FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

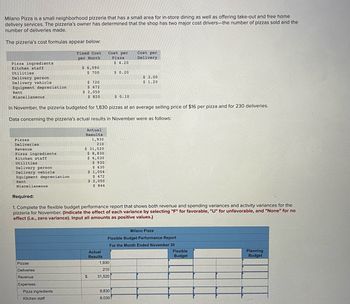

Transcribed Image Text:Milano Pizza is a small neighborhood pizzeria that has a small area for in-store dining as well as offering take-out and free home

delivery services. The pizzeria's owner has determined that the shop has two major cost drivers-the number of pizzas sold and the

number of deliveries made.

The pizzeria's cost formulas appear below:

Fixed Cost

per Month

Pizza ingredients

Kitchen staff

Utilities

Delivery person

Delivery vehicle.

Equipment depreciation

Rent

Miscellaneous

Pizzas

Deliveries

Revenue

Pizza ingredients.

Excee

Kitchen staff

n+ili+

Utilities

Delis

Delivery person

Delivery vehicle

Equipment depreciation.

Rent

Miscellaneous

$ 6,090

$ 700

Pizzas

Deliveries

Revenue

Expenses:

$ 720

$ 472

Pizza ingredients

Kitchen staff

$ 2,050

$ 820

In November, the pizzeria budgeted for 1,830 pizzas at an average selling price of $16 per pizza and for 230 deliveries.

Data concerning the pizzeria's actual results in November were as follows:

Actual

Results

1,930

210

520

$ 31,520

930

$ 8,830

$ 6,030

$930

$ 630

$ 1,004

$ 472

$ 2,050

$ 844

$

Cost per

Pizza

$ 4.20

Actual

Results

Required:

1. Complete the flexible budget performance report that shows both revenue and spending variances and activity variances for the

pizzeria for November. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no

effect (i.e., zero variance). Input all amounts as positive values.)

$ 0.20

$ 0.10

1,930

210

31,520

Cost per

Delivery

8,830

6.030

$ 3.00

$ 1.20

Milano Pizza

Flexible Budget Performance Report

For the Month Ended November 30

Flexible

Budget

Planning

Budget

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ashavinbhaiarrow_forwardOakland Precision Products (OPP) manufactures and sells a variety of scales for the kitchen and office. OPP sells primarily to kitchenware stores, discount stores, and so on. Two of the scales it produces for kitchen use are the Cook and Baker. The Cook is a basic food scale. The Baker has a greater capacity and special features that facilitate adjusting baking recipes for more or fewer people. The following information is available: Costs per unit Direct materials Direct labor Variable overhead Fixed overhead Total cost per unit Price Units produced and sold 2.40 15.00 Cook $ 1.60 Baker $ 14.40 0.80 3.20 0.60 8.00 $ 11.00 $ 35.00 $ 15.00 230,000 $ 45.00 120,000 The average wage rate is $32 per hour. Variable overhead varies with the quantity of direct labor-hours. The plant has a capacity of 20,000 direct labor-hours, but current production uses only 17,750 direct labor-hours.arrow_forwardSuppose Fine Cuisine restaurant is considering whether to (1) bake bread for its restaurant in-house or (2) buy the bread from a local bakery. The chef estimates that variable costs of making each loaf include $0.48 of ingredients, $0.26 of variable overhead (electricity to run the oven), and $0.77 of direct labor for kneading and forming the loaves. Allocating fixed overhead (depreciation on the kitchen equipment and building) based on direct labor, Fine Cuisine assigns $0.96 of fixed overhead per loaf. None of the fixed costs are avoidable. The local bakery would charge $1.78 per loaf. 1. What is the full product unit cost of making the bread in-house? 2. Should Fine Cuisine bake the bread in-house or buy from the local bakery? Why? 3. In addition to the financial analysis, what else should Fine Cuisine consider when making this decision? Requirements 1. What is the unit cost of making the bread in-house? Complete the following outsourcing…arrow_forward

