FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

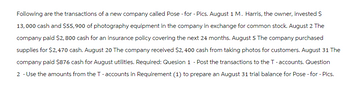

Transcribed Image Text:Following are the transactions of a new company called Pose - for - Pics. August 1 M. Harris, the owner, invested $

13,000 cash and $55,900 of photography equipment in the company in exchange for common stock. August 2 The

company paid $2,800 cash for an insurance policy covering the next 24 months. August 5 The company purchased

supplies for $2,470 cash. August 20 The company received $2,400 cash from taking photos for customers. August 31 The

company paid $876 cash for August utilities. Required: Quesion 1 - Post the transactions to the T-accounts. Question

2 - Use the amounts from the T-accounts in Requirement (1) to prepare an August 31 trial balance for Pose - for - Pics.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- James Howard owns Howard Auto Sales. He periodically borrows money from Bay City State Bank and Trust. He permits some customers to sign short-term notes for their purchases. He usually discounts these notes at the bank. Following are selected transactions that occurred in March 20X1. DATE TRANSACTIONS 20X1 Mar. 4 Mr. Howard borrows $20,000 from the bank on a note payable for the business. Terms of the note are 8 percent interest for 45 days. 11 A 90-day $18,000 note payable to the bank is discounted at a rate of 10 percent. 22 Sold a car to Darnell Jones for $30,000 on a 75-day note receivable, bearing interest at 10 percent. 23 Discounted the Jones note with the bank. The bank charges a discount rate of 12 percent. 25 Sold a car for $30,000 to Henry Thomas. Thomas paid $4,000 cash and signed a 30-day note, bearing interest at 10 percent, for the balance. 28 Alfred Herron's account receivable is overdue. Howard requires him to sign a 12…arrow_forwardPlease help mearrow_forwardRecord the following transactions for the month of June 20X1 in the cash receipts journal. Total, prove, and rule the cash receipts journal as of June 30. June 4 Collected $1,150 from Tom Whitney, a credit customer on account. 9 Received a cash refund of $105 for damaged supplies. 10 Laurie Bradley, the owner, invested an additional $14,500 cash in the business. 21 Received a check from Scott White to pay his $2,300 promissory note plus interest of $127. 26 Received $2,000 for cash sales of plus sales tax of $122. There was a cash overage of $19. Date June 4, 20X1 June 9, 20X1 June 10, 20X1 June 21, 20X1 June 26, 20X1 June 30, 20X1 Description Tom Whitney Cash refund Investment Collect note Scott White Cash sales Totals CASH RECEIPTS JOURNAL Accounts Receivable Credit 1,150 14,500 2,300 Sales Tax Payable Credit $ 17,950 $ 105 122 227 Sales Credit Other Accounts Credit $ 1,859 Account Title Laurie Bradley, Capital Supplies Laurie Bradley, Capital Notes receivable Interest income 1,859…arrow_forward

- Lowell Bank reported the following checking account fees: $2 to see a real-live teller, $20 to process a bounced check, and $1 to $3 if you need an original check to prove you paid a bill or made a charitable contribution. This past month you had to transact business through a tellet six times-a total $12 cost to you. Your bank statement shows a $305,33 balance your checkbook shows a $1,009.76 balance. You received $1.10 in interest. An $80115 deposit was not recorded on your statement. The following checks were outstanding: No. 413. $28.30, No. 414, $18.60, and No. 418, $60.72. Prepare your bank reconciliation (Input all amounts as positive values. Round your answers to 2 decimal places) Checkbook balance Add: Interest Subtotal Deduct Teller fee Reconciled balance Y BANK RECONCILIATION $ 1,009 76 Bank balance Add: 1.10 $1,010.86 12.00 $ 998 58 Deposit in transit Subtotal Deduct Outstanding checks (total) Reconciled balance - ** $ 74 $ 305.33 801.15 1,106.48 107,62 998.86arrow_forwardA company established a petty cash fund in April of the current year and experienced the following transactions affecting the fund during April. Prepare journal entries to establish the fund on April 1, to replenish it on April 25, and to record the increase in the fund on April 25. April 1 Prepared a company check for $300.00 to establish the petty cash fund. April 25 Prepared a company check to replenish the fund for the following expenditures made since April 1. Paid $84.50 for cleaning services. Paid $84.00 for postage expense. Paid $103.15 for office supplies. Counted $23.35 remaining in the petty cash box. April 25 The company decides to increase the fund by $100.arrow_forwardJames Howard owns Howard Auto Sales. He periodically borrows money from Bay City State Bank and Trust. He permits some customers to sign short-term notes for their purchases. He usually discounts these notes at the bank. Following are selected transactions that occurred in March 20X1. DATE TRANSACTIONS 20X1 Mar. 4 Mr. Howard borrows $34,560 from the bank on a note payable for the business. Terms of the note are 10 percent interest for 45 days. 11 A 90-day $47,520 note payable to the bank is discounted at a rate of 8 percent. 22 Sold a car to Darnell Jones for $40,320 on a 75-day note receivable, bearing interest at 7 percent. 23 Discounted the Jones note with the bank. The bank charges a discount rate of 10 percent. 25 Sold a car for $48,960 to Henry Thomas. Thomas paid $4,000 cash and signed a 30-day note, bearing interest at 9 percent, for the balance. 28 Alfred Herron's account receivable is overdue. Howard requires him to sign a 8…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education