FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:LL

%24

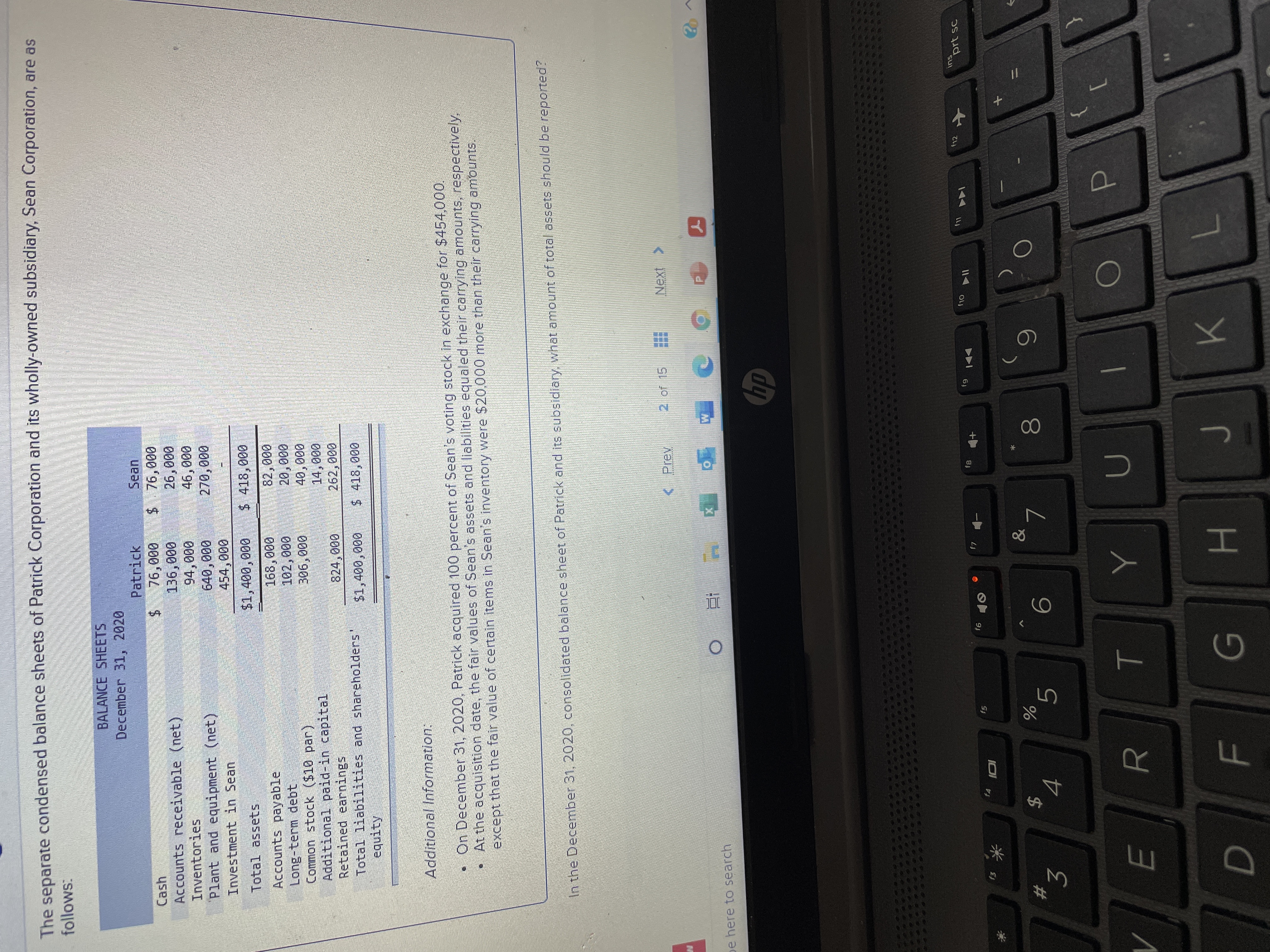

The separate condensed balance sheets of Patrick Corporation and its wholly-owned subsidiary, Sean Corporation, are as

BALANCE SHEETS

December 31, 2020

Patrick

Sean

Cash

Accounts receivable (net)

Inventories

Plant and equipment (net)

Investment in Sean

24

000'9

000 9

000

00000

000 0

000

$1,400,000

$ 418,000

Total assets

82,000

Accounts payable

Long-term debt

Common stock ($10 par)

Additional paid-in capital

Retained earnings

000'8

000

306,000

262,000

000't78

Total liabilities and shareholders'

000

Additional Information:

• On December 31, 2020, Patrick acquired 100 percent of Sean's voting stock in exchange for $454,000.

• At the acquisition date, the fair values of Sean's assets and liabilities equaled their carrying amounts, respectively,

except that the fair value of certain items in Sean's inventory were $20,000 more than their carrying amounts.

In the December 31, 2020, consolidated balance sheet of Patrick and its subsidiary, what amount of total assets should be reported?

< Prev

2 of 15

Next

be here to search

dy

144

f4

f5

米到

&

$

*3

81

4.

5.

