FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

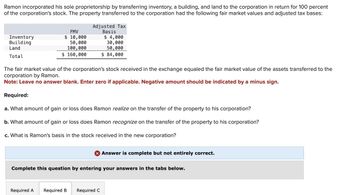

Transcribed Image Text:Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent

of the corporation's stock. The property transferred to the corporation had the following fair market values and adjusted tax bases:

Inventory

Building

Land

Total

FMV

$ 10,000

50,000

100,000

$ 160,000

Adjusted Tax

Basis

$ 4,000

30,000

50,000

$ 84,000

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the

corporation by Ramon.

Note: Leave no answer blank. Enter zero if applicable. Negative amount should be indicated by a minus sign.

Required:

a. What amount of gain

loss does Ramon realize on the transfer of the property to his corporation?

b. What amount of gain or loss does Ramon recognize on the transfer of the property to his corporation?

c. What is Ramon's basis in the stock received in the new corporation?

Required A

Complete this question by entering your answers in the tabs below.

Answer is complete but not entirely correct.

Required B Required C

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CARDO COMPANY Book Value Fair Value Book Value Fair Value Cash P500,000 P500,000 Accounts Payable P450,000 P440,000 Accounts Receivable 250,000 240,000 Mortgage Payable 200,000 220,000 Inventory 155,000 200,000 Ordinary Shares 595,000 - Fixed Assets (Net) 600,000 520,000 Retained Earnings 260,000 - SYANO COMPANY Book Value Fair Value Book Value Fair Value Cash P300,000 P300,000 Accounts Payable P350,000 P340,000 Accounts Receivable 150,000 160,000 Mortgage Payable 200,000 220,000 Inventory 125,000 100,000 Ordinary Shares 250,000 - Fixed Assets (Net) 400,000 420,000 Retained Earnings 175,000 - If CARDO Co purchases the net assets of SYANO Co by issuing 5,000 shares of their P20 par value shares with a fair value of P40 per share, incurs a mortgage loan for P90,000, pays P150,000 cash and paying direct,…arrow_forwarda. 272,500 b. 275,000 c. 277,500 d. 280,000arrow_forwardQ5arrow_forward

- LL %24 The separate condensed balance sheets of Patrick Corporation and its wholly-owned subsidiary, Sean Corporation, are as BALANCE SHEETS December 31, 2020 Patrick Sean Cash Accounts receivable (net) Inventories Plant and equipment (net) Investment in Sean 24 000'9 000 9 000 00000 000 0 000 $1,400,000 $ 418,000 Total assets 82,000 Accounts payable Long-term debt Common stock ($10 par) Additional paid-in capital Retained earnings 000'8 000 306,000 262,000 000't78 Total liabilities and shareholders' 000 Additional Information: • On December 31, 2020, Patrick acquired 100 percent of Sean's voting stock in exchange for $454,000. • At the acquisition date, the fair values of Sean's assets and liabilities equaled their carrying amounts, respectively, except that the fair value of certain items in Sean's inventory were $20,000 more than their carrying amounts. In the December 31, 2020, consolidated balance sheet of Patrick and its subsidiary, what amount of total assets should be reported?…arrow_forwardPROBLEM FIVE Wrap Ltd. is a Canadian-controlled private corporation. At the end of 2022, Wrap had the following tax account balances. Non-capital losses $ 8,000 Net capital losses 2,000 Non-eligible RDTOH 7,000 Dividend refund from non-eligible dividends 1,000 CDA 12,000 For the current year, 2023, net income for tax purposes is $261,000. Included in this amount is the following. Income from an active business carried on in Canada $200,000 Taxable capital gain 6,000 Eligible dividends from Canadian public companies 15,000 Canadian bond interest 40,000 The following is a summary of other information for Wrap Ltd. for the 2023 year. Taxable income Required: $236,000 Capital dividend paid 12,000 Eligible dividend paid 10,000 Non-eligible dividend paid 75,000 Small business deduction 38,000 Total Federal Part I tax payable 31,920 Determine the dividend refund for 2023. Would the dividend refund change if Wrap Ltd. was not a CCPC but instead was a private corporation or a public…arrow_forward20 Skipped Assume that Puritan Corporation operates in an industry for which NOL carryback is allowed. Puritan Corporation reported the following pretax accounting income and taxable income for its first three years of operations: 2023 $ 358,000 2024 (503,000) 2025 753,000 Puritan's tax rate is 25% for all years. Puritan elected a loss carryback. As of December 31, 2024. Puritan was certain that it would recover the full tax benefit of the NOL that remained after the operating loss carryback. What would Puritan report as net income for 2025? Multiple Choice $564,750 $141,198 $611,812 $613,804arrow_forward

