Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

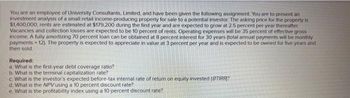

Transcribed Image Text:You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an

investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is

$1,400,000; rents are estimated at $179,200 during the first year and are expected to grow at 2.5 percent per year thereafter.

Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross

income. A fully amortizing 70 percent loan can be obtained at 8 percent interest for 30 years (total annual payments will be monthly

payments 12). The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and

then sold.

Required:

a. What is the first-year debt coverage ratio?

b. What is the terminal capitalization rate?

c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)?

d. What is the NPV using a 10 percent discount rate?

e. What is the profitability index using a 10 percent discount rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What is the

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please solve itarrow_forwardVishnuarrow_forwardConsider a new residential income producing property for sale to a potential investor. The sale price for the property is Sh. 1,250,000 of which building is Sh. 1 million and balance land. Building is depreciated over 50 years. Rent is estimated at Sh. 200,000 in the first year and is expected to grow at 3% p.a. thereafter. Vacancies and collection losses are expected to be 10% of rent. Operating expenses will be 31.5% of rent. A 70% mortgage loan can be obtained at 11% p.a. payable monthly for 30 years. The property is expected to appreciate in value at 3% per year and is expected to be owned for five years and then sold. Tax rate for both income and capital gains is 30%. Required Calculate the expected after tax IRR on equity invested. Is this investment viable if required rate of return is 15%?arrow_forward

- Your firm is considering purchasing an old office building with an estimated remaining service life of 25 years. Recently, the tenants signed a long-term lease, which leads you to believe that the current rental income of $250,000 per year will remain constant for the first five years. Then the rental income will increase by 10% for every five-year interval over the remaining life of the asset. That is, the annual rental income would be $275,000 for years 6 through 10, $302,500 for years 11 through 15, $332,750 for years 16 through 20, and $366,025 for years 21 through 25. You estimate that operating expenses, including income taxes, will be $85,000 for the first year and that they will increase by $5,000 each year thereafter. You also estimate that razing the building and selling the lot on which it stands will realize a net amount of $50,000 at the end of the 25-year period. If you had the opportunity to invest your money elsewhere and thereby earn interest at the rate of 12% per…arrow_forwardHelp me fast.....I will give good rating....arrow_forwardYou are the financial manager of the firm LAB.inc which does research in the medical field, your company needs an estimate of a financing plan for a research project. The research project according to the evaluation of the experts will be spread over a period of 4 years. The annual funding required to conduct this research is $100,000 at the beginning of each year. The firm has set a term of 7 years to raise the necessary funds to finance this research, the nominal interest rate is 8% capitalized quarterly. 1. How much does the company need to save at the end of each month to fund this research in 7 years? 2. Draw the timeline for this financing plan by presenting all the relevant elements. If the firm wants to start financing the research project today t=0, by taking out a bank loan equal to the VA of all the financing needs of the research project (for the 4 years). 3. Calculate the amount of monthly payments that the firm must pay to repay this bank loan for a period of 5 years?arrow_forward

- Based on what was reviewed in class, please submit a BOE analysis for the multi tenant retail center based on the information below. Please determine the Net Operating Income of this property. Also, what price would you pay for this property, if you wanted to achieve a 5% Cap Rate (Capitalization Rate)? NOTE: Common Area Maintenance (CAM) paid by tenants are $0.67 Per Square Foot, Per Month. Assume 5% Vacancy Rate. BOE Analysis - Assignment.pngarrow_forwardYou are an investor buying an existing office building. You determine that year 1 NOI will be $44,000 and that you the going in CAP rate is 4.1%. Using the Direct Capitalization approach, what is the estimated value of the building? You also determine that the Effective Gross Income will be $80,000 and the Effective Gross Income Multiplier is 13. What is the value using the EGIM muliplier approach? You also determine that the Annual Debt Service is 35,000. What is the Debt Service Coverage Ratio?arrow_forwardA company is considering an iron ore extraction project that requires an initial investment of $508,000 and will yield annual cash inflows of $152,000 for four years. The company's discount rate is 9%. What is the NPV of the project? Present value of an ordinary annuity of $1: 8% 9% 10% 1 2 3 4 5 6 7 8 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 OA $101,600 OB. $15,520 OC. $(15,520) OD. $(101,000) 0.917 1.759 2.531 3.24 3.89 4.486 5.033 5.535 0.909 1.736 2.487 3.17 3.791 4.355 4.668 5.335arrow_forward

- Emmons Lawn Maintenance (ELM) provides lawn and garden care for residential properties. In the current year, ELM maintains 76 properties and earns an average of $5,200 annually for each property. The owner of ELM is planning for the coming year. New building in the area is expected to increase volume by 21 percent. In addition, the owner estimates that the number of homeowners that will want ELM's service will increase by 11 percent. ELM plans to increase the price of service by 13.0 percent to cover expected increased wage and equipment costs. Required: Estimate revenues for Emmons Lawn Maintenance for the coming year. Note: Enter your answer rounded to the nearest whole dollar.arrow_forwardGeoWorld Systems uses a subset of the following questions during the interview process for new engineers. For each of the following cases, determine if “the project” or “do nothing” is preferred. The value of MARR in each case is 14%.arrow_forwardKartman Corporation is evaluating four different real estate investments. Management plans to buy the properties today and sell them three years from today. The annual discount rate for these investments is 11%. The following table summarizes the initial cost and the sale price in three years for each property: . Kartman has a total capital budget of $600,000 to invest in properties. Which properties should it choose? The profitability index for Parkside Acres is (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education