FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

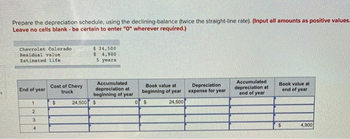

Transcribed Image Text:Prepare the depreciation schedule, using the declining-balance (twice the straight-line rate). (Input all amounts as positive values.

Leave no cells blank - be certain to enter "0" wherever required.)

Chevrolet Colorado

Residual value

Estimated life

End of year

1

2

3

4

Cost of Chevy

truck

$

24,500

$ 24,500

$ 4,900

years

5

Accumulated

depreciation at

beginning of year

$

o

Book value at

beginning of year

24,500

$

Depreciation

expense for year

Accumulated

depreciation at

end of year

Book value at

end of year

4,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] NewTech purchases computer equipment for $261,000 to use in operating activities for the next four years. It estimates the equipment's salvage value at $30,000. Exercise 8-8 (Algo) Double-declining-balance depreciation LO P1 Prepare a table showing depreciation and book value for each of the four years assuming double-declining-balance depreciation. (Enter all amounts as positive values.) Year Year 1 Year 2 Year 3 Year 4 Total Depreciation for the Period Beginning-Year Depreciation Book Value Rate Annual Depreciation End of Period Accumulated Depreciation Year-End Book Valuearrow_forwardPlease do not give solution in image format thankuarrow_forwardUse the straight-line method to fill in the row for year 3 of the depreciation table for an SUV that costs $43,000,has a residual value of $7,000 and an estimated life of six years. Year Annual depreciation Accumulated depreciation End-of-year book value 3 Complete the table. Year Annual depreciation Accumulated depreciation End-of-year book value 1 $6,000 $6,000 $37,000 2 $6,000 $12,000 $31,000 3 $enter your response here $enter your response here $enter your response herearrow_forward

- Assignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false ☆ O 1 * Updat A machine costing $58,228 with a 4-year life and $52,607 depreciable cost was purchased January 1. Compute the yearly depreciation expense using straight- line depreciation. Round your answer to the nearest whole dollar. per year Previous Next %24arrow_forwardABC Healthcare purchases a long term asset for $750,000.00 with an estimated life of 7 years and a scrap value of $150,000. You do not need to show Excel formulas but mathematical formulas in the space provided Instructions: Compute the depreciation under each of the following methods for the first 4 years. Straight Line Year 1 3 4 Depreciation Show formula here DDB Year 1 Depreciation Show formula here 2 3 4 SYD Year 1 Depreciation Show formula here 2 3 4arrow_forwardI need help with this questionarrow_forward

- Using the following information create a Double declining, depreciation schedule. Computer Equipment: $3,000 Residual Value: $150 Useful Life: 5 years Example: Straight line depreciation Scheadule. year (beginning of year value) depreciation (end of year value) 1 $3,000 $570 $2,430 2 $2,430 $570 $1,860 3 $1,860 $570 $1,290 4 $1,290 $570 $720 5 $720 $570 $150arrow_forwardBook value Find the book value for the asset shown in the accompanying table, assuming that MACRS depreciation is being used Recovery period (years) 5 Elapsed time since purchase (years) 2 Asset A Installed cost $839,000 The remaining book value is $ (Round to the nearest dollar.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery year 1 2 3 4 5 6 7 8 3 years 33% 45% 15% 7% 9 10 11 Totals Percentage by recovery year* 5 years 7 years 20% 14% 32% 19% 12% 12% 5% 25% 18% 12% 9% 8% 7% 6% 6% 6% 4% 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year 10 years 10% 18%…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Your staff person has provided you with the following journal entry for January 20x1 depreciation. The monthly deprecation is supposed to be $100.00. What is wrong with this entry?arrow_forwardWhat is the amount of double declining balance depreciation for year 4 if the cost of an asset is $75,000 the useful life is 5 years and the salvage vague is $4000arrow_forwardLinear Depreciation of an automobile An automobile purchased for us by the manager of a firm at a price of $34,000 is to be depreciated using the straight-line method over 5 years. What will be the book value of the automobile at the end of 3 years? (assume that the scrap value is $0)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education