ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

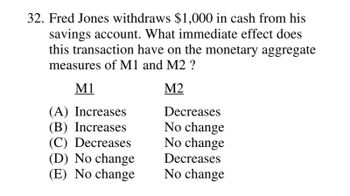

Fred Jones withdraws $1,000 in cash from his savings account. What immediate effect does this transaction have on the monetary aggregate measures of M1 and M2?

(A) M1 Increases, M2 decreases

(B) M1 Increases, M2 no change

(C) M1 Decreases, M2 no change

(D) M1 no change, M2 decreases

(E) M1 no change, M2 no change

Transcribed Image Text:32. Fred Jones withdraws $1,000 in cash from his

savings account. What immediate effect does

this transaction have on the monetary aggregate

measures of M1 and M2 ?

M1

M2

(A) Increases

(B) Increases

(C) Decreases

(D) No change

(E) No change

Decreases

No change

No change

Decreases

No change

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Homework (Ch 34) a central bank called the Fed, but a major difference is that this economy is closed (and therefore does not have any interaction with other world economies). The money market is currently in equilibrium at an interest rate of 2.5% and a quantity of money equal to $0.4 trillion, designated on the graph by the grey star symbol. INTEREST RATE (Percent) 4.5 4.0 3.5 3.0 2.5 2.0 - 1.5 + 1.0 + 0.5 0 Money Demand 0.1 0.2 0.3 0.4 Money Supply 0.5 0.6 0.7 0.8 14 New MS Curve + New Equilibrium ? Q Search this coursearrow_forwardThe Federal Reserve and the money supply Suppose the money supply (as measured by checkable deposits) is currently $300 billion. The required reserve ratio is 25%. Banks hold $75 billion in reserves, so there are no excess reserves. The Federal Reserve (“the Fed”) wants to decrease the money supply by $32 billion, to $268 billion. It could do this through open-market operations or by changing the required reserve ratio. Assume for this question that you can use the simple money multiplier. If the Fed wants to decrease the money supply using open-market operations, it should ______(buy/sell) $_________ billion worth of U.S. government bonds. If the Fed wants to decrease the money supply by adjusting the required reserve ratio, it should ______(increase/decrease) the required reserve ratio. THis is one question . please answer with an explanation.arrow_forwardBased on the analysis presented in this week's lectures, the following actions can increse the total Money Supply (M1) in the economy, EXCEPT: Increase in Monetary Base (Mo) Expansion of Excess Reserves Reduction of Reserve Requirements (RR) Increase in Bank Deposits (Do)arrow_forward

- How do changes in interest rates impact consumer spending, business investment, and overall economic activity, and how does the central bank use interest rates as a tool of monetary policy? A) Changes in interest rates have no effect on economic activity. B) Lower interest rates typically encourage consumer borrowing and business investment, stimulating economic activity. The central bank uses interest rate adjustments as a tool to influence borrowing and spending. C) Higher interest rates boost economic activity by increasing consumer savings. D) Changes in interest rates only affect government spending.arrow_forwardCurrency in Circulation (October 2020) 40.5 billion Nigerian currency Reserves (October 2020) 34.2 billion Nigeriancurrency M1 (October 2020) 2,465.9 billion Nigeriancurrency M2 (October 2020) 2,638.8 billion Nigeriancurrency Calculate the size of the actual money (M2) multiplier in October 2020. Round your answer to one decimal place. Nigeria's central bank, N. Bank, has not set a required reserve ratio (you can treat the required reserve ratio as 0%). Calcuate the excess reserve ratio for Norway in October 2020. Enter your answer in percent form without the percent sign. Round to one decimal place.arrow_forwarddo fast.arrow_forward

- to calculate the money multiplier at each of the following values for the reserve requirement. 3. RR = 0 (no reserve is necessary) RR = 0arrow_forwardThe following diagram shows the Money Market for a hypothetical economy. Suppose that the economy begins with a Money Supply (Ms) of $300 million, and an equilibrium interest rate of 5.0%. Finally suppose that the required reserve ratio (rr) is 15%. Use the scenario to answer Questions 10 to 13. Interest rates (i) 5.5% 5% 4.5% Ms O increase the money supply $10 million O increase the money supply $100 million O decrease the money supply $300 million O decrease the money supply $200 million O decrease the money supply $100 million $200 $300 $350 Mp Quantity of Money (millions) Suppose that the Central Bank wished to raise the equilibrium interest rate up to 5.5%. In order to achieve this, it would need I toarrow_forwardSuppose a central bank has a required reserve ratio of 6.6% for all banks and the central bank changes reserves at one of these banks by $536. By how much will the money supply change, at most, after all the effects of the money multiplier? (Round this to two digits after the decimal and enter this value as either a positive value or a negative value without the dollar sign.)arrow_forward

- Assume the Fed sells $32,140 worth of U.S. Treasury bonds to the First National Bank. Assuming that the required reserve ratio is 10.5 percent, then the money supply in the economy will ultimately: decrease by a maximum of $32,140. decrease by a maximum of $28,765. decrease by a maximum of $257,120. decrease by a maximum of $306,095. decrease by a maximum of $273,955.arrow_forwardList three main tools available to the Fed to change money supply in the economy. If the Fed wanted to decrease money supply in the economy, would the Fed buy or sell securities in the open market?arrow_forwardSuppose the money supply is currently $500 billion and the Fed wishes to increases it by $100 billion. Given a required reserve ration of 0.25, what should it do? If it decided to change the money supply by changing the required reserve ratio, what change should it make? Why may the Fed be reluctant to change the reserve requirement?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education