ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

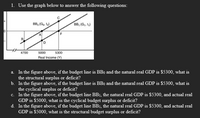

Transcribed Image Text:1. Use the graph below to answer the following questions:

BB, (Go. to)

BB, (G,. t,)

D.

5300

5000

Real Income (Y)

4700

a. In the figure above, if the budget line is BBo and the natural real GDP is $5300, what is

the structural surplus or deficit?

b. In the figure above, if the budget line is BBo and the natural real GDP is $5300, what is

the cyclical surplus or deficit?

c. In the figure above, if the budget line BB1, the natural real GDP is $5300, and actual real

GDP is $5000, what is the cyclical budget surplus or deficit?

d. In the figure above, if the budget line BB1, the natural real GDP is $5300, and actual real

GDP is $5000, what is the structural budget surplus or deficit?

Transcribed Image Text:2. If government expenditures are $100 and the average tax rate is 0.6, derive the equation

for the budget line and draw the budget line. What is the real GDP when there is no

deficit and no surplus?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. What is fiscal equalization? Give an examplearrow_forward7. The national debt a. Is paid off each fiscal year when the debt is refinanced. b. Will never be paid off in any given year, but it will be entirely paid off when it is refinanced over a number of years. Will be paid off when the budget is finally balanced. Equals the dollar amount of outstanding U.S. Treasury bonds. c darrow_forward1. Use the graph below to answer the following questions: BB, (Go. to) BB, (G,. t,) D. 5300 5000 Real Income (Y) 4700 a. In the figure above, if the budget line is BBo and the natural real GDP is $5300, what is the structural surplus or deficit? b. In the figure above, if the budget line is BBo and the natural real GDP is $5300, what is the cyclical surplus or deficit? c. In the figure above, if the budget line BB1, the natural real GDP is $5300, and actual real GDP is $5000, what is the cyclical budget surplus or deficit? d. In the figure above, if the budget line BB1, the natural real GDP is $5300, and actual real GDP is $5000, what is the structural budget surplus or deficit?arrow_forward

- Suppose the government's present value of current and projected future outlays is 75 percent of GDP and its present value of current and projected future revenues is 50 percent of GDP. What gap does this describe, and what is the size of the gap? This information describes the _______. A. fiscal gap, which is 25 percent of GDP B. generational gap, which is 25 percent of GDP C. fiscal gap, which is 125 percent of GDP D. fiscal gap, which is – 25 percent of GDParrow_forward8. Agreement and disagreement among economists Suppose that Kevin, an economist from a consulting firm, and Maria, another economist from a graduate program in the Northeast, are both guests a popular science podcast. The host of the podcast is facilitating their debate over budget deficits. The following dialogue represents a portion of the transcript of their discussion: Maria: Most people recognize that the budget deficit has been rising considerably over the last century. We need to find the best course of action to remedy this situation. Kevin: I believe that a cut in income tax rates would boost economic growth and raise tax revenue enough to reduce budget deficits. Maria: I actually feel that raising the top income tax rate would reduce the budget deficit more effectively. The disagreement between these economists is most likely due to Despite their differences, with which proposition are two economists chosen at random most likely to agree? Central banks should focus more on…arrow_forwardAlways use economic terms, diagrams. "Counter-cyclical fiscal policy works. If consumers and businesses lose confidence because of the changing world, the government can fix this economic problem - that is what the Biden $1.9 trillion stimulus was all about. Sure, there might be some issues with the deficit, but given a recovery, the government can pay that deficit off. Also, since we are in a very inflationary period again we might expect counter-cyclical fiscal policy to resolve some of the debt issues." Please explain this comment. (Hint: don't forget to use an AS AD diagram and possibly a business cycle diagram).arrow_forward

- Read the following premise carefully and answer the questions specifically and in detail. "In the face of unstable economic growth due to a recession or accelerated inflation, the potential problems of high public debt include increased income inequality, reduced economic incentives, and crowding out private investment." A. Express in detail the effects of expansionary and contractionary fiscal policy on income and the price level. B. Using the premise presented as a basis, argue about the intervention of fiscal policy as an instrument to promote the growth, sustainability and economic stability of a country. (Gives an example in detail.)arrow_forward2arrow_forwardAnswer the questions below for the economy of Motak using the graph below. The Economy of Motak Government spending / net taxes 400 350 300 250 200 150 100 50 200 400 600 800 1000 1200 1400 1600 Real GDP NTR G1 Tools a. If GDP is $800 and government spending is G₁, the size of Motak's budget deficit is $ b. If government spending is decreased by the size of the deficit in part (a), draw the new curve labelled G₂ in the graphing area above. c. Suppose the multiplier has a value of 2, the new level of equilibrium GDP is $ d. Motak's deficit at this new level of equilibrium GDP is $ billion. billion. billion.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education