FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

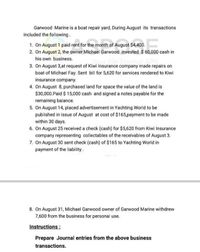

Transcribed Image Text:Garwood Marine is a boat repair yard, During August its transactions

included the following.

1. On August 1 paid rent for the month of August $4,400.

2. On August 2, the owner Michael Garwood invested $ 60,000 cash in

his own business.

3. On August 3,at request of Kiwi Insurance company made repairs on

boat of Michael Fay. Sent bill for 5,620 for services rendered to Kiwi

insurance company.

4. On August 8, purchased land for space the value of the land is

$30,000.Paid $ 15,000 cash and signed a notes payable for the

remaining balance.

5. On August 14, placed advertisement in Yachting World to be

published in issue of August at cost of $165,payment to be made

within 30 days.

6. On August 25 received a check (cash) for $5,620 from Kiwi Insurance

company representing collectables of the receivables of August 3.

7. On August 30 sent check (cash) of $165 to Yachting World in

payment of the liability.

8. On August 31, Michael Garwood owner of Garwood Marine withdrew

7,600 from the business for personal use.

Instructions:

Prepare Journal entries from the above business

transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Bob Night opened "The General's Favorite Fishing Hole." The fishing camp is open from April through September and attracts many famous college basketball coaches during the off-season. Guests typically register for one week, arriving on Sunday afternoon and returning home the following Saturday afternoon. The registration fee includes room and board, the use of fishing boats, and professional instruction in fishing techniques. Net income for the month of April was $54,250. Ledger balances for The General's Favorite Fishing Hole at the end of April, after adjusting entries, are as follow: Accounts Payable $66,500 Accumulated Depreciation- Fishing Boats 1,000 Bob Night, Capital 90,000 Bob Night, Drawing 6,000 Cash 130,650 Depreciation Expense-Fishing Boats 1,000 Fishing Boats 60,000 Food Supplies 8,000 Food Supplies Expense 30,700 Insurance Expense 1,500 Office Supplies 100 Office Supplies Expense 400 Postage Expense 150 Prepaid Insurance 7,500 Registration…arrow_forwardThe following transactions are July activities of Bill’s Extreme Bowling, Incorporated, which operates several bowling centers. Bill's paid $1,500 to a plumbing company on the day of repairing a broken pipe in the restrooms. Bill's paid $2,000 for the June electricity bill and received the July bill for $2,500, which will be paid in August. Bill's paid $5,475 to employees for work in July. Required:Prepare journal entries to record the above transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardCaritas Publishing issues the Weekly Welder. The company's primary sources of revenue are sales of subscriptions to customers and sales of advertising in the Weekly Welder. Caritas owns its building and has excess office space that it leases to others. The following transactions involved the receipt of advance payments. Prepare the indicated journal entries for each set of transactions. 1) On September 1, 20X7, the company received a $48,000 payment from an advertising client for a 6-month advertising campaign. The campaign was to run from November, 20x7, through the end of April, 20X8. Prepare the journal entry on September 1, and the December 31 end-of-year adjusting entry. 2) The company began 20X7 with S360,000 in unearned revenue relating to sales of subscriptions for future issues. During 20X7, additional subscriptions were sold for $3,490,000. Magazines delivered during 20X7 under outstanding subscriptions totaled $3,060,000. Prepare a summary journal entry to reflect the sales…arrow_forward

- Bob Night opened The General’s Favorite Fishing Hole. The fishing camp is open from April through September and attracts many famous college basketball coaches during the off-season. Guests typically register for one week, arriving on Sunday afternoon and returning home the following Saturday afternoon. The registration fee includes room and board, the use of fishing boats, and professional instruction in fishing techniques. The chart of accounts for the camping operations is provided below. Enter the transactions in a general journal. Enter transactions from April 1–5 on page 1, April 7–18 on page 2, April 21–29 and the first two entries for April 30 on page 3, and the remaining entries for April 30 on page 4. Post the entries to the general ledger. Prepare a trial balance on a work sheet. Complete the work sheet. Journalize the adjusting entries. Post the adjusting entries to the general ledger. The following transactions took place during April 20--. Apr. 1 Night invested…arrow_forwardDec. 2 Paid $1,060 cash to Northview Mall for Security First’ share of mall advertising costs. Dec. 3 Paid $520 cash for minor repairs to the company’s computer. Dec. 4 Received $6,900 cash from Brady Engineering Co. for the receivable from November. Dec. 10 Paid cash to Zahara Hughes for six days of work at the rate of $160 per day. Dec. 14 Notified by Brady Engineering Co. that Security First’ bid of $7,100 on a proposed project has been accepted. Brady paid a $1,550 cash advance to Security First. Dec. 15 Purchased $2,250 of computer supplies on credit from Arnold Office Products. Dec. 16 Sent a reminder to Jackson Co. to pay the fee for services recorded on November 8. Dec. 20 Completed a project for Masters Corporation and received $7,900 cash. Dec. 22-26 Took the week off for the holidays. Dec. 28 Received $4,400 cash from Jackson Co. on its receivable. Dec. 29 Reimbursed K. Hughes for business automobile mileage…arrow_forwardLindley Enterprises sells hand-woven rugs. Paige Corporation is a regular customer of Lindley. On June 30, Paige purchased 500 rugs from Lindley for $400,000 on credit. On August 15, Paige paid Lindley in full on its $400,000 balance. Prepare the related journal entries for Lindley.arrow_forward

- i am doing chart of accounting general journal, 4/10 Paid Culvers Landscaping $150 to plant flowers around the office entrance. 4/11 Received $4,500 for assisting Delphi Company’s bookkeeper in setting up their company accounting system. 4/13 Paid for repairs to the brakes of the company auto, $145. (Note: This is not an asset.) 4/15 Paid the Staples bill for the office supplies purchased on 4/3. 4/15 Paid employee salaries of $850. 4/15 Received $6,900 from Transport Iowa Inc. for setting up their QuickBooks accounts. 4/16 Purchased an additional computer from Best Buy for $350. how to solve this problem? with puting into general journal as debit and credit sidearrow_forwardBluestreak Painting Company incurs the following transactions for September. 1. September 3 Paint houses in the current month for $16,500 on account. 2. September 8 Purchase painting equipment for $17,500 cash. 3. September 12 Purchase office supplies on account for $2,800. 4. September 15 Pay employee salaries of $3,500 for the current month. 5. September 19 Purchase advertising to appear in the current month for $1,200 cash. 6. September 22 Pay office rent of $4,700 for the current month. 7. September 26 Receive $11,500 from customers in (1) above. 8. September 30 Receive cash of $5,300 in advance from a customer who plans to have his house painted in the following. month. Required: 1. Record each transaction. 2. Post each transaction to T-accounts and calculate the ending balance for each account. At the beginning of September, the company had the following account balances: Cash, $42,600; Accounts Receivable, $1,350; Supplies, $430; Equipment, $6,700; Accounts Payable, $1,100;…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education