FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

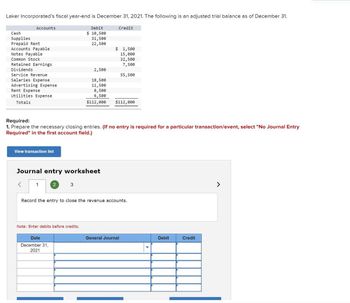

Question

Transcribed Image Text:Laker Incorporated's fiscal year-end is December 31, 2021. The following is an adjusted trial balance as of December 31.

Accounts

Cash

Supplies

Prepaid Rent

Accounts Payable

Notes Payable

Common Stock

Retained Earnings

Dividends

Service Revenue

Salaries Expense

Advertising Expense

Rent Expense

Utilities Expense

Totals

View transaction list

<

1

Journal entry worksheet

Required:

1. Prepare the necessary closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry

Required" in the first account field.)

2

Debit

$ 10,500

31,500

22,500

3

Date

December 31,

2021

2,500

Note: Enter debits before credits.

18,500

11,500

8,500

6,500

$112,000

Credit

$ 1,500

15,000

32,500

7,500

55,500

$112,000

Record the entry to close the revenue accounts.

General Journal

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On Dec. 31, 2021, Boss Company had a credit balance of $50,000 in its records pertaining to allowance for uncollectible accounts. Analysis of its accounts receivable on the same date revealed the following: Age Amount % collectible 0-30 days $5,000,000 95 31-60 days 600,000 85 61-90 days 450,000 70 Over 90 days 100,000 50 Total $6,150,000 The company has written off $20, 000 of accounts receivable during 2021. How much is the allowance for uncollectible accounts to be reported on Dec. 31, 2021?arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardAccounts Receivable Free Company gathered the following information from its accounting records for the year ended December 31, 2019: • Net Credit Sales for the year - P680,000 • Accounts Receivable at December 31 - 92,000 • Allowance for doubtful accounts at December 31 - 1,850arrow_forward

- DO NOT GIVE SOLUTION IN IMAGEarrow_forwardPotaw Company reported the following data at the end of 2019: Sales revenue (80% on credit) Expenses (25% on credit) Accounts receivable, net at December 31, 2019 (a decrease of $12,500 during 2019) Total assets Stockholders' equity The average number of days to collect receivables during 2019 is closest to: (Do not round your intermediate calculations. Use 365 days a year.) Multiple Choice The average number of days to collect receivables during 2019 is closest to: (Do not round your intermediate calculations. Use 365 days a year.) O O O 17.67. 22.08. $470,000 77,000 12.81. 16,500 370,000 170,000 30.90.arrow_forwardGrandview, Incorporated uses the allowance method. At December 31, 2021, the company's balance sheet reports Accounts Receivable, Net in the amount of $27, 200. On January 2, 2022, Grandview writes off a $ 2,400 customer account balance when it becomes clear that the customer will never pay. What is the amount of Accounts Receivable, Net after the write-off? a $27, 200 b $2,400 c $29, 600 d $24, 800arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education