Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

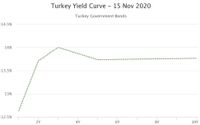

For the 10 Year Government Bonds Yield Curve for Turkey, what is the market predicting about the movement of interest rates that go further into the longer future? Explain in detail using the Expectations Theory.

Transcribed Image Text:Turkey Yield Curve - 15 Nov 2020

Turkey Government Bonds

14.5%

14%

13.5%

13%

12.5%

2Y

4Y

6Y

8Y

10Υ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Show complete stepsarrow_forwardSuppose the interest rate on a 1-year government bond is 3.00%, on a 4-year government bond is 3.50% and that on a 6-year government bond is 4.90%. What is the market's forecast for 2-year rates 4 years from now, assuming the pure expectations theory is correct? Show your work.arrow_forwardSuppose the interest rate on a 3-year Treasury Note is 2.25%, and 5-year Notes are yielding 4.00%. Based on the expectations theory, what does the market believe that 2-year Treasuries will be yielding 3 years from now?arrow_forward

- someone please help me with this!arrow_forwardI need help with this questionarrow_forwardWhat is the nominal yield on a 10-year government T-note if the real rate is 4%, the expected inflation is 5%, the liquidity premium is 1%, and the maturity risk premium is 1%? 1.5% • not enough information • 1.0% • 2.0% .arrow_forward

- Today is the 10th January 2023. You want to buy a Floating Rate Note (FRN) that matures on the 10th July 2027 and pays an annual coupon equal to LIBOR. Compute the fair price of the note. Use the data in Table 1. The LIBOR rate at selected dates are showed in Table 3. Please show your calculations. Discuss your result.arrow_forwardThe market has an expected rate of return of 8.0 percent. The long-term government bond is expected to yield 4.8 percent and the U.S. Treasury bill is expected to yield 1.1 percent. The inflation rate is 3.2 percent. What is the market risk premium? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardI would love some expertise help on this question showing the formulas used. Thank you very much in advancearrow_forward

- In 2020, the US 10-year Treasury Note yield stood at a nominal .7% and taking into account an expected inflation rate of 1.6% meant that the real yield was negative. In such a case, the negative yield may provide incentive for many investors to a. buy stocks b. undertake more risky investments (relative to buying US Treasuries) c. bid down the value of the US $ by buying foreign developed country bonds d. All of the abovearrow_forwardImagine that, during a job interview, you are handed the following quotes on U.S. Treasuries: Bond Maturity Coupon rate Yield to (years) maturity 1 1 5% 4.5% 2 2 5% 5.0% 3 3 0% 5.0% Assume that the par value is $100 and coupons are paid annually, with the first coupon payment coming in exactly one year from now. The yield to maturity is also quoted as an annual rate. What should be the 1-year forward rate between years 2 and 3? a. 6.482% ○ a. O b. 6.137% c. 6.507% O d. 6.736% NAVAarrow_forwardDiscuss the 10-year Bond rate of UK government as proxy of risk-free rate.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education