FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

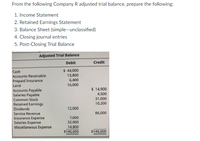

Transcribed Image Text:From the following Company R adjusted trial balance, prepare the following:

1. Income Statement

2. Retained Earnings Statement

3. Balance Sheet (simple-unclassified)

4. Closing journal entries

5. Post-Closing Trial Balance

Adjusted Trial Balance

Debit

Credit

Cash

Accounts Receivable

Prepaid Insurance

Land

$ 44,000

13,800

6,400

16,000

$ 14,900

Accounts Payable

Salaries Payable

4,500

Common Stock

31,000

10,200

Retained Earnings

Dividends

Service Revenue

Insurance Expense

Salaries Expense

Miscellaneous Expense

12,000

86,000

7,600

32,000

14,800

$146,600

$146,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject:arrow_forwardThe general ledger of Zips Storage at January 1, 2024, includes the following account balances: Credits Accounts Cash Accounts Receivable Prepaid Insurance Land Accounts Payable Deferred Revenue Common Stock Retained Earnings Totals 8. November 20 9. December 30 Requirement The following is a summary of the transactions for the year: 1. January 9 2. February 12 3. April 25 4. May 6 5. July 15 6. September 10 7. October 31 Provide storage services for cash, $144,100, and on account, $57,200. Collect on accounts receivable, $52,500. General Journal Receive cash in advance from customers, $13,900. Purchase supplies on account, $11,200. Pay property taxes, $9,500. Pay on accounts payable, $12,400. Pay salaries, $133,600. Issue shares of common stock in exchange for $37,000 cash. Pay $3,800 cash dividends to stockholders. Insurance expired during the year is $8,000. Supplies remaining on hand at the end of the year equal $3,900. Provide services of $12,800 related to cash paid in advance by…arrow_forwardUse the Adjusted Trial Balance below for the Year Ended December 31, 2020 to complete the Income Statement, Statement of Stockholder's Equity, and Balance Sheet. Statement formats are included on the Exam 1 format document. M4 Engineering Use the $ dollar sign convention on all statements Debit Credit Cash 25,000 Accounts Receivable 7,500 Supplies Building 500 100,000 Accum. Depreciation 37,500 Accounts Payable 8,000 Notes Payable 12,500 Common Stock 5,000 Retained Earnings 10,000 Dividends 3,750 Fees Earned 85,500 Advertising Expense 10,000 Telephone Expense 6,250 Depreciation Expense 5.500 Total 158,500 158.500arrow_forward

- The following pre-closing accounts and balances were drawn from the records of Carolina Company on December 31, Year 1: $5,300 Accounts receivable 3,300 Common stock 4,500 Revenue 2,450 Expense 7,200 Cash Dividends Land Accounts payable Retained earnings What is the amount of total assets that will be reported on the balance sheet as of December 31, Year 1? Multiple Choice $19,000 $9,800 $14,500 $4,700 5,200 4,500 2,850 $17,800arrow_forwardM4-14 through M4-17 (Algo) Reporting an Income Statement, Reporting a Statement of Retained Earnings, Reporting a Balance Sheet and Recording Closing Journal Entries [LO 4-4, LO 4-5] Skip to question [The following information applies to the questions displayed below.] The Sky Blue Corporation has the following adjusted trial balance at December 31. Debit Credit Cash $ 1,260 Accounts Receivable 2,300 Prepaid Insurance 2,600 Notes Receivable (long-term) 3,300 Equipment 13,500 Accumulated Depreciation $ 3,200 Accounts Payable 5,720 Salaries and Wages Payable 1,150 Income Taxes Payable 3,200 Deferred Revenue 660 Common Stock 2,700 Retained Earnings 1,120 Dividends 330 Sales Revenue 44,730 Rent Revenue 330 Salaries and Wages Expense 22,200 Depreciation Expense 1,600 Utilities Expense 4,520 Insurance Expense 1,700 Rent Expense 6,300 Income Tax Expense 3,200 Total $ 62,810 $ 62,810 M4-17 (Algo)…arrow_forwardPrepare correct Trial BAlance?arrow_forward

- Provide journal entry for the following transaction: The following is taken from Adjusted Trial Balance of Company. Provide journal entry to close related revenue accounts. Accounts Debit Credit Sales Revenues 160,000 Sales Return 4,000 5,000 80,000 40,000 Interest Expense Cost of Goods Sold Salaries and Wages Expense Losses due to fire 8,000 10,000 Dividendsarrow_forwardQuestion Content Area Finley CompanyEnd-of-Period SpreadsheetFor the Year Ended December 31 Adjusted Trial Balance Income Statement Balance Sheet Account Title Debit Credit Debit Credit Debit Credit Cash 16,000 16,000 Accounts Receivable 6,000 6,000 Supplies 2,000 2,000 Equipment 19,000 19,000 Accumulated Depr. 6,000 6,000 Accounts Payable 10,000 10,000 Wages Payable 2,000 2,000 Common Stock 5,000 5,000 Retained Earnings 2,911 2,911 Dividends 1,000 1,000 Fees Earned 49,736 49,736 Wages Expense 21,463 21,463 Rent Expense 5,022 5,022 Depreciation Expense 5,162 5,162 Totals 75,647 75,647 31,647 49,736 44,000 25,911 Net Income (Loss) 18,089 18,089 49,736 49,736 44,000 44,000 The ending balance of retained earnings isarrow_forwardCash Accounts Receivable Prepaid Expenses Equipment Accumulated Depreciation Accounts Payable Notes Payable Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Utilities Expense Depreciation Expense Miscellaneous Expense Stockton Company Adjusted Trial Balance December 31 Determine the retained earnings ending balance. Oa. $31,896 Ob. $1,577 Oc. $12,793 Od. $13,088 6,827 2,410 706 16,000 872 3,473 823 483 224 78 31,896 4,532 1,761 5,857 1,000 12,088 6,658 31,896arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education