Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

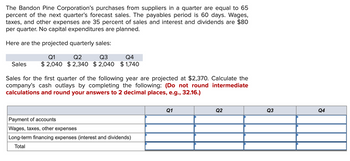

Transcribed Image Text:The Bandon Pine Corporation's purchases from suppliers in a quarter are equal to 65

percent of the next quarter's forecast sales. The payables period is 60 days. Wages,

taxes, and other expenses are 35 percent of sales and interest and dividends are $80

per quarter. No capital expenditures are planned.

Here are the projected quarterly sales:

Q1

Q2

Q3

Q4

Sales $2,040 $2,340 $2,040 $1,740

Sales for the first quarter of the following year are projected at $2,370. Calculate the

company's cash outlays by completing the following: (Do not round intermediate

calculations and round your answers to 2 decimal places, e.g., 32.16.)

Payment of accounts

Wages, taxes, other expenses

Long-term financing expenses (interest and dividends)

Total

Q1

Q2

Q3

Q4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Financial forecasting percent of sales) Tulley Appliances, Inc. projects next year's sales to be $19.9 million. Current sales are at $15.3 million, based on current assets of $5.1 million and fixed assets of $4.9 million. The firm's net profit margin is 5.3 percent after taxes. Tulley forecasts that current assets will rise in direct proportion to the increase in sales, but fixed assets will increase by only $110,000. Currently, Tulley has $1.6 million in accounts payable (which vary directly with sales), $1.9 million in long-term debt (due in 10 years), and common equity (including $3.8 million in retained earnings) totaling $6.3 million. Tulley plans to pay $501,000 in common stock dividends next year. a. What are Tulley's total financing needs (that is, total assets) for the coming year? b. Given the firm's projections and dividend payment plans, what are its discretionary financing needs? c. Based on your projections, and assuming that the $110,000 expansion in fixed assets will…arrow_forwardSexton Products has projected the following sales for the coming year: Q1 Q2 Q3 Q4 Sales $ 930 $ 1,010 $ 970 $ 1,070 Sales in the year following this one are projected to be 10 percent greater in each quarter. a. Calculate payments to suppliers assuming that the company places orders during each quarter equal to 30 percent of projected sales for the next quarter. Assume that the company pays immediately. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. Calculate payments to suppliers assuming a 90-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g ., 32.16.) c. Calculate payments to suppliers assuming a 60-day payables period. (Do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)arrow_forward2 You currently have a cash balance of $140,000, receivables of $220,000 and payables of $90,000. Average days in receivables is 30 and average days in payables is 42. You typically order 50% of next quarter's predicted sales in raw materials which is your variable cost. Salaries and other related costs typically amount to 20% of your current period sales. Last year's sales were as detailed below by quarter. You expect an increase of 5% year on year on last year's sales. Q1 400,000 02 410,000 Q3 430,000 Create a cashflow prediction by quarter for the next four quarters. Q4 400,000arrow_forward

- Distribution Limited projects sales next year to be $4 million and expects to earn 5% of that amount after taxes. The company is currently in the process of projecting its financial needs and has made the following assumptions (projections): - Current Assets will equal 8% of sales, and fixed assets will remain at their current level of $1million. - Common equity is currently $0.6million (made up entirely of Retained earnings), and the company pays out half of its after-tax earnings in dividends. - The company has short-term payables that normally equal 7% of sales each and it has no long-term debt outstanding. What are the company’s financing needs for the coming year?arrow_forwardXYZ sdn bhd estimating its cash requirement for the third quarter year 2011. The company's projected sales are as follows: month sales (rm) march 170,000 april 160,000 may 140,000 june 180,000 july 200,000 august 220,000 september 195,000 october 180,000 i) cash sales are 10% of the current month's sales, while 90% of them were sold on credit. 60% of the month's credit sales are paid in the month following the sale, while 30% of it are paid in the second month following the sales. another 10% is bad debt. ii) purchases are 50% of sales and were made one month before sales. iii) payments on accounts are on 30% of current month's purchases plus 70% of the previous month's purchases. iv) wages and salaries amounting to 10% of the preceeding month's sales. v) an 8% semi-annually interest payment on rm 100,000 notes payable is to the paid in July 2011. vi) the company plans to pay rm 6,500 in cash for a brand-new computer in august. vii) a quarterly dividend of rm 10,000 will be paid to ABC…arrow_forwardViolet Sales Corp, reports the year-end information from 2023 as follows: Sales (35,500 units) $284,000 Cost of goods sold 105,000 Gross margin 179,000 Operating expenses 152,000 Operating income $27,000 Violet is developing the 2024 budget. In 2024 the company would like to increase selling prices by 3.5%, and as a result expects a decrease in sales volume of 14%. All other operating expenses are expected to remain constant. Assume that cost of goods sold is a variable cost and that operating expenses are a fixed cost. What is budgeted sales for 2024?arrow_forward