- What is Ratio Corporation's Current Ratio at 12/31/2021? Question 2 options: 2.11 2.22 1.21 None of these optionsarrow_forwardNonearrow_forwardQuestion:29 Your corporation has the following cash flows: Operating income $ 2,50,000 Interest received 10,000 Interest paid 45,000 Dividends received 20,000 Dividends paid 50,000 If the applicable income tax rate is 40 percent, and if 70 percent of dividends received are exempt from taxes, what is the corporation's tax liability? A) $74,000 B) $88,400 C) $91,600 D) $100,000 E) $106,500arrow_forward

- PROBLEM FIVE Wrap Ltd. is a Canadian-controlled private corporation. At the end of 2022, Wrap had the following tax account balances. Non-capital losses $ 8,000 Net capital losses 2,000 Non-eligible RDTOH 7,000 Dividend refund from non-eligible dividends 1,000 CDA 12,000 For the current year, 2023, net income for tax purposes is $261,000. Included in this amount is the following. Income from an active business carried on in Canada $200,000 Taxable capital gain 6,000 Eligible dividends from Canadian public companies 15,000 Canadian bond interest 40,000 The following is a summary of other information for Wrap Ltd. for the 2023 year. Taxable income Required: $236,000 Capital dividend paid 12,000 Eligible dividend paid 10,000 Non-eligible dividend paid 75,000 Small business deduction 38,000 Total Federal Part I tax payable 31,920 Determine the dividend refund for 2023. Would the dividend refund change if Wrap Ltd. was not a CCPC but instead was a private corporation or a public…arrow_forwardThe following are the balance sheets of Ukraine Limited, Poland Limited and Russia Limited, as at the 31 December 2019. The three companies are major players in the automotive industry. Max Limited acquired 75% of the shares in Poland Limited on January 1 2017 when the reserve balances were as follows: General reserves: $24,000 and retained earnings $60 000. The acquisition of Poland Limited consisted of a deferred cash payment of $300,000 and a share exchange of 2 shares in Ukraine Limited for every 5 shares acquired in Poland Limited. The market price for a Ukraine Limited share at that date was $4.50. The transaction has not been recorded on the books. On 1 July 2019 Ukraine Limited acquired 30,000 shares in Russia Limited for cash at a price of $2.70 per share. For the year ended 31 December 2019 Russia Limited reported a profit of $64,000 (assume profit accrued evenly during the year). This transaction was recorded on the books. Balance Sheet as at 31 December 2019 Ukraine Ltd…arrow_forward17. 2022 Corp Z Cash Method Taxpayer – (Corp. Aggregate Receipts < $27 Mil.) 100% Owned by Shareholder A Business Income - 1200000 Business Expenses - 160000 NYS Bond Interest - 2000 Dividend received from 75 % owned Corporation - 8000 Reasonable Compensation - 5500000 Compensation of Family Members Not Active in the Company - 150000 Capital Loss – (5000) Interest Expense paid to Bank - 250000 §179 Depreciation Tractor - 25000 Bonus Depreciation Heavy Truck - 50000 Questions: a. What is taxable income? _______________ Show calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education