Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

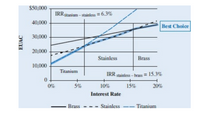

From the figure, the interest rate where the EUAC for titanium and stainless steel are equal is:

give answer in percentage (%)

Transcribed Image Text:$50,000

IRR titanium – stainless = 6.3%

40,000

Best Choice

30,000

20,000

Stainless

Brass

10,000

Titanium

IRR stainless – brass = 15.3%

0%

5%

10%

15%

20%

Interest Rate

Brass -

Stainless

Titanium

EUAC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- On the London Metals Exchange, the price for copper to be delivered in one year is $5,500 a ton. (Note: Payment is made when the copper is delivered.) The risk-free interest rate is 2% and the expected market return is 8%. a. Suppose that you expect to produce and sell 10,000 tons of copper next year. What is the PV of this output? Assume that the sale occurs at the end of the year. Note: Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places. b-1. If copper has a beta of 1.2, what is the expected price of copper at the end of the year? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b-2. Assume copper has a beta of 1.2. What is the certainty-equivalent end-of-year price? X Answer is complete but not entirely correct. 53.92 million per ton a. Present value b-1. Expected price b-2. Certainty-equivalent price $ $ IS 6,383.38 5,937 per tonarrow_forwardThe one-year foward rate fof the British pound is qouted at $1.59, and the spot rate of the British pound is qouted at $1.65. The foward premium is ______ percent.arrow_forwardLet S = $100, K = $95, \sigma = 30%, r = 8% (continuously compounded), T = 1, and \delta = 0. Let u = 1.3, d=0.8, and n = 2. Construct the binomial tree for a European put option. At each node provide the premium, \Delta, and B.arrow_forward

- Using below information: Current spot rate CAD1 = USD 0.95 Annual interest rate in Canada: 2% Annual interest rate in US: 6% Applying International Fishier Effect theory, what should be the expected future spot rate for CAD? Use 4 numbers after decimal point.arrow_forwardWhat exact real rate of return is implied by a nominal return of 6% and an inflation rate of 2.4% over the same time period?(please write answer in a decimal format using 5 decimal places)arrow_forwardYou are given that the annual Australian dollar interest rate is 1% and the United States annual interest rate is 2.5%. The spot rate for the United States dollar is $A1.20. (a) Using interest rate parity, calculate the forward rate premium of the United States dollar with respect to the Australian dollar. (b) Using your answer to (a), calculate the one-year forward rate.arrow_forward

- 4d) Price the European call having strike 60 GBP. Use the two-periods binomial model with u = 1.1, d = 0.9 and ∆t = 1. Assume that the risk free rate is 5%, and the current price of the underlying asset is 50 GBP.arrow_forwardSubject:- financearrow_forwardSuppose today’s LIBOR rates for 1, 2, 3, 4, 5, and 6 months are 1.6%, 1.8%, 2.0%, 2.0%, 1.9%, and 1.6% with continuous compounding. What are the forward rates for future 1-month periods?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education