ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

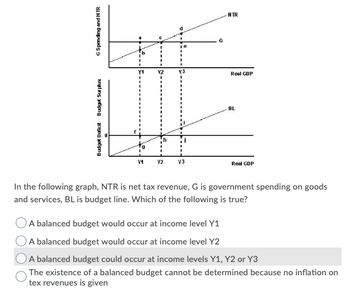

Transcribed Image Text:G Spending and NTR

Budget Deficit Budget Surplus

Y1

V1

.

I

I

Y2

V2

je

I

I

Y3

I

V3

G

NTR

Real GDP

BL

Real GDP

In the following graph, NTR is net tax revenue, G is government spending on goods

and services, BL is budget line. Which of the following is true?

A balanced budget would occur at income level Y1

A balanced budget would occur at income level Y2

A balanced budget could occur at income levels Y1, Y2 or Y3

The existence of a balanced budget cannot be determined because no inflation on

tex revenues is given

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Only typed Answerarrow_forwardWhich legislative action shifted the budget power from the executive branch to the legislative branch? a. Budget and Accounting Act of 1921 b. Congressional Budget and Impoundment Control Act of 1974 c. Balanced Budget and Emergency Deficit Control Act of 1985 d. Budget Enforcement Act of 1990arrow_forwardAnswer plzzarrow_forward

- ww. STEADY AS SHE GOES Read A G what a BALANCED BUDGET THE ECONOMY Eipcs- Reprinted with permission from The Detroit News O A. Government revenues will stay the same. B. Government revenues will decrease. Spotify What does a balanced budget mean In terms of government revenue? Question 142 of 190 OC. Government revenue equals its spending. O D. Government receives less revenue than it spends. O E. Government generates more revenue than it spends. Chilled Carrow_forwardDescribe the fiscal interdependence of the various levels of government in the U.S. How do the budget cycles and budget processes of each effect the others? How does this complicate the budget deliberations at the various levels?arrow_forwardAnswer exercises 11-14 on the basis of the following information. Assume that equilibrium real GDP is $800 billion, potential real GDP is $950 billion, the MPC is .80, and the MPI is .40.arrow_forward

- 2) Transfer payments are the ________ in the government's budget. A) smallest expenditure source B) largest expenditure source C) smallest revenue source D) largest revenue source 3) Personal taxes are the ________ in the government's budget. A) smallest expenditure source B) largest expenditure source C) smallest revenue source D) largest revenue source 4) A government's debt is increased when it A) balances is budget. B) buys more bonds. C) runs a deficit. D) runs a surplus. 5) When a government runs a surplus A) its debt increases. B) it must raise taxes. C) its debt decreases. D) it must cut spending. 6) The amount the government owes to the public is the federal debt. 7) If tax receipts are greater than government expenditures the government is running a surplus. 8) If the government runs a surplus, then the government debt increases. 9) Transfer payments are the largest part of the U.S.…arrow_forwardQuestion 1 Which of the following accurately describes the phenomenon of crowding out? O government borrowing pushes up interest rates, driving out private investment and consumption O government spending drive up the budget deficit O government spending causes more goods to be allocated to the public sector and fewer are available for the private sector O Increasing the proportion of public sector spending in the composition of GDP renders production less competitive and therefore less efficient.arrow_forward2. If government expenditures are $100 and the average tax rate is 0.6, derive the equation for the budget line and draw the budget line. What is the real GDP when there is no deficit and no surplus?arrow_forward

- 1. Why is a $100 billion increase in government spending on goods and services more expansionary than a $100 billion decrease in taxes?arrow_forwardWhich of the following statements about the Canadian federal budget is FALSE? A. Currently, Canada has a federal budget deficit. B. The Minister of Finance presents the federal bugdet to the Canadian Parliament. C. The largest source of federal government revenues are personal income taxes. D. The largest source of federal government outlays are transfer payments to persons and other levels of government. E. Canada has not had federal budgetary surpluses in any fiscal year over the 2000 to 2020 period.arrow_forward11arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education