FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

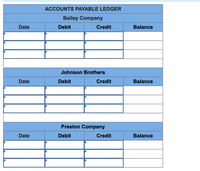

Transcribed Image Text:ACCOUNTS PAYABLE LEDGER

Bailey Company

Date

Debit

Credit

Balance

Johnson Brothers

Date

Debit

Credit

Balance

Preston Company

Date

Debit

Credit

Balance

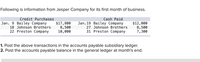

Transcribed Image Text:Following is information from Jesper Company for its first month of business.

Credit Purchases

Jan. 9 Bailey Company

18 Johnson Brothers

22 Preston Company

$17,800

8,500

10,000

Cash Paid

Jan. 19 Bailey Company

27 Johnson Brothers

31 Preston Company

$12,000

8,500

7,300

1. Post the above transactions in the accounts payable subsidiary ledger.

2. Post the accounts payable balance in the general ledger at month's end.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maniarrow_forwardDuring March, Sam Company had cash sales of $35,000 and sales on account of $210,000. In April, payments on account totaled $175,000. The journal entry prepared by Sam to record the March sales would include a debit to: A. Cash for $35,000, debit to accounts receivable for $210,000, and credit to sales revenue for $245,000 B. Cash for $35,000, debit to deferred revenue for $210,000, and credit to sales revenue for $245,000 C. Cash for $35,000, debit to accounts payable for $210,000, and credit to sales revenue for $245,000 D. Cash and credit to sales revenue for $35,000arrow_forwardDecember 31, current year. Balances January 1, current year Accounts receivable (various customers) $ 120,000 Allowance for doubtful accounts 9,000 In the following order, except for cash sales, the company sold merchandise and made collections on credit terms 4/10, n30 (assume a unit sales price of $700 in all transactions). Transactions during current year a. Sold merchandise for cash, $260,000. b. Sold merchandise to R. Smith; invoice price, $9,000. c. Sold merchandise to K. Miller; invoice price, $23,000. d. Two days after purchase date, R. Smith returned one of the units purchased in (b) and received account credit. e. Sold merchandise to B. Sears; invoice price, $26,000. f. R. Smith paid his account in full within the discount period. g. Collected $93,000 cash from customer sales on credit in prior year, all within the discount periods. h. K. Miller paid the invoice in (c) within the discount period. i. Sold merchandise to R. Roy; invoice price, $25,500. j. Three days after…arrow_forward

- Blossom Company has a balance in its Accounts Receivable control account of $11,300 on January 1, 2022. The subsidiary ledger contains three accounts: Bixler Company, balance $4,200: Cuddyer Company, balance $2,200, and Freeze Company. During January the following receivable-related transactions occurred. Bixler Company Cuddyer Company Freeze Company (a) Credit Sales Collections $9,000 $7,900 2.600 8.800 7.100 8.500 Returns $0 3.000 Balance in the Freeze Company subsidiary account S 0 What is the January 1 balance in the Freeze Company subsidiary account?arrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $225,000, terms n/30. 31 Issued a 30-day, 8% note for $225,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $600,000 from Triple Creek Bank, issuing a 45-day, 6% note. Jul. 1 Purchased tools by issuing a $50,000, 60-day note to Poulin Co., which discounted the note at the rate of 6%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 7% note for $600,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $280,000, paying $80,000 cash and issuing a series of ten 9% notes for…arrow_forward1. Prepare general journal entries for the following transactions for the current year: April 25 Sold $3,500 of merchandise to Phillip Corporation receiving a 9%, 60-day, $3,500 note receivable (the merchandise cost $2,000) June 24 The note of Phillip Corporation was dishonored. Date Description Post Ref Debit Creditarrow_forward

- Current Attempt in Progress Crane Company has the following accounts in its general ledger at July 31: Accounts Receivable $32,800 and Allowance for Doubtful Accounts $2,050. During October, the following transactions occurred. Oct. 15 Sold $13,100 of accounts receivable to Nelson Factors, Inc. who assesses a 4% finance charge. 25 Made sales of $800 on VISA credit cards. The credit card service charge is 3%. Journalize the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Creditarrow_forwardOn January 15, Tundra Co. sold merchandise to customers for cash of $45,000 (cost $30,600). Merchandise costing $11,400 was sold to customers for $17,000 on January 17; terms 2/10, n/30. Sales totalling $321,500 (cost $216,000) were recorded on January 20 to customers using MasterCard; assume the credit card charges a 2% fee. On January 25, sales of $78,600 (cost $52,700) were made to debit card customers. The bank charges Tundra a flat fee of 0.5% on all debit card transactions. Required: Prepare journal entries for each of the transactions described (assume a perpetual inventory system). View transaction list Journal entry worksheet Record the sale of merchandise on terms 2/10, n/30.arrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $175,000, terms n/30. 31 Issued a 30-day, 6% note for $175,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $400,000 from Triple Creek Bank, issuing a 45-day, 5% note. Jul. 1 Purchased tools by issuing a $45,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6% note for $400,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $260,000, paying $40,000 cash and issuing a series of ten 9% notes for…arrow_forward

- Below are amounts (in millions) from three companies' annual reports. Beginning Accounts Ending Accounts Receivable $2,722 6,494 625 WalCo TarMart CostGet Receivable $1,775 5,966 589 Net Sales $318,427 63,878 64,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales?arrow_forwardHaresharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education