- Charles has provided some of the costs he expects to incur as follows. Decide on the classifications that could be applied to each of these costs using the table provided. The cost object in each case is the cheesecake. Cost Product Period Direct Direct Factory Selling Administrative Direct Indirect Prime Conversion Cost Materials Labor Overhead Expense Expense Cost Cost Cost Cost Eggs used to make cheesecakes Baker’s wages Delivery driver wages Depreciation of office computers Power to run the cheesecake ovens President’s salary Sales commissions Factory supervisor salaryarrow_forwardMoto loroarrow_forwardThe Evendale Store is one of many stores owned and operated by the company. The Apparel Department is one of many departments at the Evendale Store. The central warehouse serves all of the company’s stores. Required: 1. What is the total amount of the costs listed above that are direct costs of the Apparel Department? 2. What is the total amount of the costs listed above that are direct costs of the Evendale Store? 3. What is the total amount of the Apparel Department’s direct costs that are also variable costs with respect to total departmental sales?arrow_forward

- Hiram’s Lakeside is a popular restaurant located on Lake Washington in Seattle. The restaurant's owner wants to better understand his costs and hired a student intern to conduct an activity-based costing study. The intern identified three activities, completed the first-stage cost allocations and gathered the activity measure data shown below. Activity Cost Pool Activity Measure Total Cost Total Activity Serving a party of diners Number of parties served $ 12,760 5,800 parties Serving a diner Number of diners served $ 105,270 12,100 diners Serving drinks Number of drinks ordered $ 24,960 10,400 drinks The above costs exclude organization-sustaining costs such as rent, property taxes, and top-management salaries. Some costs, such as the cost of cleaning the linens that cover the restaurant's tables, vary with the number of parties served. Other costs, such as washing plates and glasses, depend on the number of diners served or the number of drinks served. Prior to the…arrow_forwardIm having an issue with this problem. Thank you!arrow_forwardPatterson Lawn Co. wants to determine the cost of each lawn care maintenance job. The Company has two operating departments, one that performs lawn care services for commercial properties and one that services residential properties. Both operating departments are supported by two service departments, administrative and machine maintenance. Costs for each of these supporting departments are as follows: Administrative Machine Maintenance Total cost $576,000 $3,825,000 The following estimates that are related to the operating departments is as follows: Commercial Residential Total properties properties # of employees 68 60 128 # of customers 225 260 485 # of billable hours 23,000 22,000 45,000 Total overhead cost* $ 525,000 $ 450,000 $ 975,000 *Note that total overhead cost includes costs allocated from service departments and other overhead costs. The Company uses the…arrow_forward

- Hiram’s Lakeside is a popular restaurant located on Lake Washington in Seattle. The restaurant's owner wants to better understand his costs and hired a student intern to conduct an activity-based costing study. The intern identified three activities, completed the first-stage cost allocations and gathered the activity measure data shown below. Activity Cost Pool Activity Measure Total Cost Total Activity Serving a party of diners Number of parties served $ 12,760 5,800 parties Serving a diner Number of diners served $ 105,270 12,100 diners Serving drinks Number of drinks ordered $ 24,960 10,400 drinks The above costs exclude organization-sustaining costs such as rent, property taxes, and top-management salaries. Some costs, such as the cost of cleaning the linens that cover the restaurant's tables, vary with the number of parties served. Other costs, such as washing plates and glasses, depend on the number of diners served or the number of drinks served. Prior to the…arrow_forwardManjiarrow_forwardGreen Thumb Gardening is a small gardening service that uses activity-based costing to estimate costs for pricing and other purposes. The proprietor of the company believes that costs are driven primarily by the size of customer lawns, the size of customer garden beds, the distance to travel to customers, and the number of customers. In addition, the costs of malntalning garden beds depends on whether the beds are low malntenance beds (malnly ordinary trees and shrubs) or high malntenance beds (malnly flowers and exotic plants). Accordingly, the company uses the five activity cost pools listed below: Activity Cost Pool Caring for lawn Caring for garden beds-low maintenance Caring for garden beds-high maintenance Travel to jobs Customer billing and service Activity Measure Square feet of lawn Square feet of low maintenance beds Square feet of high maintenance beds Miles Number of customers The company already has completed Its first stage allocations of costs and has summarized Its…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education