ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

The choices for the last question:

This is an example of.....

rational ignorance

a progressive tax

logrolling

special-interest effect.

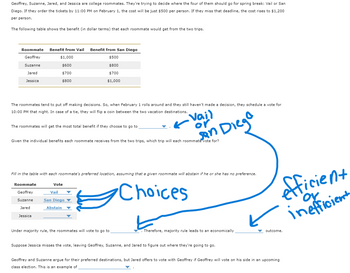

Transcribed Image Text:Geoffrey, Suzanne, Jared, and Jessica are college roommates. They're trying to decide where the four of them should go for spring break: Vail or San

Diego. If they order the tickets by 11:00 PM on February 1, the cost will be just $500 per person. If they miss that deadline, the cost rises to $1,200

per person.

The following table shows the benefit (in dollar terms) that each roommate would get from the two trips.

Roommate

Geoffrey

Suzanne

Jared

Jessica

Benefit from Vail

$1,000

$600

$700

$800

The roommates tend to put off making decisions. So, when February 1 rolls around and they still haven't made a decision, they schedule a vote for

10:00 PM that night. In case of a tie, they will flip a coin between the two vacation destinations.

The roommates will get the most total benefit if they choose to go to

Roommate

Geoffrey

Suzanne

Jared

Jessica

Benefit from San Diego

$500

$800

$700

$1,000

Given the individual benefits each roommate receives from the two trips, which trip will each roommate vote for?

Vote

Fill in the table with each roommate's preferred location, assuming that given roommate will abstain if he or she has no preference.

Choices

Vail

San Diego

Abstain

Vail

or

San Diega

Under majority rule, the roommates will vote to go to

Therefore, majority rule leads to an economically

Suppose Jessica misses the vote, leaving Geoffrey, Suzanne, and Jared to figure out where they're going to go.

efficient

inefficient

outcome.

Geoffrey and Suzanne argue for their preferred destinations, but Jared offers to vote with Geoffrey if Geoffrey will vote on his side in an upcoming

class election. This is an example of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the demand for a product is inelastic but the supply is elastic, the ________ will bear the tax incidence. Question 43 options: a) the local government b) the producer c) the consumer d) the federal governmentarrow_forwardWhat are the two fundamental doctrines of tax equity?arrow_forwardWith respect to the sources of state tax revenue, the corporate income tax generates approximately twice the revenue as state sales and use taxes. O True O Falsearrow_forward

- In which S is the before-tax supply curve and St is the supply curve after the imposition of an excise tax. The burden of this tax is borne: P St B A 0 C E G only by consumers. F most heavily by consumers. D S most heavily by producers. equally by consumers and producers. Qarrow_forwardConsider an ad-valorem tax on a good X. The Demand for good X is constant elasticity with elasticity -2. The Supply for good Y is constant elasticity with elasticity 3. What is the incidence of the tax? Provide a fraction that shows the ratio of the tax burden that falls on the supply side relative to the demand side: 3/2 2/3 none of these (2+3)/2 (2+3)/3arrow_forwardA CBO study estimated that the excess burden from the corporate income tax ________ of the revenues raised by the tax. This estimate would make the corporate income tax ________ imposed by the federal government. A) equals less than 3 percent; the most efficient tax B) equals less than 10 percent; one of the most efficient taxes C) equals more than 90 percent; the most inefficient tax D) could equal more than half; one of the most inefficient taxes Only typed answer and don't use chat gptarrow_forward

- Refer to Figure 2. It shows the imposition of a per-unit tax on the market for cigarettes. S = Market Supply Curve; D = Market Demand Curve; S+Tax = Market Supply Curve with per-unit tax imposed. The total tax collected can be represented by: A) Triangle ABFB) Rectangle PTaxC) Rectangle PTaxECAD) Rectangle P0 ECBarrow_forwardWhich of the following is an example of a potential tax implication resulting from recent government policies? A)Increase in tax rates for high - income earners B) Expansion of tax deductions for charitable donations C) Introductionof tax credits for small businesses D) Elimination of payroll taxes for all employeesarrow_forwardHow much would the excess burden of this $12 tax be if the equation of the original supply curve had been: Supply: P = 40 +0.2Q? A) $80 B) $120 C) $140 D) $360arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardTax liability is given by the function T(y) = -10,000 + 0.25y where y is income. 7. The marginal tax rate in Tuvalu is: 8. The average tax rate in Tuvalu on an income of 40,000 is equal to: 9. The tax system is Tuvalu is; a) progressive b) regressive c) proportionalarrow_forwardAccording to the textbook, which of the following statements about taxes in the U.S. is (are) correct? (x) Tax evasion is illegal, but tax avoidance is legal. (y) Most economists believe that a corporate income tax affects the stockholders of a corporation but not its employees or customers. (z) In practice, the U.S. income tax system is filled with special provisions that alter a family's tax based on its specific circumstances. A. (x), (y) and (z) B. (x) and (y) only C. (x) and (z) only D. (y) and (z) only E. (z) onlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education