FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

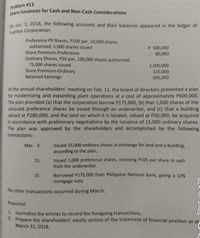

Transcribed Image Text:Share Issuances for Cash and Non-Cash Considerations

Problem #13

0n Jan. 1, 2018, the following accounts and their balances appeared in the ledger of

Fuentes Corporation:

Preference P9 Shares, P100 par, 10,000 shares

authorized, 5,000 shares issued

Share Premium-Preference

Ordinary Shares, P20 par, 100,000 shares authorized,

75,000 shares issued

Share Premium-Ordinary

Retained Earnings

P 500,000

80,000

1,500,000

125,000

505,000

At the annual shareholders' meeting on Feb. 11, the board of directors presented a plan

for modernizing and expanding plant operations at a cost of approximately P600,000.

The plan provided (a) that the corporation borrow P175,000, (b) that 1,000 shares of the

unissued preference shares be issued through an underwriter, and (c) that a building

valued at P280,000, and the land on which it is located, valued at P50,000, be acquired

in accordance with preliminary negotiations by the issuance of 15,000 ordinary shares.

The plan was approved by the shareholders and accomplished by the following

transactions:

Issued 15,000 ordinary shares in exchange for land and a building,

according to the plan.

Mar. 3

Issued 1,000 preference shares, receiving P105 per share in cash

from the underwriter.

15

31

Borrowed P175,000 from Philippine National Bank, giving a 12%

mortgage note.

No other transactions occurred during March.

Required:

1. Journalize the entries to record the foregoing transactions.

2. Prepare the shareholders' equity section of the statement of financial position as at

March 31, 2018.

Shot on Y15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A corporation has 49,000 shares of $27 par value stock outstanding. If the corporation issues a 3-for-1 stock split, the number of shares outstanding after the split will be O a. 147,000 shares. O b. 49,000 shares. OC. 12,250 shares O d. 196,000 shares.arrow_forward16arrow_forwardHow to journal entry?arrow_forward

- Nevada corporation has 52,128 shares of $21 par stock outstanding that has a current market value of $207 per share. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be a.260,640 b.10,426 c.547,344 d.52,128arrow_forwardKA.arrow_forward9. The following data pertain to BUENO Corporation: Redeemable Preference Share Capital, P100 par; 5,000 shares issued and outstanding Preference Share Premium Retained Earnings P500,000 50,000 100,000 June 5 Redeemed and retired 500 preference shares at P150 per share. 30 Redeemed and retired 500 preference shares at P90. Direction: a) Journal entries b) Prepare the shareholders' Equity Section as of June 30.arrow_forward

- Nevada Corporation has 63,600 shares of $16 par stock outstanding that has a current market value of $267. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be a.63,600 b.318,000 c.508,800 d.254,400arrow_forwardSubject-accountingarrow_forwardNevada Corporation has 53,200 shares of $18 par stock outstanding that has a current market value of $128. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be a.266,000 b.53,200 c.478,800 d.212,800arrow_forward

- How much is credited to Share Premium when some of the fractional share warrants outstanding lapsed?arrow_forwardThe corporation records included the following shareholders equity accounts: 2,550,000 Preference share par150,authorized 20,000 shares Share premium preference 150,000 Ordinary share, no par 50 stated value, 100,000 shares authorized 3,000,000 In the statement of shareholders equity, the number of issued and outstanding shares for each class of stock would be ORDINARY ; PREFERENCE sample answer: 10,000;5,000arrow_forwardPLease answer only B3, B4, B5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education