FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

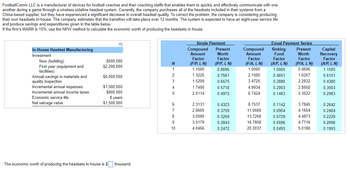

Transcribed Image Text:FootballComm LLC is a manufacturer of devices for football coaches and their coaching staffs that enables them to quickly and effectively communicate with one another during a game through a wireless sideline headset system. Currently, the company purchases all of the headsets included in their systems from a China-based supplier, but they have experienced a significant decrease in overall headset quality. To correct the problem, the company is considering producing their own headsets in-house. The company estimates that the transition will take place over 12 months. The system is expected to have an eight-year service life and produce savings and expenditures given in the table below.

If the firm's MARR is 15%, use the NPW method to calculate the economic worth of producing the headsets in-house.

### In-House Headset Manufacturing

#### Investment

- **Now (building):** $500,000

- **First year (equipment and facilities):** $2,200,000

- **Annual savings in materials and quality inspection:** $5,000,000

- **Incremental annual expenses:** $1,500,000

- **Incremental annual income taxes:** $800,000

- **Economic service life:** 8 years

- **Net salvage value:** $1,500,000

### Discount Factors Table

The table below provides the necessary factors for computing the NPW at various times (N) for a given interest rate (i), in this case 15%.

| N | Compound Amount Factor (F/P, i, N) | Present Worth Factor (P/F, i, N) | Compound Amount Factor (F/A, i, N) | Sinking Fund Factor (A/F, i, N) | Present Worth Factor (P/A, i, N) | Capital Recovery Factor (A/P, i, N) |

|----|-----------------------------------|----------------------------------|-----------------------------------|---------------------------------|---------------------------------|-----------------------------------|

| 1 | 1.1500 | 0.8696 | 1.0000 | 1.0000 | 0.8696 | 1.1500 |

| 2 | 1.3225 | 0.7561 | 2.3225 | 0.4651 | 1.6257 | 0.6151 |

| 3 | 1.5209 | 0.6575

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing. Management has asked you to investigate the cost allocation problem. You find that manufacturing overhead is currently assigned to products based on their direct labor costs. For your investigation, you have data form last year. Manufacturing overhead was $1,432,000 based on production of 290,000 handheld consoles and 108,000 home consoles. Direct labor and direct materials costs were as follows. Handheld Home Total Direct labor…arrow_forwardWatko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon 5,000 $ 182 40 Total purchases (cartons) Average purchase price (per carton) Number of deliveries Percentage of cartons delivered late. 30% Bacon Hessel Hessel 3,000 $198 20 15% The Accounting Department recorded $255,450 as the cost of late deliveries to customers. Effective Cost Per Carton Total 8,000 $ 188 60 25% Exercise 10-38 (Algo) Activity-Based Costing of Suppliers (LO 10-3, 4) Required: Assume that the average quality, measured by the percentage of…arrow_forwardShady Fabrication Group (SFG) manufactures components for manufacturing equipment at several facilities. The company produces two, related, parts at its Park River Plant, the models SF-08 and SF-48. The differences in the models are the quality of the materials and the precision to which they are produced. The SF-48 model is used in applications where the precision is critical and thus requires greater oversight in the production process. Although sales remain reasonably strong, managers at SFG have noticed that the company is meeting more resistance to the pricing for SF-08, although there seems to be little need for negotiation on the price of the SF-48 model. As a result, the marketing manager at SFG has asked the financial staff to review the costs of the two products to understand better what might be happening in the market. Manufacturing overhead is currently assigned to products based on their direct labor costs. For the most recent month manufacturing overhead was $212,400.…arrow_forward

- WAVERS Inc. is a California based firm that specializes in the manufacturing of high- end surfboards. Consumers in the coastal African region as well as Japan and the UK have recently discovered the joys of surfing. WAVERS has hired you as a consultant to provide advice regarding global expansion. They are debating whether to continue exporting to the UK or possibly licensing the technology to a London firm that has expressed some interest in manufacturing the product in the UK. Currently, Wavers return on investment from their domestic market is 35% with a net profit of $5 million from $20 million in sales. Labor is roughly 50% of total expenses and 20% cheaper in the UK than the US. Costs other than labor in the UK are roughly on par with the US. Discuss whether they should license or continue to export and the contingencies that need to be considered. If they license, what should the royalty rate be? Provide any assumptions that you have madearrow_forwardFast Wire Incorporated manufactures a scrambling device for cellular phones. The main component of the scrambling device is a very delicate part—DTV-12. DTV-12 requires careful handlings during manufacturing. Once damaged, the part must be discarded. Only skilled laborers are hired to manufacture and install DTV-12. Damages still occur, however. The following are the operating data of Fast Wire Incorporated for 2021 and 2022 relative to the insertion of DTV-12. 2021 2022 Number of phones manufactured 600,000 780,000 Units of DTV-12 used 960,000 1,072,500 Direct labor hours for DTV-12 insertion 1,800 2,600 Total cost of DTV-12 units $ 1,443,750 $ 2,333,750 Direct labor wage rate per hour $ 67 $ 82 The partial operational productivity ratio of DTV-12 in 2022 is: Multiple Choice 0.63 per unit. 0.73 per unit. 1.92 per unit. 3.00 per unit. 3.33 per unit.arrow_forwardWatko Entertainment Systems (WES) buys audio and video components for assembling home entertainment systems from two suppliers, Bacon Electronics and Hessel Audio and Video. The components are delivered in cartons. If the cartons are delivered late, the installation for the customer is delayed. Delayed installations lead to contractual penalties that call for WES to reimburse a portion of the purchase price to the customer. During the past quarter, the purchasing and delivery data for the two suppliers showed the following: Bacon 5,000 $ 192 40 30% Bacon Hessel Hessel 3,000 $ 208 Total purchases (cartons) Average purchase price (per carton) Number of deliveries Percentage of cartons delivered late. The Accounting Department recorded $265,200 as the cost of late deliveries to customers. Effective Cost Per Carton Total 8,000 $ 198 20 15% Required: Assume that the average quality, measured by the percentage of late deliveries, and prices from the two companies will continue as in the…arrow_forward

- Maglie Company manufactures two video game consoles: handheld and home. The handheld consoles are smaller and less expensive than the home consoles. The company only recently began producing the home model. Since the introduction of the new product, profits have been steadily declining. Management believes that the accounting system is not accurately allocating costs to products, particularly because sales of the new product have been increasing. Management has asked you to investigate the cost allocation problem. You find that manufacturing overhead is currently assigned to products based on their direct labor costs. For your investigation, you have data from last year. Manufacturing overhead was $1,237,000 based on production of 290,000 handheld consoles and 100,000 home consoles. Direct labor and direct materials costs were as follows. Handheld Home Total Direct labor $ 1,135,250 $ 411,000 $ 1,546,250 Materials 700,000 671,000 1,371,000…arrow_forwardDell Computers receives large shipments of microprocessors from Intel Corp. It must try to ensure the proportion of microprocessors that are defective is small. Suppose Dell decides to test five microprocessors out of a shipment of thousands of these microprocessors. Suppose that if at least one of the microprocessors is defective, the shipment is returned. Calculate the probability that the entire shipment will be kept by Dell even though the shipment has 10% defective microprocessors. 0.4550 0.5905 0.3979 0.3995arrow_forwardShady Fabrication Group (SFG) manufactures components for manufacturing equipment at several facilities. The company produces two, related, parts at its Park River Plant, the models SF-08 and SF-48. The differences in the models are the quality of the materials and the precision to which they are produced. The SF-48 model is used in applications where the precision is critical and thus requires greater oversight in the production process. Although sales remain reasonably strong, managers at SFG have noticed that the company is meeting more resistance to the pricing for SF-08, although there seems to be little need for negotiation on the price of the SF-48 model. As a result, the marketing manager at SFG has asked the financial staff to review the costs of the two products to understand better what might be happening in the market. Manufacturing overhead is currently assigned to products based on their direct labor costs. For the most recent month manufacturing overhead was $201,600.…arrow_forward

- Wheels, Inc. manufactures bicycles sold through retail bicycle shops in the southeastern United States. The company has two salespeople that do more than just sell the products - they manage relationships with the bicycle shops to enable them to better meet consumers' needs. The company's sales reps visit the shops several times per year, often for hours at a time. The owner of Wheels is considering expanding to the rest of the country and would like to have distribution through 450 bicycle shops. To do so, however, the company would have to hire more salespeople. Each salesperson earns $30,000 plus 3 percent commission on all sales annually. Another alternative is to use the services of sales agents instead of its own sales force. Sales agents would be paid 6 percent of sales. Each sales call lasts approximately 3 hours, and each sales rep has approximately 675 hours per year to devote to customers. Wheels needs 6 salespeople if it has 450 bicycle shop accounts that need to be called…arrow_forwardZynex Co manufactures a range of electronic devices, which it sells to online stores and retail outlets. It has a risk-seeking attitude and its objective is to maximise profit. Six months ago it released a new version of its smartphone, the ZV. Zynex Co's main smartphone competitor has announced that it will launch a new version of its smartphone in one month's time and Zynex Co is concerned about the effect of the launch of this rival product on future demand for the ZV. For each of the previous ten smartphones launched by its competitors, Zynex Co's marketing team has analysed the impact on Zynex Co's sales performance. This data was retained specifically for the purpose of forecasting future demand of Zynex Co's smartphones and is stored in the company's financial database. Based on this analysis, the marketing team has identified three possible outcomes for the impact on the demand of the ZV: a small decrease, a medium decrease and a large decrease. Production volumes for the ZV…arrow_forwardJireh Limited also manufactures prefab components for the housing industry. They have just been offered a new four year contract to supply a component, subject to them meeting certain quality requirements set by GREDA Ghana. The production manager is concerned that the current machine, which has been fully depreciated, will not be able to meet the stringent quality controls that will be required because the technology is obsolete, and the machine is unreliable. The company currently spends £50,000 per year to maintain and operate this machine which has no secondhand market value. On the basis of the production managerʼs recommendation, management has decided to replace the current machine. It is estimated that the replacement machine will cost £1 million with a four-year useful life. The companyʼs depreciation policy is to use a 20% reducing balance method over the life of the asset. As part of the purchase agreement for the new machine, the suppliers are offering a special maintenance…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education