FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

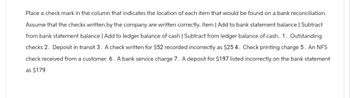

Transcribed Image Text:Place a check mark in the column that indicates the location of each item that would be found on a bank reconciliation.

Assume that the checks written by the company are written correctly. Item | Add to bank statement balance | Subtract

from bank statement balance | Add to ledger balance of cash | Subtract from ledger balance of cash.. 1. Outstanding

checks 2. Deposit in transit 3. A check written for $52 recorded incorrectly as $25 4. Check printing charge 5. An NFS

check received from a customer. 6. A bank service charge 7. A deposit for $197 listed incorrectly on the bank statement

as $179

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Indicate whether each transaction would require an adjustment to the bank balance or the book balance when reconciling cash. Interest earned on the cash balance per the bank Choose. statement Minimum balance bank fee charged on the bank Choose. statement Collecton on a note from a customer as indicated on the Choose. bank statement NSF check received from a customer as revealed on the Choose. bank statement Outstanding checks Choose. Bank service charge on the bank statement Choose.arrow_forwardWhat steps are followed in posting from the cash receipts journal to the general ledger?arrow_forwardWhy should sales to and receipts of cash from credit customers be recorded and posted immediately?arrow_forward

- True or False. 13. Deposit in transit is a reconciling item added to the unadjusted book balance.14. Outstanding check is a reconciling item deducted from the unadjusted bank balance.15. Adjusting journal entries are prepared based on the reconciling items on the bank side of the bank reconciliation.arrow_forwardAccompanying the bank statement was a debit memorandum for an NSF check received from a customer. This item would be included on the bank reconciliation as a(n) ____.arrow_forwardA prenumbered document that tells the bank to pay the designated party a specific amount is a A. check B. deposit ticket C. routing number D. remittance advicearrow_forward

- Hello, How do I solve this? Thanksarrow_forwardThe debit recorded in the journal to reimburse the petty cash fund is to Select one: A. Cash B. Petty Cash C. various accounts for which the petty cash was disbursed D. Accounts Receivablearrow_forwardAccompanying the bank statement was a credit memo for a short-term note collected by the bank for the customer. What entry is required in the company's accounts? Oa. debit Cash; credit Notes Receivable and Interest Revenue Ob. debit Accounts Receivable; credit Cash Oc. debit Cash; credit Miscellaneous Income Od. debit Notes Receivable; credit Casharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education