FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

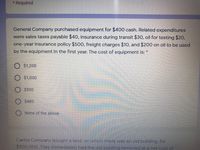

Transcribed Image Text:* Required

General Company purchased equipment for $400 cash. Related expenditures

were sales taxes payable $40, insurance during transit $30, oil for testing $20,

one-year insurance policy $500, freight charges $10, and $200 on oil to be used

by the equipment in the first year. The cost of equipment is:

O $1,200

$1,000

$500

$480

None of the above

Carlos Company bought a land, on which there was an old building, for

$900,000. They immediately had the old building removed at a net cost of

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Global Traders purchases a piece of equipment for $1.5 million and incurs the following expenses: Freight charges = $250,000 Installation charges = $25,000 Cost of training machine maintenance staff = $12,000 Cost of strengthening the factory floor = $5,500 Cost of painting factory walls = $7,000 The amounts capitalized and expensed by the company are closest to: Balance Sheet ($) A 1,775,000 B 1,780,500 C 1,792,500 O Row B Row C Row A Income Statement ($) 24,500 19,000 7,000arrow_forwardSteele Corp. purchases equipment for $20,000. Regarding the purchase, Steele recorded the following transactions: • Paid shipping of $800. • Paid installation fees of $1,600. Pays annual maintenance cost of $240. • Received a 5% discount on $20,000 sales price. Determine the acquisition cost of the equipment.arrow_forwardWildhorse Company incurs these expenditures in purchasing a truck: cash price $46,000, accident insurance (during use) $2,200, sales taxes $4,400, motor vehicle license $300, and painting and lettering $1,700 What is the cost of the truck? Cost of the truck $arrow_forward

- Champion Contractors completed the following transactions Involving equipment. Year 1 January 1 Paid $287,600 cash plus $11,500 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $20,600 salvage value. Loader costs are recorded in the Equipment account. January 3 Paid $4,800 to install air-conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,400. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $5,400 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. February 17 Paid $820 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events. View transaction list Journal entry…arrow_forwardOwearrow_forward6arrow_forward

- A company purchased new equipment for $40,000. The company paid cash for the equipment. Other costs associated with the equipment were: transportation costs, $2,300; sales tax paid, $2,400; and installation cost, $2,300. The total capitalized cost reported for the equipment was: Multiple Choice $44,700. $47,000. $40,000. $42,300.arrow_forwardDaly Publishing Corporation recently purchased a truck for $30,000. Under MACRS, the first year’s depreciation was $6,000. The truck driver’s salary in the first year of operation was $32,000. The company’s tax rate is 30 percent. Required: 1-a. Calculate the after-tax cash outflow for the acquisition cost and the salary expense. 1-b. Calculate the reduced cash outflow for taxes in the first year due to the depreciation.arrow_forwardChampion Contractors completed the following transactions involving equipment. Year 1 January 1 Paid $287,600 cash plus $11,500 in sales tax and $1,500 in transportation (FOB shipping point) for a new loader. The loader is estimated to have a four-year life and a $20,600 salvage value. Loader costs are recorded in the Equipment account. January 3 Paid $4,800 to install air-conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,400. December 31 Recorded annual straight-line depreciation on the loader. Year 2 January 1 Paid $5,400 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. February 17 Paid $820 for minor repairs to the loader after the operator backed it into a tree. December 31 Recorded annual straight-line depreciation on the loader. Required: Prepare journal entries to record these transactions and events. REarrow_forward

- nt Oaktree Company purchased new equipment and made the following expenditures: Purchase price Sales tax $46,000 2, 300 Freight charges for shipnent of equipnent Insurance on the equipnent for the first year Installation of equipment 71e 910 1,100 The equipment, including sales tax, was purchased on open account, with payment due in 30 days. The other expenditures listed above were paid in cash. Required: Prepare the necessary journal entries to record the above expenditures. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet > Record the purchase of equipment. Note: Enter debits before credits. Transaction General Journal Debit Credit Journal entry worksheet 11 Record any expenditures not capitalized in the purchase of equipment. Note Peter Oebits before credita Transaction General Journal Debit Credit 21arrow_forwardKeaubie Co. purchased machinery at a cost of $175,000 cash. Other costs included: taxes, $15,500, freight charges$6,500, and insurance during transit, $5,500, insurance for first year $10,000 . Assume that Keaubie Co. sold the equipment for $14,000 cash and accumulated depreciation on the equipment is $190,000, . Journalize the transaction.arrow_forwardColorado Mining paid $564.000 to acquire a mine with 47,000 tons of coal reserves. The financial statements model shown on the last tab reflects Colorado Mining's financial condition just prior to purchasing the coal reserves. The company extracted 24,675 tons of coal in year Land 21150 tons in year 2. Required a Compute the depletion charge per unit b-1. Compute the depletion expense for years 1 and 2 in a financial statements. b-2. Record the acquisition of the coalreserves and the depletion expense for years Fand 2 in a financial statements model. Complete this question by entering your answers in the tabs below. Req A Req B1 Req B2 Compute the depletion charge per unit. Deple charge per unit per ton Reg BTXarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education