FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

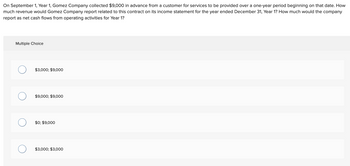

Transcribed Image Text:On September 1, Year 1, Gomez Company collected $9,000 in advance from a customer for services to be provided over a one-year period beginning on that date. How

much revenue would Gomez Company report related to this contract on its income statement for the year ended December 31, Year 1? How much would the company

report as net cash flows from operating activities for Year 1?

Multiple Choice

$3,000; $9,000

$9,000; $9,000

$0; $9,000

$3,000; $3,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alanta Corporation reported the following information for Year 7 and Year 6. December 31 Year 7 Year 6 Operating assets $147,691 $137,890 Operating liabilities 108,707 103,352 Net cash flow from operations 42,038 35,586 Net operating profit after tax (NOPAT) 30,034 28,568 Discount factor 6% 6% What are the company’s free cash flows to the firm (FCFF) for Year 7? Select one: a. $37,592 b. $34,480 c. None of these are correct d. $23,582 e. $25,588arrow_forwardTB EX Gu. 4-185 During the current year, a company provides services... 6. During the curremt year, a company provides services on account for $110,000. By the end of the year, SE been recelved. In addition, cash payments for the year were employees' salaries, $56,000; office suppli $25,000. Determine the amount of operating cash flows the company will report in the current year. (Cash ou minus sign.)arrow_forwardThe following details are provided by a manufacturing company: Investment Useful life Estimated annual net cash inflows for first year Estimated annual net cash inflows for second year Estimated annual net cash inflows for next ten years Residual value Product line OA. 2.74 years OB. 6.36 years O c. 6.71 years OD. 2.24 years $1,030,000 12 years $460,000 $430,000 $190,000 $50,000 Depreciation method Straight-line 12% Required rate of return Calculate the payback period for the investment. (Round your answer to two decimal places.) ...arrow_forward

- This Information will be used for all questions: Selected Balance Sheet Information Year 2020 Year 2021 Cash 40,000 ? Accounts Receivable 10,000 14,000 Prepaid Rent 5,000 6,000 Inventory 35,000 30,000 Accounts Payable 3,000 2,000 Unearned Revenue 5,000 7,000 Income Taxes Payable 14,000 12,000 Other Relevant Information for 2021 Beginning Cash Balance 40,000 Net Income 65,000 Depreciation Expense 40,000 Cash Paid for Dividends 10,000 Cash Received for Loan 40,000 Cash Repaying Loan 10,000 Cash Payment to Purchase Land 12,000 Cash Received for Sale of Equipment 15,000 Gain on Sale of Equipment 5,000 Cash Received for Issuance of Stock…arrow_forwardThe following are the financial statement Quick Ltd. for the year ended 31st December 2020: Quick Ltd. Income statement For year ended 31st December 2020 $”000” Revenue 1276.50 Cost of sales (907.00) 369.50 Distribution costs (62.50) Administrative expenses (132.00) 175.00 Interest received 12.50 Interest paid (37.50) Profit before tax 150.00 Tax (70.00) Profit after tax 80.00 Quick Ltd. Statement of financial position as at 31 December 2020 2019 $”000” $”000d” ASSETS: Non- current assets: Property, plant and equipment 190 152.5 Intangible assets 125 100 Investments 12.5 Current assets: Inventories 75 51 Receivables 195 157.5 Short-term investment 25 Cash in hand 1 0.5 Total assets 611 474 Equity and liabilities: Equity: Share capital 100 75 Share premium 80 75 Revolution reserve 50 45.5 Retained earnings 130 90 Non-current liabilities: Loan 85 25…arrow_forwardRequired information [The following information applies to the questions displayed below.] Portions of the financial statements for Parnell Company are provided below. For the Revenues and gains: Sales Cost of goods sold Gain on sale of building Expenses and loss: Salaries Insurance Depreciation PARNELL COMPANY Income Statement Income tax expense Year Ended December 31, 2021 ($ in thousands) Interest expense Loss on sale of equipment Income before tax Net income $ 820 10 $310 122 42 125 52 13 $830 664 166 83 $ 83arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education