FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

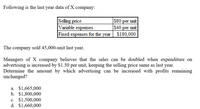

Transcribed Image Text:Following is the last year data of X company:

Selling price

Variable expenses

S80 per unit

$40 per unit

$180,000

Fixed expenses for the year

The company sold 45,000-unit last year.

Managers of X company believes that the sales can be doubled when expenditure on

advertising is increased by $1.50 per unit, keeping the selling price same as last year.

Determine the amount by which advertising can be increased with profits remaining

unchanged?

а. $1,665,000

b. $1,800,000

c. $1,500,000

d. $1,660,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- davubenarrow_forwardPlease help me with all answers thankuarrow_forwardLast year company A introduced a new product and sold 25,900 units at $97.00 per unit. The product variable expense $67.00 per unit with a fixed price expense of $835,500 per year. a. What is the product's net income or loss last year? b. What is the product break-even point in unit sales and dollar sales? c. Assume the company has conducted a market study that estimates it can increase sales by 5,000 units for each $2.00 reduction in its selling price. If the company would only consider increments of $2.00(e.g. $68,$66, etc) What is the maximum annual profit that can be earned on this product? What sales volume and selling price per unit generate the maximum profit? d. What would be the break-even point in unit sales and dollar sales using the selling price that was determined in the required letter c above? Thank you,arrow_forward

- Kk.1. Subject :- Accountarrow_forwardLast year's contribution format income statement for Huerra Company is given below: Unit $ 49.60 29.76 19.84 15.74 Sales Variable expenses Contribution margin Fixed expenses Net operating income Income taxes @ 40% Net income The company had average operating assets of $496,000 during the year. Required: 1. Compute last year's margin, turnover, and return on investment (ROI). For each of the following questions, indicate whether last year's margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI. Consider each question separately. 2. Using Lean Production, the company is able to reduce the average level of inventory by $95,000. 3. The company achieves a cost savings of $11,000 per year by using less costly materials. 4. The company purchases machinery and equipment that increase average operating assets by $124,000. Sales remain unchanged. The new, more efficient equipment reduces production costs by $7,000 per…arrow_forwardRequired information [The following information applies to the questions displayed below.] Westerville Company reported the following results from last year's operations: Sales Variable expenses Contribution margin Fixed expenses $ 1,600,000 700,000 900,000 660,000 Net operating income $4 240,000 Average operating assets $ 1,000,000 At the beginning of this year, the company has a $325,000 investment opportunity with the characteristics: Sales Contribution margin ratio Fixed expenses $ 520,000 70 % of sales $ 312,000 The company's minimum required rate of return is 15%. 9. If the company pursues the investment opportunity and otherwise performs the same as last year, wha (Round your percentage answer to 1 decimal place (i.e., 0.1234 should be considered as 12.3%.)) ROI % ( Prev 1O Pr Ps to search RELSarrow_forward

- ssarrow_forwardCompany B’s income statement for this year is shown below. Assume that the company’s sales will increase by 10% but fixed expenses remain the same next year. By what percentage will net operating income increase? Sales $100 Variable expenses 30 Contribution Margin 70 Fixed expenses 35 Net operating income $35 a)20% b)10% c)40% d)30%arrow_forwardWaffle Fries are Heavenly (WFH) has the following financial information for the previous year of operations: Operating income $128,000 Invested assets $800,000 Sales $296,000 WFH has internally set the minimum acceptable rate of return as 15%. Based on the information provided, what is the residual income? Waffle Fries are Heavenly (WFH) has the following financial information for the previous year of operations: Operating income $128,000 Invested assets $800,000 Sales $296,000 WFH has internally set the minimum acceptable rate of return as 15%. Based on the information provided, what is the residual income? $8,000 $83,600 $176 $128,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education