Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

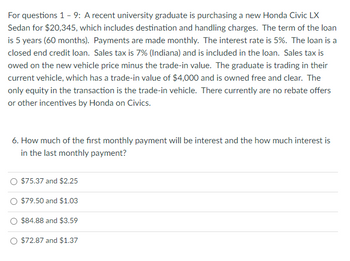

Transcribed Image Text:For questions 1 - 9: A recent university graduate is purchasing a new Honda Civic LX

Sedan for $20,345, which includes destination and handling charges. The term of the loan

is 5 years (60 months). Payments are made monthly. The interest rate is 5%. The loan is a

closed end credit loan. Sales tax is 7% (Indiana) and is included in the loan. Sales tax is

owed on the new vehicle price minus the trade-in value. The graduate is trading in their

current vehicle, which has a trade-in value of $4,000 and is owned free and clear. The

only equity in the transaction is the trade-in vehicle. There currently are no rebate offers

or other incentives by Honda on Civics.

6. How much of the first monthly payment will be interest and the how much interest is

in the last monthly payment?

$75.37 and $2.25

$79.50 and $1.03

$84.88 and $3.59

O $72.87 and $1.37

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- PLEASE, PERFORM THE EXERCISE IN EXCEL AND SHOW THE FORMULASProblem 4:Financiera FIAT normally grants loans for the purchase of new cars, at 13.½% interest with monthly payments, for 4 years. It requests a minimum down payment of 5% and a maximum of 35% of the initial value of the car, not including insurance and license plates; these expenses are paid in cash. Considering the above, calculate the interest cost and the amount of the monthly payments considering the down payments from smallest to largest and varying from (5, 15, 25 and 35%). As the down payment increases, the rate decreases each time by 0.25%. The final cost of the fully equipped FIAT automobile is $274,000.00, including $18,500.00 of insurance and license plates. Note:In the image, this is the original exercise, it is in Spanish, but it is easy to understand. Very important Note:It is necessary that you make a solution approach and then the result. Above all, to check the procedure and/or the formulas used, especially…arrow_forwardWade Ellis buys a new car for $16,447.22. He puts 10% down and obtains a simple interest amortized loan for the rest at at 11.5% interest for four years. (Round your answers to the nearest cent.) (a) Find his monthly payment.$ (b) Find the total interest.$ (c) Prepare an amortization schedule for the first two months of the loan. PaymentNumber PrincipalPortion InterestPortion TotalPayment Balance 0 $ 1 $ $ $ $ 2 $arrow_forwardA metallurgist purchases a car for total cost including tax and license of $31,795.66. If the metallurgist obtains a 4 year loan at an annual interest rate of 4.4% compounded monthly, what is a monthly car payment (in dollars)? Round your answer to the nearest cent. arrow_forward

- The Mexican restaurant where Tristan works borrowed $78,000 for 90 days to purchase new kitchen equipment. The rate was 11.4% using ordinary interest (360-day year). On day 34 of the loan, the restaurant made a partial payment of $5,000. What is the adjusted balance after this partial payment? Round to the nearest cent.arrow_forwardDave Krug finances a new automobile by paying $6,500 cash and agreeing to make 40 monthly payments of $500 each, the first payment to be made one month after the purchase. The loan bears interest at an annual rate of 12%. What is the cost of the automobile?arrow_forwardThe Magic Pumpkin Limousine Company wants to purchase a car telephone system for one of its automobiles. The telephone vendor has offered to finance the $1,500 purchase over one year in 12 installments, with a total of $140 in interest to be paid on the loan. Magic Pumpkin's bank has offered to finance the purchase with an instalment loan, where $155 in interest will be repaid and payments on the loan must be made quarterly. What are the annual interest rates on these loans?arrow_forward

- am. 113.arrow_forwardYou are financing a car worth $26194.15 with tax included. Interest rates are 11.9% compounded daily. Payments are monthly and made at the end of the month. You will own the car in 5 years. You have a down payment of $1274, Calculate the finance charge (interest charged on purchase). Round your answer to two decimal places. Do not enter the dollar sign. Sample input: 1564.23 (Hint: Take the down payment off the total worth of the car including tax; this is your PVn. Then, find the monthly payment by hand using the ordinary general annuity formuls or use the TVM salver, You will need an interest conversion if you do this question by hand or Excel because we have daily interest but monthly payments, you will need a monthly periodic interest rate. Then find the total value of ALL your monthly payments (e. g., PMT x Total Number of Monthly Payments) and add this to your down payment; subtract the purchase price including tax of the car from this figure-the difference is the interest you'll…arrow_forwardYou bought a used car for $4,000.00 at a nominal interest rate of 6%. You agreed to pay for the car in 12 equal monthly payments, beginning with the first payment at the time of the purchase of the car. b) Immediately after making the sixth payment, you made an arrangement with the company to pay back the rest of the loan with one single payment at the time when the seventh payment was due. What is your seventh payment?arrow_forward

- Please Answer with Explanation complesariarrow_forwardSimple Simon's Bakery purchases supplies on terms of 1.1/10, net 25. If Simple Simon's chooses to take the discount offered, it must obtain a bank loan to meet its short-term financing needs. A local bank has quoted Simple Simon's owner an interest rate of 10.6% on borrowed funds. Should Simple Simon's enter the loan agreement with the bank and begin taking the discount? (Hint: Use 365 days for a year.) The cost of forgoing the discount is %. (Round to one decimal place.) Should Simple Simon's enter the loan agreement with the bank and begin taking the discount? (Select the best choice below.) A. Simple Simon's should enter into the loan agreement but not begin taking the discount. B. Need more information to answer the question. OC. Simple Simon's should enter into the loan agreement with the bank and begin taking the discount. D. Simple Simon's should not enter into the loan agreement but should begin taking the discount.arrow_forwardA student is buying a new car for$37,000. The sales tax is6%. Title, license, and registration fee is$1250to be paid in cash. The dealer offers95%financing for 48 months at a rate of9%per year compounded monthly. Use both, the tables, and a spreadsheet to calculate each answer.(a) How much cash is paid when the car is purchased? b) How much is the monthly payment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education