Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

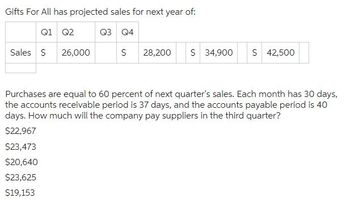

Transcribed Image Text:**Projected Sales for "Gifts For All" for Next Year:**

| Quarter | Sales ($) |

|---------|-----------|

| Q1 | 26,000 |

| Q2 | 28,200 |

| Q3 | 34,900 |

| Q4 | 42,500 |

**Problem Statement:**

Purchases are equal to 60% of the next quarter's sales. Each month has 30 days, the accounts receivable period is 37 days, and the accounts payable period is 40 days. Calculate the amount the company will pay suppliers in the third quarter.

**Options:**

- $22,967

- $23,473

- $20,640

- $23,625

- $19,153

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- PROBLEM 14 Find how much money should be deposited in a bank paying interest at the rate of 3.5% per yearcompounded quarterly so that at the end of 5 years the accumulated amount will be $40,000arrow_forwardCalculate the amount of additional cash that a company could raise from suppliers if its trade credit is extended by 10 days. Assume that the company’s trade payables are $300,000 and that it buys $2,300,000 from various suppliers yearly.arrow_forwardDiscuss the overarching idea of Asset Liability Management and its key objectives. How does the process of Gap Analysis support Asset Liability Management?arrow_forward

- A $34,000 new car loan is taken out with the terms 9% APR for 48 months. How much are monthly payments on this loan? OA. $846.09 OB. $930.70 OC. $1,015.31 OD. $1,099.92arrow_forward3 How much is accumulated in each of the following savings plans over X years? X= Y= Z= A= 1 years 30 $ 20 $ 24% $Y deposited at the end of each month at A% compounded monthly Try Again $Z deposited at the end of the first month, $Z+1 at the end of the second month, and so forth, increasing by $1 per month, at A% compounded monthly. Try Againarrow_forwardA firm is borrowing $1 million to expand its operations. The annual interest on the loan is 13% and the loan will be repaid in quarterly installments over the next for ten years. What will the quarterly payments be? Select one: A. $43,262 B. $44,246 C. $45,028 D. $58,492arrow_forward

- A business plans to use £20,000 of cash during the forthcoming year. It holds most of its cash in a deposit account from which it costs £30 to make each withdrawal and which pays interest at 10 per cent p.a. What is the optimal size for each withdrawal?arrow_forwardplease help with this Qarrow_forwardbhavuarrow_forward

- How much would you need to deposit in an account each month in order to have $30,000 in the account in 8 years? Assume the account earns 7% interest. S Submit Question Search hparrow_forwardA $38,000 new car loan is taken out with the terms 12% APR for 48 months. How much are monthly payments on this loan? O A. $1,300.89 B. $1,200.82 C. $1,100.75 D. $1,000.69arrow_forwardThe Gallery offers credit to its customers at a rate of 1.6 percent per month. What is the effective annual rate (EAR or EFF%) of this credit offer? a) 7.06% b) 20.98% c) 13.20%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education