FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

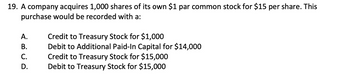

Transcribed Image Text:19. A company acquires 1,000 shares of its own $1 par common stock for $15 per share. This

purchase would be recorded with a:

A.

B.

C.

D.

Credit to Treasury Stock for $1,000

Debit to Additional Paid-In Capital for $14,000

Credit to Treasury Stock for $15,000

Debit to Treasury Stock for $15,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 16. ABC bought 100 common shares of XYZ. The price paid was $ 40, per share, plus he paid $ 280 in brokerage costs. The entry to register this purchase includes: Select one: a. debit to cash for $ 4,000. b. Debit to Investment in shares of $ 4,000. c. Debit to Investment in shares for $ 4,280. d. debit to brokerage expense of $ 280 and a debit to investment in shares of $ 4,000.arrow_forwardAn investor purchased 505 shares of common stock, $23 par, for $19,190. Subsequently, 106 shares were sold for $27 per share. What is the amount of gain or loss on the sale? a.$1,166 gain b.$1,590 gain c.$1,590 loss d.$1,166 lossarrow_forwardAssume that a company paid $6 per share to re-purchase 1,100 of its $3 par value common stock. The purchase of this treasury stock: Group of answer choices increased total equity by $6,600 increased total equity by $3,300 decreased total equity by $3,300 decreased total equity by $6,600arrow_forward

- A corporation has 71,868 shares of $36 par stock outstanding that has a current market value of $312 per share. If the corporation issues a 4-for-1 stock split, the market value of the stock will fall to approximately a.$17,967 b.$9 c.$78 d.$276arrow_forwardNevada Corporation has 53,200 shares of $18 par stock outstanding that has a current market value of $128. If the corporation issues a 5-for-1 stock split, the number of shares outstanding will be a.266,000 b.53,200 c.478,800 d.212,800arrow_forwardAn investor purchased 689 shares of common stock, $21 par, for $28,249. Subsequently, 114 shares were sold for $27 per share. What is the amount of gain or loss on the sale? a. $2,280 loss b. $2,280 gain c. $1,596 loss Od. $1,596 gainarrow_forward

- If Dakota Company issues 1,500 shares of $6 par common stock for $75,000, O Common Stock will be credited for $75,000 O Paid-In Capital in Excess of Par will be credited for $9,000 Paid-In Capital in Excess of Par will be credited for $66,000 O Cash will be debited for S66,000arrow_forwardXYZ Company sold 500 shares of treasury stock (from (c)) at $45 per share. DATE Debit Credit X/Xarrow_forwardA corporation purchases 41500 shares of its own $30 par common stock for $45 per share, recording it at cost. What will be the effect on total stockholders’ equity? Increase by $1245000 Decrease by $1867500 Increase by $1867500 Decrease by $1245000arrow_forward

- Part A - A corporation reacquires 60,000 shares of its own $10 par common stock for $3,000,000, recording it at cost. What effect does this transaction have on revenue or expense of the period? What effect does it have on stockholders' equity?arrow_forwardNizwa Co. issues 2,000 ordinary shares with a RO 10 par value at RO 16 per share. What should be recorded for this transaction.arrow_forward2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education