policy with the result that all nondiscount customers paid on the 35th day? Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forwardThe MacDonald Corporation’s purchases from suppliers in a quarter are equal to 60 percent of the next quarter’s forecast sales. The payables period is 60 days. Wages, taxes, and other expenses are 40 percent of sales, and interest and dividends are $124 per quarter. No capital expenditures are planned. Projected quarterly sales are: Q1 Q2 Q3 Q4 Sales $1,230 $1,380 $1,470 $1,680 Sales for the first quarter of the following year are projected at $1,350. Calculate the company’s cash outlays by completing the following: (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardVijayarrow_forward

- The Bandon Pine Corporation's purchases from suppliers in a quarter are equal to 60 percent of the next quarter's forecast sales. The payables period is 60 days. Wages, taxes, and other expenses are 40 percent of sales, and interest and dividends are $114 per quarter. No capital expenditures are planned. Projected quarterly sales are: Sales Q1 $ 1,500 Q2 Q3 04 $ 1,650 $ 1,710 $ 1,950 Sales for the first quarter of the following year are projected at $1,620. Calculate the company's cash outlays by completing the following: Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Payment of accounts Wages, taxes, other expenses Long-term financing expenses (interest and dividends) Total Q1 Q2 Q3 Check my work Q4arrow_forwardYou are considering an investment in a Third World bank account that pays a nominal annual rate of 18%, compounded monthly. If you invest $5,200 at the beginning of each month, how many months would it take for your account to grow to $500,000? Round fractional months up. a. 38 months b. 60 months c. 46 months d. 17 months e. 27 monthsarrow_forwardDynamic Futon forecasts the following purchases from suppliers: Jan. Feb. Mar. Apr. May Jun. Value of goods ($ millions) 33 29 26 23 21 21 a. Fifty percent of goods are supplied cash-on-delivery. The remainder are paid with an average delay of one month. If Dynamic Futon starts the year with payables of $23 million, what is the forecasted level of payables for each month? (Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.) b. Suppose that from the start of the year the company stretches payables by paying 50% after one month and 30% after two months. (The remainder continue to be paid cash on delivery.) Recalculate payables for each month assuming that there are no cash penalties for late payment. (Do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.)arrow_forward

- A loan of $3,000 for a new, high-end laptop computer is to be repaid in 15 end-of-month payments (starting one month from now). The monthly payments are determined as follows. Loan principal Interest for 15 months at 1.5% per month Loan application fee Total Monthly payment = $3,824.25/15 = $254.95 What nominal and effective interest rates per year are actually being paid? Hint: Draw a cash-flow diagram from the perspective of the lender. O C. $3,000 0 $3,000 1 0 2 1 7-- 3 $254.95. HI 2 3 $254.95_ 14 15 15 16 Q Q Q Q C O D. $3,000 $3,000 1 $3,000 675.00 149.25 $3,824.25 1 2 3 2 3 $254.95. 14 $254.95__ 15 15 16 Q Q Qarrow_forwardWhat is the APR of return for a $10,000 treasury bill maturing in 2 months if you pay $9,800 for it?arrow_forwardReceivables Investment Snider Industries sells on terms of 2/10, net 25. Total sales for the year are $500,000. Thirty percent of customers pay on the 10th day and take discounts; the other 70% pay, on average, 30 days after their purchases. Assume a 365-day year. What is the days sales outstanding? Do not round intermediate calculations. Round your answer to the nearest whole number. days What is the average amount of receivables? Do not round intermediate calculations. Round your answer to the nearest dollar. $ What would happen to average receivables if Snider toughened its collection policy with the result that all nondiscount customers paid on the 25th day? Do not round intermediate calculations. Round your answer to the nearest dollar. $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education