FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

For financial reporting, Clinton Poultry Farms has used the declining-balance method of

| ($ in thousands) | |||

| Year | Straight Line | Declining Balance | Difference |

|---|---|---|---|

| 2021 | $ 678 | $ 1,440 | $ 762 |

| 2022 | 678 | 720 | 42 |

| 2023 | 678 | 360 | (318) |

| $ 2,034 | $ 2,520 | $ 486 |

Required:

2. Prepare any 2024

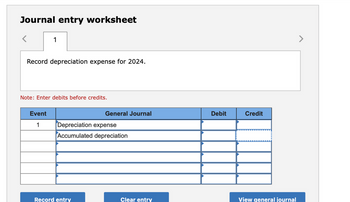

Transcribed Image Text:Journal entry worksheet

1

Record depreciation expense for 2024.

Note: Enter debits before credits.

Event

1

General Journal

Depreciation expense

Accumulated depreciation

Record entry

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For financial reporting, Clinton Poultry Farms has used the declining-balance method of depreciation for conveyor equipment acquired at the beginning of 2018 for $2,816,000. Its useful life was estimated to be six years with a $224,000 residual value. At the beginning of 2021, Clinton decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows: ($ in thousands) Year Straight-Line Declining Balance Difference 2018 $ 432 $ 938 $ 506 2019 432 626 194 2020 432 417 (15 ) $ 1,296 $ 1,981 $ 685 Required:2. Prepare any 2021 journal entry related to the change. (Enter your answers in dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardWarhol Enterprises purchased a spray painter at the beginning of 2018 at a cost of $150,000. Costs for training personnel on usage of this painter were $200. Warhol estimated that the spray painter would have a residual value of $30,000. The company decided to use declining-balance method of depreciation at a rate of 20%. Two years later, at the end of 2020, Warhol sold the spray painter for $120,000.a. Calculate the book value of the spray painter at the end of 2018 and the end of 2019, prior to its sale.b. Calculate the gain or loss on the sale of the spray painter.c. Calculate the income statement effect, assuming that Warhol decided to give the spray painter to a charitable foundation.arrow_forwardNavigation Inc. acquired an equipment on January 1, 2014 at a cost of $2,200,000 including an estimated residual value of $200,000 and twenty (20) years estimated useful life. The replacement cost of the equipment is $2,400,000 on December 30, 2017. The depreciated replacement cost declined to $1,470,000 after two years. If there is a need to gross up, round off percentage to whole number and to nearest dollar. Questions: 1. What is the carrying amount of the equipment on December 31, 2020?2. What is the balance of the revaluation surplus immediately after revaluation?arrow_forward

- Mustang Company changed from straight line depreciation to double declining balance method at the beginning of 2021. The plant asset originally cost P1,500,000 in 2016 using the straight-line depreciation. Periodic depreciation using the straight-line method is P60,000. What amount of depreciation should Mustang recognize for the year 2021?arrow_forwardIvanhoe Ltd. purchased a piece of equipment on January 1, 2019, for $1,275,000. At that time, it was estimated that the mad would have a 15-year life and no residual value. On December 31, 2023, Ivanhoe's controller found that the entry for depreciation expense was omitted in error in 2020. In addition, Ivanhoe planned to switch to double-declining-balance depreciation beca change in the pattern of benefits received, starting with the year 2023. Ivanhoe currently uses the straight-line method for depreciating equipment. Ivanhoe Ltd. follows IFRS.arrow_forwardOn April 1, 2021, Metro Co. purchased machinery at a cost of $42,000. The machinery is expected to last 10 years and to have a residual value of $6,000. Required: Compute depreciation for 2021 (for 9 months, 4/1/21 ~ 12/31/21) assuming the sum-of-the-years'-digits method is used. No credit if no computation is shown.arrow_forward

- Blossom Company purchased a warehouse on January 1, 2019, for $480,000. At the time of purchase, Blossom anticipated that the warehouse would be used to facilitate the expansion of its product lines. The warehouse is being depreciated over 20 years and is expected to have a residual value of $60,000. At the beginning of 2024, the company decided that the warehouse would no longer be used and should be sold for its carrying amount. At the end of 2024, the warehouse still had not been sold, and its net realizable value was estimated to be only $312,000. Prepare all the journal entries that Blossom should make during 2024 related to the warehouse. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry isrequired,select Indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the Amounts. List debit entry before credit entry.)arrow_forwardIrwin, Inc. constructed a machine at a total cost of $39 million. Construction was completed at the end of 2017 and the machine was placed in service at the beginning of 2018. The machine was being depreciated over a 10-year life using the straight-line method. The residual value is expected to be $3 million. At the beginning of 2021, Irwin decided to change to the sum-of-the-years’-digits method. Ignoring income taxes, prepare the journal entry relating to the machine for 2021.arrow_forwardFor financial reporting, Kumas Poultry Farms has used the declining-balance method of depreciation for conveyer. equipment acquired at the beginning of 2021 for $2,560,000. Its useful life was estimated to be six years with a $160,000 residual value. At the beginning of 2024, Kumas decides to change to the straight-line method. The effect of this change on depreciation for each year is as follows: Year 2021 2022 2023 Straight-Line $ 400 400 400 $ 1,200 View transaction list ($ in thousands) Declining Balance $ 853 569 379 $ 1,801 Required: 2. Prepare any 2024 journal entry related to the change. Note: Enter you answers rounded to the nearest dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet 1 Difference. $ 453 169 (21) $ 601 Record the adjusting entry for depreciation in 2024. Note: Enter debits before credits.arrow_forward

- Irwin, Inc., constructed a machine at a total cost of $35 million. Construction was completed at the end of 2014and the machine was placed in service at the beginning of 2015. The machine was being depreciated over a10-year life using the sum-of-the-years’-digits method. The residual value is expected to be $2 million. At thebeginning of 2018, Irwin decided to change to the straight-line method. Ignoring income taxes, what journalentry(s) should Irwin record relating to the machine for 2018?arrow_forwardOn July 1, 2020, ABC Company sells equipment for $105,000. The equipment originally cost $300,000, had an estimated 5-year life and an expected residual value of $50,000. The accumulated depreciation account had a balance of $200,000 on January 1, 2020, using the straight-line method. The gain or loss on disposal is _________________. (Indicate whether gain or loss)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education