Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

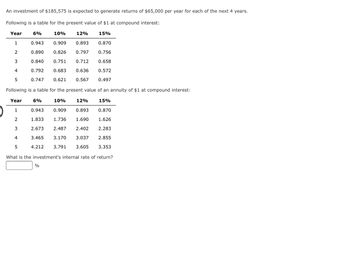

Transcribed Image Text:An investment of $185,575 is expected to generate returns of $65,000 per year for each of the next 4 years.

Following is a table for the present value of $1 at compound interest:

Year

1

2

3

4

12%

0.943

0.909

0.893

0.870

0.890

0.826 0.797 0.756

0.840

0.751 0.712 0.658

0.792

0.683

0.636

0.572

0.747 0.621 0.567

0.497

Following is a table for the present value of an annuity of $1 at compound interest:

Year

6%

10%

12%

15%

1

0.943 0.909 0.893

0.870

2

1.833

1.736

1.690

1.626

3

2.673

2.487 2.402

2.283

4

3.465

3.170 3.037 2.855

4.212

3.791

3.605 3.353

5

5

6%

10%

%

15%

What is the investment's internal rate of return?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assuming a 14% interest rate, which of the following is closest to the total present value of the following payments? Year 3 $12,000 Year 5 $10,000 Present Value of $1 Periods 14% 1 0.877 2 0.769 3 0.675 4 0.592 5 0.519 0.456 0.400 6 7 8 9 0.351 0.308 10 0,270 $12.978 $13,290 $8,100 O $32,054 Present Value of Annuity Periods 14% 0.877 2 1.647 3 2.322 4 2.914 3.433 3.889 4.288 1 5 6 7 8 9 10 4.639 4.946 5.216arrow_forwardComplete the following without using Table12.1. Note: Round the "Total amount" and "Total interest" to the nearest cent. Principal: $1,360 Time (years): 1 Rate of compound interest: 10% Compounded: Quarterly Periods: Rate: % Total amount: Total interest: Period 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 1 1.0050 1.0100 1.0150 1.0200 1.0250 1.0300 1.0350 1.0400 1.0450 1.0500 1.0550 1.0600 1.0650 1.0700 1.0750 1.0800 1.0850 1.0900 1.0950 1.1000 2 1.0100 1.0201 1.0302 1.0404 1.0506 1.0609 1.0712 1.0816 1.0920 1.1025 1.1130 1.1236 1.1342 1.1449 1.1556 1.1664 1.1772 1.1881 1.1990 1.2100 3 1.0151 1.0303 1.0457 1.0612 1.0769 1.0927 1.1087 1.1249 1.1412 1.1576 1.1742 1.1910 1.2079 1.2250 1.2423 1.25.97 1.2773 1.2950 1.3129 1.3310 4 1.0202 1.0406 1.0614 1.0824 1.1038 1.1255 1.1475 1.1699 1.1925 1.2155 1.2388 1.2625 1.2865 1.3108 1.3355 1.3605 1.3859 1.4116 1.4377 1.4641 5 1.0253 1.0510 1.0773 1.1041 1.1314 1.1593 1.1877…arrow_forwardInterest rates determine the present value of future amounts. (Round to the nearest dollar.) Read the requirements. View the Present Value of $1 table. View the Future Value of $1 table. View the Present Value of Ordinary Annuity of $1 table. View the Future Value of Ordinary Annuity of $1 table. Requirement 1. Determine the present value of seven-year bonds payable with face value of $91,000 and stated interest rate of 14%, paid semiannually. The market rate of interest is 14% at issuance. (Round intermediary calculations and final answer to the nearest whole dollar.) Present Value 91000 When market rate of interest is 12% annually C When market rate of interest is 14% annually Requirement 2. Same bonds payable as in requirement 1, but the market interest rate is 16%. (Round intermediary calculations and final answer to the nearest whole dollar.) Present Value When market rate of interest is 16% annually Requirement 3. Same bonds payable as in requirement 1, but the market interest…arrow_forward

- Calculating Interest Using 360 days as the denominator, calculate interest for the following notes using the formula I = P x R × T. Round your answers to the nearest cent. Principal Rate Time Interest $4,100 6.00% 30 days 1,000 7.50 60 3,500 8.00 120 950 6.80 95 1,250 7.25 102 2,600 7.00 90arrow_forwardThe investment committee of Sentry Insurance Co. is evaluating two projects, office expansion and upgrade to computer servers. The projects have different useful lives, but each requires an investment of $490,000. The estimated net cash flows from each project are as follows: Year 1 2 Year 3 4 5 The committee has selected a rate of 12% for purposes of net present value analysis. It also estimates that the residual value at the end of each project's useful life is $0, but at the end of the fourth year, the office expansion's residual value would be $180,000. 6 7 8 9 10 1 1 2 3 2 4 5 6 3 0.943 0.890 0.840 Present Value of $1 at Compound Interest 6% 10% 12% 0.792 0.747 0.705 0.665 0.627 0.592 0.558 Net Cash Flows Office Expansion $125,000 125,000 125,000 125,000 125,000 125,000 0.943 1.833 2.673 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 Net Cash Flows Servers $165,000 165,000 165,000 165,000 0.909 1.736 2.487 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322…arrow_forwardFollowing is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 5 0.747 0.621 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 Using the tables provided, the present value of $6,453 (rounded to the nearest dollar) to be received at the end of each of the next 4 years, assuming an earnings rate of 12%, isarrow_forward

- At a annual effective rate of interest i, payment of $100 from now,$200 two years from now and $100 four years from now have a total present value of $300. Calculate i A.11.7% B.13% C.14.5% D.15.8% E.16.9%arrow_forwardCalculating Interest Using 360 days as the denominator, calculate interest for the following notes using the formula I = P x R × T. Round your answers to the nearest cent. Principal Rate Time Interest $5,000 6.00% 30 days 1,000 7.50 60 4,500 8.00 120 %24 950 6.80 95 1,250 7.25 102 2,900 7.00 90 %24 %24arrow_forwardA4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education