- The MacDonald Corporation’s purchases from suppliers in a quarter are equal to 60 percent of the next quarter’s forecast sales. The payables period is 60 days. Wages, taxes, and other expenses are 40 percent of sales, and interest and dividends are $124 per quarter. No capital expenditures are planned. Projected quarterly sales are: Q1 Q2 Q3 Q4 Sales $1,230 $1,380 $1,470 $1,680 Sales for the first quarter of the following year are projected at $1,350. Calculate the company’s cash outlays by completing the following: (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardOgier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%?a. What are the projected sales in Years 1 and 2?b. What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? c. What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2?d. What is the projected FCF for Year 2?arrow_forwardLast year, Garrison Manufacturing sold 500 000 units at $4 each. Sales volume is expected to increase by 15% in the upcoming year, and sales price is expected to decrease by 5% in the upcoming year. The expected sales revenue for the upcoming year is: A. $2 255 000 B. $2 185 000 C. $2 645 000 D. $2 000 000arrow_forward

- The S&H construction company expects to have total sales next year totaling $15,300. In addition, the firm pays taxes at 35 percent and will owe $280,000 in interest expense. Based on last year’s operations the firm’s management predicts that its cost of goods sold will be 57 percent of sales and operating expenses will total 32 percent. What is your estimate of firm’s net income after taxes for the coming year? Complete the forma income statement below Round to the nearest dollar Pro-forma income statement Sales Cost of goods sold Gross profit Operating expenses Net operating income Interest expenses Earnings before taxes Taxes Net incomearrow_forwardFor the year ending December 31, 2017, sales for Company Y were $73.91 billion. Beginning January 1, 2018 Company Y plans to invest 9.5% of their sales amount each year and they expect their sales to increase by 4% each year over the next three years.Company Y invests into an account earning an APR of 2.2% compounded continuously. Assume a continuous income stream.How much money will be in the investment account on December 31, 2020?Round your answer to three decimal places. billion dollarsHow much money did Company Y invest in the account between January 1, 2018 and December 31, 2020?Round your answer to three decimal places. billion dollarsHow much interest did Company Y earn on this investment between January 1, 2018 and December 31, 2020?Round your answer to three decimal places. If intermediate values are used, be sure to use the unrounded values to determine the answer. billion dollarsarrow_forwardThe Bandon Pine Corporation's purchases from suppliers in a quarter are equal to 60 percent of the next quarter's forecast sales. The payables period is 60 days. Wages, taxes, and other expenses are 40 percent of sales, and interest and dividends are $114 per quarter. No capital expenditures are planned. Projected quarterly sales are: Sales Q1 $ 1,500 Q2 Q3 04 $ 1,650 $ 1,710 $ 1,950 Sales for the first quarter of the following year are projected at $1,620. Calculate the company's cash outlays by completing the following: Note: Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Payment of accounts Wages, taxes, other expenses Long-term financing expenses (interest and dividends) Total Q1 Q2 Q3 Check my work Q4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education