R

H.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ssarrow_forwardQUESTION 12arrow_forwardProblem 18-5 (Algo) Shareholders' equity transactions; statement of shareholders' equity; financial statement effects [LO18-6, 18-7, 18-8] Listed below are the transactions that affected the shareholders' equity of Branch-Rickie Corporation during the period 2024-2026. At December 31, 2023, the corporation's accounts included: Common stock, 112 million shares at $1 par Paid-in capital-excess of par Retained earnings ($ in thousands) $ 112,000 672,000 910,000 a. November 1, 2024, the board of directors declared a cash dividend of $0.70 per share on its common shares, payable to shareholders of record November 15, to be paid December 1. b. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Rickie was holding as an investment. The bonds had a fair value of $2.8 million, but were purchased two years previously for $2.4 million. Because they were intended to be held to maturity, the bonds had not been…arrow_forward

- Walking Bear Resources Inc. Equity Section of the Balance Sheet March 31, 2023 Contributed capital: Preferred shares, $17 cumulative, 3,500 shares authorized, issued, and outstanding Common shares, unlimited shares authorized, se,000 shares issued and outstanding Total contributed capital Retained earnings Total equity 1,190,000 1,200,000 2,390,000 472,000 2,062,000 Required: a. Refer to the equity section above. Assume that the preferred are convertible into common at a rate of eight common shares for each share of preferred. if 1000 shares of the preferred are converted into common on April 1, 2023, prepare the journal entryarrow_forwardE 36-3 - Computation of basic EPS; with retrospe Miming Corp. had the following capital structure during 2020 and 2021: Preference share capital, P100 par, 10% cumulative, 100,000 shares Ordinary share capital, P100 par, 400,000 shares P10,000,000 40,000,000 Miming reported profit of P8,000,000 for the year ended Dec. 31, 2021. Miming paid no preference share dividends during 2020 and paid P1,500,000 preference share dividends in 2021. On Jan. 31, 2022, prior to the date that the 2021 financial statements are authorized for issue, Miming distributed 10% ordinary share dividend. Required: Compute the basic EPS to be presented in Miming Corp.'s statement of profit or loss for the year ended Dec. 31, 2021. E 36-4 - Computation of basic and diluted EPS; convertible instruments Kate Corp. had 200,000 ordinary shares, 20,000 convertible preference shares, and P1,000,000 of outstanding during 2021. The preference share is convertible into 40,000 ordinary shares. During 2021, Kate paid…arrow_forwardExtracts from group financial statements of AB, a public limited company, year ended April 30, 2021. OMR (millions) Profit from continuing operations 35,000 Minority interest distributed1,500 Preference dividend30 Share capital at April 30, 2021 Ordinary shares of OMR 1 1,000 5% Convertible preference shares 300 Other Information 1. The profits for the three months to April 30, 2021, are OMR1,200 million. 2. On May 11, 2021, there was a bonus issue of one for four ordinary shares. The financial statements are made up to April 30, 2021, and had not yet been published. 3. XY plc, a 100% owned subsidiary of AB, has in issue 9% convertible bonds of OMR200 million that can be converted into one ordinary share of AB for every OMR10 worth of bonds. Income tax is levied at 33%. Required Calculate basic and diluted earnings per share.arrow_forward

- CH Required information Sovran Financial Corporation reported net income of $154 mlion for the current year (tax rate 25%). Its capital structure consksted of the folkowing. Unchanged during the year Common Stock Jan. 1 60 million common shares were outstanding (S amounts in milions, except per share amount) Basic EPS: Netincome $154 $2.57 60 Shares outstanding 0:00/1:23 720p 1X CC O Knowledge Check 01 Greene Corporation reported net income of $300,000. The company had 60,000 common shares outstanding, which remained unchanged during the current year. What is the company's basic EPS? (Round your answer to 2 decimal places.) Basic EPS IMG-1894.jpg IMG-1895.jpg IMG-1896.jpg --pdf 490CA57F-89F1....pdfarrow_forwardAssets Liabilities Capital stock Retained earnings Total equities Assets Liabilities Capital stock Retained earnings Total equities Balance Sheet December 31, 2025 Skysong Company Balance Sheet December 31, 2025 $2040000 $210000 1020000 810000 $2040000 $1440000 $320000 970000 150000 $1440000 If Oriole Company acquired a 30% interest in Skysong Company on December 31, 2025 for $350000 and during 2026, Skysong had net income of $141000 and paid a cash dividend of $51000, applying the equity method would result in a debit balance in the Equity Investments (Skysong) account at the end of 2026 of O $392300. ○ $377000. ○ $350000. O $334700.arrow_forwardQuestion 33 ACME Incorporated had the following balances for its equity accounts on the company's audited statement of financial position at December 31, 2019: Shareholder's Equity Paid in on capital shares Preferred [8%, cumulative, 30,000 authorized, issued & outstanding $ 300,000 Common [unlimited authorized, 550,000 issued & outstanding] Contributed surplus 865,000 216,250 $ 1,381,250 Retained earnings Accumulated other comprehensive income Total shareholder's equity 432,500 216,250 $ 2,030,000 Information for 2020: Net income was Gain on disposal of bonds Dividends declared and paid on preferred shares Issued 3,000 common shares Foreign translation gain on subsidiary Comprehensive income $ 350,000 135,000 15,000 5,000 87,500 262,500 Required: Prepare ACME's statement of changes in equity at December 31, 2020 in good form.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education