ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

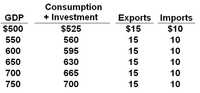

(All figures in the table are in billions.)

Refer to the attached data. If exports increased by $15 billion at each level of

Select one:

a. $550 billion

b. $600 billion

c. $650 billion

d. $700 billion

Transcribed Image Text:Consumption

+ Investment

GDP

Exports Imports

$15

$10

$500

$525

550

560

15

10

600

595

15

10

650

630

15

10

700

665

15

10

750

700

15

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- if consumption is $3.8 trillion, investment is $1.1 trillion, government spending is $1.1 trillion, imports are $1.6 trillion, and exports are $1.4 trillion, how much is GDP?arrow_forwardc Suppose the real GDP in an economy is currently $320 billion, C is $160 billion, I is $50 billion, G is $32 billion, and Nx is $-20 billion. What can you say about the state of equilibrium in this economy? Will its real GDP rise, fall, or stay the same? Explain.arrow_forwardUsing the table below, calculate the indicated values. Sector Consumption Investment Government spending Net exports Population Value (millions) $770,000 $165,000 $220,000 $-60,000 55 Instructions: Round your answers to the nearest dollar. a. Total gross domestic product = $ million. GDP per person is $ b. Consumption, investment, government spending, and net exports each as a percentage of total GDP. (Note: Enter your answers in the table below.) c. Consumption, investment, government spending, and net exports per person. (Note: Enter your answers in the table below.) % of total GDP Per person ($) Consumption Investment Government spending Net exportsarrow_forward

- Use the information in the table to answer the following questions. All numbers are in billions of 2012 dollars. \table[[ Real GDP (Y), Consumption (C), \table[[Planned], [Investment (I)]], \table [[Government], [Purchases (G)]], \table[[Net Exports], [(NX)]]], [$12,000, $10, 100, $500, $2,500,- $500 Use the information in the table to answer the following questions. All numbers are in billions of 2012 dollars. Real GDP (Y) $12,000 $13,000 $14,000 $15,000 $16,000 Consumption (C) $10,100 $10.900 $11,700 $12.500 $13,300 Planned Investment (0) Government Purchases (G) Net Exports INX) $500 $2,500 -$600 $500 $2,500 -$500 $500 $2,500 -$500 $500 $2,500 -$500 $500 $2,500 -$500 The equilibrium level of CDP la bilion. The MPC is (enter your response to two decimal places). Suppose that net exports inoroase by $300 billion. Using the multiplier formula, determine the new level of GDP A $300 billion increase in net exports leads to a change in spanding of $ $billion. billion, so the new level of…arrow_forwardHi I need help with this problem, please answer all of the questionsarrow_forwardif investment is $0.5 trillion, government spending is $1 trillion, and next exports are -$0.5 trillion, the equilibrium GDP is:arrow_forward

- Use the figure below to answer the following questions. Aggregate Expenditure (billions of 2012 dollars) 400 360 320 280 240 200 160 120 80 80 40 45° line AE 0 40 80 120 160 200 240 280 320 360 400 Real GDP (billions of 2012 dollars) The economy depicted does not engage in international trade and has no government. Planned aggregate expenditure (AE) is equal to the sum of consumption expenditure (C) and investment (I). Investment is $ billion. If investment increases by $75 billion, then real GDP increases by $ billion.arrow_forwardGDP in an economy is $8,000 billion. Consumer expenditures are $4,800 billion, government purchases are $1,600 billion, and gross investment is $1,500 billion. Net exports must be $_____ billion. Your Answer: Answer 4arrow_forwardRefer to the data for 2019 below to answer the following questions: The Equivalence of Expenditure and Income (in Billions of Dollars) Expenditure C: Consumer goods and services 1: Investment in plants, equipment, and inventory G: Government goods and services X: Exports M: Imports GDP: Total value of output % b. Corporate profits? $14,561 % 3,744 3,754 2,504 Wages and salaries Corporate profits Proprietors' income Instructions: Enter your responses as a percentage rounded to one decimal place. What share of U.S. total income in 2019 consisted of a. Wages and salaries? Income Rents Interest Taxes on output and imports Depreciation Statistical discrepancy (3,136) $21,427 = Total value of income $11,434 2,075 1,658 778 645 1,494 3,463 (120) $21,427arrow_forward

- < 2/2 Part B GDP: Where and what is counted? For each of the following items, write one of the following in the space provided. C if the item is counted as consumption spending I if the item is counted as investment spending ▶ G if the item is counted as government spending Xif the item is counted as exports M if the item is counted as imports NC if the item is not counted in the calculation of the GDP 11. You spend $7.00 to see the latest Justin Bieber movic. 12. A family pays a contractor $100,000 for a house he built for them this year. 13. A family pays $75,000 for a house built three years ago. 14. An accountant from Ernst & Young purchases a new Italian suit. 15. The government increases defense expenditures by $1,000,000,000 16. A homemaker works hard caring for her spouse and two children. 17. Ford Motor Company buys new auto-making robots. 18. Apple Computer builds a new factory in the United States. 19. You buy a new Toyota Tacoma that was made in Japan. 20. A Japanese…arrow_forwardUsing the domestic goods demand and net exports graphs, illustrate graphically and explain the effects of a decrease in taxes on output, exports, imports, and net exports. Label all the curves, the initial and new equilibrium points.arrow_forwardDiscuss which of the following fall into the categories of consumption, investment, government expenditure and net exports from the Y = C + I + G + NX (X – M) identity, and whether the impact is to increase or decrease GDP. Thomas buys a new housearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education