FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

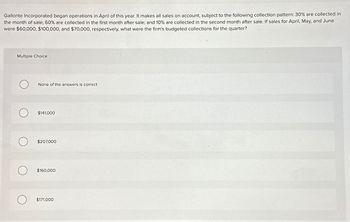

Transcribed Image Text:Gallonte Incorporated began operations in April of this year. It makes all sales on account, subject to the following collection pattern: 30% are collected in

the month of sale; 60% are collected in the first month after sale; and 10% are collected in the second month after sale. If sales for April, May, and June

were $60,000, $100,000, and $70,000, respectively, what were the firm's budgeted collections for the quarter?

Multiple Choice

None of the answers is correct

$141,000

$207,000

$160,000

О

$171,000

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Majan company has budgeted sales in units for the next five months as follows: June 5,400 units July 6,500 units August 7,000 units September 8,200 units October 4,800 units Past experience has shown that the ending inventory for each month should be equal to 10% of the next month's sales in units. The inventory on May 31 is 400 units. The company needs to prepare a Production Budget for the next five months. The total number of units to be produced in August is a. 7,120 units b. 7,420 units c. 7,170 units d. 8,520 units W Parrow_forwardMcMichael Inc. collects 90% of its sales on account in the month of the sale and 10% in the month following the sale. If sales on account are budgeted to be $495,000 for September and $431,000 for October, what are the budgeted cash receipts from sales on account for October?$arrow_forwardABC Store. has budgeted sales for June and July at $690,000 and $720,000, respectively. Sales are 90% credit, of which 70% is collected in the month of sale and 30% is collected in the following month. What are the cash collections in July.arrow_forward

- Zisk Company purchases direct materials on credit. Budgeted purchases are April, $80,000; May, $110,000; and June, $120,000. Cash payments for purchases are: 70% in the month of purchase and 30% in the first month after purchase. Purchases for March are $70,000. Prepare a schedule of cash payments for direct materials for April, May, and June.arrow_forwardMultiple Choice Gallonte Inc. began operations in April of this year. It makes all sales on account, subject to the following collection pattern: 20% are collected in the month of sale; 70% are collected in the First month after sale; and 10% are collected in the second month after sale. If sales for April, May, and June were $80,000, $140,000, and $130,000, respectively, what were the firm's budgeted collections for the quarter? $201,000. $220,000. $232,000. $292,000. Help None of the answers is correct. Save & EXIL SUBarrow_forwardWala Incorporated bases its selling and administrative expense budget on the number of units sold. The variable selling and administrative expense is $3.70 per unit. The budgeted fixed selling and administrative expense is $30,360 per month, which includes depreciation of $3,630. The remainder of the fixed selling and administrative expense represents current cash flows. The sales budget shows 3,100 units are planned to be sold in July. Required: Prepare the selling and administrative expense budget for July.arrow_forward

- Blue Wave Co. predicts the following unit sales for the coming four months: September, 3,300 units; October, 4,900 units; November, 6,700 units; and December, 7,900 units. The company's policy is to maintain finished goods inventory equal to 50% of the next month's sales. At the end of August, the company had 2,800 finished units on hand. Prepare a production budget for each of the months of September, October, and November. Blue Wave Co. Production Budget September, October and November September Next month's budgeted sales (units) Units to be produced % October % November %arrow_forwardNuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business September, October, and November are $239,000, $309,000, and $419,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. The cash collections expected in October from accounts receivable are estimated to be a. $173,040 b. $206,500 c. $139,580 d. $247,800arrow_forwardDove Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business are $245,000, $302,000, and $402,000, respectively, for September, October, and November. The company expects to sell 25% of its merchandise for cash. Of sales on account, 70% are expected to be collected in the month of the sale and 30% in the month following the The cash collections expected in October are O & $267,120 O & $218120 Oc $278,520 O d. $289.175arrow_forward

- Expetn company has budgeted total sales for April and May at $200,000 and $250,000 respectively. sales are 68%credit, of which 18% is collected in the month of the sale and rest collected following month. what are the budgeted cash collection from sales in May?arrow_forwardPlease help mearrow_forwardCapstone Inc. collects 80% of its sales on account in the month of the sale and 20% in the month following the sale. If sales on account are budgeted to be $399,000 for September and $479,000 for October, what are the budgeted cash receipts from sales on account for October?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education