FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:DS

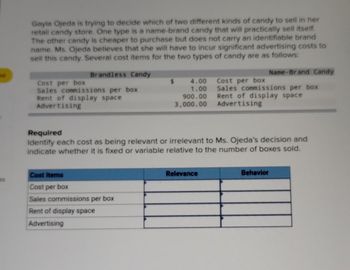

Gayla Ojeda is trying to decide which of two different kinds of candy to sell in her

retail candy store. One type is a name-brand candy that will practically sell itself.

The other candy is cheaper to purchase but does not carry an identifiable brand

name. Ms. Ojeda believes that she will have to incur significant advertising costs to

sell this candy. Several cost items for the two types of candy are as follows:

Brandless Candy

Name-Brand Candy

Cost per box

Sales commissions per box

Rent of display space

Advertising

$

Cost items

Cost per box

Sales commissions per box

Rent of display space

Advertising

4.00

1.00

900.00

3,000.00

Required

Identify each cost as being relevant or irrelevant to Ms. Ojeda's decision and

indicate whether it is fixed or variable relative to the number of boxes sold.

Cost per box

Sales commissions per box

Rent of display space

Advertising

Relevance

Behavior

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jordahl's grocery store has a small bakery that sells a variety of baked goods. Sales from the bakery average less than 5 percent of the store's total revenue and is considered a cost center. As a means of attracting customers , the bakery manager has decided to sell a cup of coffee and doughnut combo at low price price of $ 2.00. Incremental material costs associated with each combo sale average 0.50 per donut and $ 0.60 per serving of coffee (including a disposable cup). Incremental labor and overhead costs are expected to average $0.80 per combo sale . What is the contribution margin of a combo sale ? How might the manager think the combo will affect the bakery's responsibility margin ?arrow_forwardDavid decides to make and sell dolls as a side business. The function below gives the average cost A(x) (in dollars) per doll when x dolls are produced. Use the function to fill in the boxes below. 9x + 800 A) The average cost to produce 19 dolls is $ A(x) = X B) To reduce the average cost to produce each doll down to $17, dolls must be produced.arrow_forwardA school purchasing manager is seeking to buy tablets from either Entity A or Entity B and will pay shipping costs. The purchase price is $500 each. Entity A purchases the tablets from the manufacturer, Banana Industries (for $400). Entity A has the tablets shipped to its distribution center in Denver, and then ships them to schools when a sale is made. Entity A at times offers discounts to schools in accordance with its marketing strategy. On the other hand, Entity B sells tablets from a variety of manufacturers including Banana Industries. When a sale is made, Entity B remits the proceeds to the manufacturer, and retains a 10% commission (here $50). Entity B has no discretion as to the sales price. The manufacturer then ship the equipment to the customer. For each arrangement, indicate how much revenue and gross profit should be recognized. Provide support for your answer from the ASC and cite the applicable provisions. You should cite like this: ASC 606-10-35-3(e) so we can find…arrow_forward

- Suppose you are the buyer for the housewares department of a department store. A number of vendors in your area carry similar lines of merchandise. On sets of microwavable serving bowls, Brand A offers a list price of $400 per dozen less a 35% trade discount. Brand B offers a similar set for a list price of $425 less a 42% trade discount. (a) Which vendor is offering the lower net price? Brand A Brand B (b) If you order 500 dozen sets of the bowls, how much money (in $) will be saved by using the lower-priced vendor?arrow_forwardYou are a newly hired accountant for Sushi Beeber, Inc., a retail company specializing in apparel for small pets. The company would like to expand its apparel line to include sweaters for cats. Sushi Beeber has found several manufacturers that offer competitive prices to ensure cost of goods sold is low. Because the company receives merchandise from different manufacturers and the cat sweaters will be commoditized, the company needs to develop an internal accounting system to keep track of inventory cost. You think that the weighted average cost method may help the company stay up-to-date with the inventory cost as purchase cost changes over time. Your task is to create a spreadsheet that can calculate the inventory cost based on purchases and sales for the month. To help you get started, the file already has a list of columns for you to fill out. Row 2 has the beginning inventory. Starting with row 3, you need to fill in each field so that you can find the updated inventory total…arrow_forwardKim works at a sports store and needs to determine the selling price for running shoes. The running shoes have a cost of $110. The manager asked Kim to price the running shoes with a 60% target gross margin. Kim hes priced the running shoes with a 60% markup percentage Required: 1. What selling price does the manager want? 2. Whet selling price has Kim calculated? 3. If there are 43 running shoes, how much will the store lose in sales if the price is not corected?arrow_forward

- Sagararrow_forwardLevine Company is a manufacturer of very inexpensive DVD players and television sets. The company uses recycled parts and a highly structured manufacturing process to keep costs low so that it can sell at very low prices. The company uses lean accounting procedures to help keep costs low and to examine financial performance. Levine uses value streams to study the profitability of its two main product groups, DVD players and TVs. Information about finished goods inventory, sales, production, and average sales price follows: DVD Group TV Group Units Beginning inventory 390 700 Price $ 55 $ 46 Sold 17,300 17,500 Budgeted and actual production 17,800 16,900 Levine’s costs for the current quarter are as follows. Note that some of the company’s manufacturing and selling costs are traceable directly to the two value streams, while other costs are not traceable. Levine considers all traceable fixed costs to be controllable by…arrow_forwardBubba’s Western Wear is a western hat retailer in Lubbock, Texas. Although Bubba’s carries numerous styles of western hats, each hat has approximately the same price and invoice (purchase) cost, as shown in the following table. Sales personnel receive a commission to encourage them to be more aggressive in their sales efforts. Currently, the Lubbock economy is really humming, and sales growth at Bubba’s has been great. The business is very competitive, however, and Bubba, the owner, has relied on his knowledgeable and courteous staff to attract and retain customers who otherwise might go to other western wear stores. Because of the rapid growth in sales, Bubba is also finding the management of certain aspects of the business more difficult, such as restocking inventory and hiring and training new salespeople. Sales price $ 80.00 Per unit variable expenses Purchase cost 26.50 Sales commissions 28.50 Total per unit variable costs $ 55.00 Total annual fixed expenses…arrow_forward

- Kim works at a sports store and needs to determine the selling price for running shoes. The running shoes have a cost of $120. The manager asked Kim to price the running shoes with a 60% target gross margin. Kim has priced the running shoes with a 60% markup percentage.Required:1. What selling price does the manager want? 2. What selling price has Kim calculated? 3. If there are 42 running shoes, how much will the store lose in sales if the price is not corrected?arrow_forwardVikrambhaiarrow_forwardDinesh bhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education