College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

None

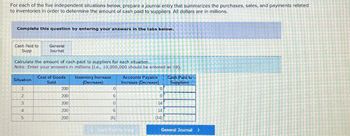

Transcribed Image Text:For each of the five independent situations below, prepare a journal entry that summarizes the purchases, sales, and payments related

to inventories in order to determine the amount of cash paid to suppliers. All dollars are in millions.

Complete this question by entering your answers In the tabs below.

Cash Paid to

Supp

General

Journal

Calculate the amount of cash paid to suppliers for each situation.

Note: Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

Cost of Goods

Situation

Sold

Inventory Increase

(Decrease)

Accounts Payable

Increase (Decrease)

Cash Paid to

Suppliers

1

200

0

0

2

200

6

0

3

200

0

14

4

200

6

14

5

200

(6)

(14)

Cash Pad to Sung

General Journal >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accounting Questionarrow_forwardCheck my work For each of the three independent situations determine the amount of cash received from the customers and prepare journal entries that summarize the selling and collection activities for the reporting period. All dollars are in millions. Complete this question by entering your answers in the tabs below. Cash Recd General from Cust Journal Determine the amount of cash received from the customers. (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).) Sales Accounts Receivable Cash Received from Situation Revenue Increase (Decrease) Customers 1 170 2 170 23 3 170 (23) Cash Recd from Cust General Journalarrow_forwardFor each of the three independent situations determine the amount of cash received from the customers and prepare journal entries that summarize the selling and collection activities for the reporting period. All dollars are in millions. Complete this question by entering your answers in the tabs below. Cash Recd from Cust Determine the amount of cash received from the customers. Note: Enter your answers in millions (.e., 10,000,000 should be entered as 10). Situation 1 2 General Journal 3 Sales Revenue 160 160 160 Accounts Receivable Cash Received from Increase (Decrease) Customers 0 21 (21) Cash Recd from Cust General Journal >arrow_forward

- The entry to record the cash sale of a webpage by Tellmore in the amount of $500 is: A) debit to Sales for $500, credit to Cash for $500. debit to Cash for $500, credit to Sales for $500. debit to Sales Discounts for $500, credit to Sales for $500. debit to Cash for $500, credit to Sales Discounts for $500.arrow_forwardPrepare the following journal entries. sales on account are $ 8,200. customer returns $ 1,200. customer is given an allowance of $ 425. a customer owes on account $ 2,000. The customer pays within the discount period and receives a sales discount of $ 40. Record the receipt of cash of $1,960.arrow_forward8. Provide journal entries to record each of the following transactions. For each, using the capital letter only, identify whether the transaction represents a source of cash (S), a use of cash (U), or neither (N). PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). For the journal entry, you must enter the account names exactly as written below. Cash Accounts Payable Dividends Payable Treasury Stock Dividends Preferred Stock Note Receivable Common Stock Bonds Payable Paid $22,000 cash on bonds payable. DR CR Transaction - Source of cash (S), Use of cash (U), or Neither (N)? Collected $12,600 cash for a note receivable. DR CR Transaction - Source of cash (S), Use of cash (U), or Neither (N)? Declared a dividend to shareholders for $16,000. DR CR Transaction - Source of cash (S), Use of cash (U), or Neither (N)?…arrow_forward

- Use the following items to prepare a balance sheet and a cash flow statement. Determine the total assets, total liabilities, net worth, total cash inflows, and total cash outflows. (Omit the "$" sign in your response.) Rent for the month Monthly take-home salary Cash in chequing account Savings account balance Spending for food Balance of educational loan Current value of automobile Telephone bill paid for month Credit card balance Loan payment picture Click here for the Excel Data File Total assets Total liabilities Net worth Total cash inflows Total cash outflows $ $ $ $ 1,410 3,740 650 2,860 1,040 2,320 7,960 70 265 98 Auto insurance Household possessions Stereo equipment Payment for electricity Lunches/parking at work Donations Home computer Value of stock investment Clothing purchase Restaurant spendingarrow_forwardPlease do 4.1.1 and use the table below. Please also complete the totals for each columnarrow_forward1. Provide journal entries to record each of the following transactions. For each, using the capital letter only, identify whether the transaction represents a source of cash (S), a use of cash (U), or neither (N). PLEASE NOTE: All whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). For the journal entry, you must enter the account names exactly as written below and for accounts having similar accounting treatment (DR or CR), you are to record Income Statement accounts first, followed by Balance Sheet accounts. Cash Truck Land Loss on Sale of Land Dividends Gain on Sale of Land Accounts Receivable Common Stock Note Payable Declared and paid to shareholders, a dividend of $24,000. DR CR Transaction - Source of cash (S), Use of cash (U), or Neither (N). Issued common stock at par value for $12,000. DR CR Transaction - Source of cash (S), Use of cash (U), or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub