Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

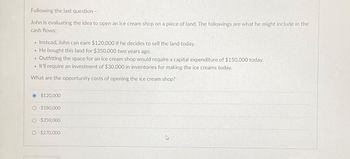

Transcribed Image Text:Following the last question -

John is evaluating the idea to open an ice cream shop on a piece of land. The followings are what he might include in the

cash flows:

Instead, John can earn $120,000 if he decides to sell the land today.

He bought this land for $350,000 two years ago.

• Outfitting the space for an ice cream shop would require a capital expenditure of $150,000 today.

It'll require an investment of $30,000 in inventories for making the ice creams today.

What are the opportunity costs of opening the ice cream shop?

1

·

.

-$120,000

O-$180,000

O-$350,000

O-$270,000

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Ron is an avid woodworker and a grill master and is thinking about investing £900,000 of his savings to start a new business. He is considering two alternative business opportunities, a furniture workshop and a steak restaurant, but can only accept one investment project. The projected cash flows of the two investments are shown below. Ron asks for your help and advice in reaching a decision on which investment project to accept. He tells you he requires a 6% rate of return on his investment. Furniture Steak workshop restaurant Cash flows £000 £000 Initial investment (900) (900) Cash inflows year 1 Cash inflows year 2 Cash inflows year 3 Cash inflows year 4 Cash inflows year 5 Cash inflow from sale of the investment at the end of year 5 225 300 300 262.5 337.5 262.5 337.5 300 262.5 375 112.5 150 Assume the initial investment arises at the start of the first year of the project. The depreciation method is straight line over the project's life.arrow_forwardWhat is the comparison (analysis) of the Days Sales Outstanding of Industry Average Ratio and the Company A Ratio? The Days Sales Outstanding has decreased and increased. Why? Industry Average DSO 2015: 138 days 2016: 104 days 2017: 173 days 2018: 125 days 2019: 98 days Company A DSO 2015: 245 days 2016: 338 days 2017: 332 days 2018: 169 days 2019: 81 daysarrow_forward1.You’ve spent $10,000 searching for an investment property. Now, you’re considering investing in a cottage near Brighton Beach. You can buy the house for $300,000 with cash, earn $20,000 per year in rent and pay $7,000 per year in HOA, taxes, and other expenses. Assume you’ll be able to sell the house in ten years for $400,000 (the "salvage value"). Your second-best investment alternative would earn a return of 6.50%. Calculate in Excel the NPV and IRR of this investment.arrow_forward

- You own a restaurant and are considering buying a liquor license. You estimate that it will cost you $200,000 to buy a five-year license and construct a bar and that you will generate $40,000 in after-tax cash flows each year for the next nine years. (The cost of the license is capitalized and the cash flows already reflect the depreciation). If your cost of capital is 15%, estimate the net present value of buying a liquor license. (There is no salvage value at the end of the 9th year). b. Assume now that the bar will bring in additional customers to your restaurant. If your after-tax operating margin is 60%, how much additional revenue would you have to generate each year in your restaurant for the liquor license to make economic sense?arrow_forwardKaleo has made up his mind—he wants a pool in the family’s backyard! He figures his kids and spouse will be thrilled. However, to cover the cost of the pool, they’ll have to pack up and live away from home for a few weeks during the summer to rent their home to vacationers. He crunched the numbers based on the following estimates. 1. Cost of pool/installation $50,000 2. Life of the pool (no salvage value) 20 years 3. Annual net cash inflows from renting (net of cash expenses for renting and pool maintenance) $6,500 4. Tax rate 23% 5. Average rate of return 8% Kaleo’s daughter, Sarah, found the above information written on a sheet of paper in his office, along with the following notes. “This is a no-brainer! We’ll recover the cost of this pool in just 7 years, even though we plan to live here until we’re old and gray, or at least as long as the pool hangs on. If we can rent our house out for just 3 weeks each year, it’ll be almost pure profit that we can put toward paying off…arrow_forwardCalculate it manually, not in excel. Show complete solution and cash flow diagram. Thank you!arrow_forward

- You are considering starting a new doughnut shop in the Prince Kuhio Mall. You wish to complete a cash flow statement to be used for capital budgeting purposes. You will have to purchase $80,000 of equipment with cash you have saved to manufacture the doughnuts. You will purchase the equipment on the day you start the business. You will depreciate the equipment using 3-year straight-line depreciation to a salvage value of $20,000. You will need to have $20,000 of inventory and you will need to have $5,000 in cash for the cash registers. You will need to have the inventory and cash in place the day you start the business and it will remain in place throughout the life of the business. You will owe your suppliers $5,000 at all times, beginning the day that you start the business and continuing through the life of the business. Based on your sales estimate, you believe that you will be able to sell $1,000,000 of doughnuts per year. You have estimated labor costs to be $200,000 for the…arrow_forwardam. 105.arrow_forwardGodoarrow_forward

- Which of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardSeema is looking at an investment in upgrading an inspection line at her plant. The initial cost would be $300,000 with a salvage value of $50,000 after 5 years. Use the capital recovery formula to determine how much money must be saved every year to justify the investment at 8% interest rate.arrow_forwardQ-H Alli is planning to open a small gym in Óseyri. He has researched the prices of equipment and necessary equipment and believes he needs to invest €250,000 to get off the ground (year 0). He has also assessed the demand and believes that the activity can bring him €50,000 per year after taxes in positive cash-flow for the next eight years. Alli assumes that the devices and equipment will be worthless after that time. He considers it appropriate to assume a 15% rate of return on the capital he needs for the investment. Alli asks you to evaluate this project by calculating the project's profitability index (Profitability Index). i) What is the profitability index of the project? ii) Do you think Alli should go into this activity based on that result? Why / why not? iii) How high a rate of return does this investment support?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education