FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

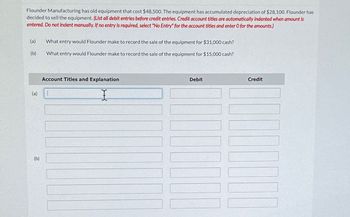

Transcribed Image Text:Flounder Manufacturing has old equipment that cost $48,500. The equipment has accumulated depreciation of $28,100. Flounder has

decided to sell the equipment. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

(a) What entry would Flounder make to record the sale of the equipment for $31,000 cash?

(b)

What entry would Flounder make to record the sale of the equipment for $15,000 cash?

Account Titles and Explanation

I

(a) 1

(b)

Debit

Credit

11

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardAt the beginning of 2021, Brad’s Heating & Air (BHA) has a balance of $26,000 in accounts receivable. Because BHA is a privately owned company, the company has used only the direct write-off method to account for uncollectible accounts. However, at the end of 2021, BHA wishes to obtain a loan at the local bank, which requires the preparation of proper financial statements. This means that BHA now will need to use the allowance method. The following transactions occur during 2021 and 2022.1. During 2021, install air conditioning systems on account, $190,000.2. During 2021, collect $185,000 from customers on account.3. At the end of 2021, estimate that uncollectible accounts total 15% of ending accounts receivable.4. In 2022, customers’ accounts totaling $8,000 are written off as uncollectible.Required:1. Record each transaction using the allowance method.2. Record each transaction using the direct write-off method.3. Calculate the difference in net income (before taxes) in 2021 and…arrow_forwardDexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $10,000 of its accounts receivable from Leer Company. March 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions. View transaction list Journal entry worksheet 1 2 3 Record write-off of Leer Company account. Note: Enter debits before credits. Date March 11 General Journal Debit Credit Record entry Clear entry View general journal >arrow_forward

- I am completely lost on how to find the net realizable valuesarrow_forwardDexter Company uses the direct write-off method. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from Leer Co. 29 Leer Co. unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above transactions View transaction list Journal entry worksheet < 1 Record write off of Leer Co. account Note: Enter debits before credits. Date General Journal Debit Credit March 11 Cash 45,000 45,000 Narrow_forward1. Ace Plus is a home improvement store that began operations last year. On December 31st of the first year of operations, Ace Plus had accounts receivable totaling $50,000 and the store’s manager, Bill Henrickson, estimated that $1,500 of those receivables will not be collected. On January 17 of Year 2, Ace Plus decided to write off as uncollectible a $500 receivable owed by Roman Grant. Benny, the new accountant at Ace Plus, is struggling with receivables. Please advise him by answering the questions below. Assume Ace Plus uses the Allowance method for write-offs. 1. What should the December 31st journal entry look like? 2. What should the January 17th journal entry look like? 3. What type of account is Allowance for Doubtful Accounts and what type of balance does it have, debit or credit? 4. Briefly explain why a company might use the Direct Write-Off method instead of the Allowance method? Does it even make a difference?arrow_forward

- The controller for Swifty Corp. is concerned about certain business transactions that the company experienced during 2023. The controller, after discussing these matters with various individuals, has come to you as the CFO for advice. Swifty follows ASPE. The transactions at issue are presented below: 1. 2. 3. The company has decided to switch from the direct write-off method for accounting for bad debts to the percentage-of- sales approach. Assume that Swifty has recognized bad debt expense as the receivables have actually become uncollectible in the following way: From 2022 sales From 2023 sales 2022 10,500 2023 3,900 14,900 The controller estimates that an additional $21,800 in bad debts will be written off in 2024: $3,700 applicable to 2022 sales and $18,100 to 2023 sales. Inventory has been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such (on account). At December 31, 2023, inventory billed and in the hands of consignees amounted…arrow_forwardAt the end of 2016, Whispering Winds Corp. has accounts receivable of $749,900 and an allowance for doubtful accounts of $23,580. On January 24, 2017, it is learned that the company's receivable from Madonna Inc. is not collectible and therefore management authorizes a write-off of $4,564. (a) Prepare the journal entry to record the write-off. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit (b) What is the cash realizable value of the accounts receivable before the write-off and after the write-off? Before Write-Off After Write-Off Cash realizable value 2$arrow_forwardNeed Help with this Questionarrow_forward

- (2) Accounting for Bad Debts The following data was associated with the accounts receivable and uncollectible accounts of Hilton, Inc. during 2003. (1) Prepare journal entries under the direct write off method to record the fact that: (2) Prepare journal entries under the allowance method to record the fact that: (If a journal entry is not needed, state no entry.) (a) The company estimates that $920,000 of bad debts will occur this year. Date entry as of 1/1/03. (b) John Smith did not pay his account of $50,000, and it was written off on 12/15/03. J C (2) Accounting for Bad Debts- The following data was associated with the accounts receivable and uncollectible accounts of Hilton, Inc. during 2003. (1) Prepare journal entries under the direct write off method to record the fact that: (2) Prepare journal entries under the allowance method to record the fact that: (If a journal entry is not needed, state no entry.) (a) The company estimates that $920,000 of bad debts will occur this year.…arrow_forwardEmily is a sole trader. Emily’s payables ledger control account shows a balance of $24,903 which does not agree with the payables ledger. She has found three errors: A purchase invoice has been entered into the purchase day book as $594 rather than $495 The purchase day book has been undercast by $200 Discounts received of $150 from credit suppliers have not been entered in the control account What is the corrected payables ledger control account balance?arrow_forwardOn May 15, Baxtor, Inc. sold $26,000 of merchandise to James, on account. Baxtor could not collect cash from James and wrote off the account. What is the journal entry to record the write-off, assuming Baxtor uses the allowance method? Bad Debt Expense $26,000 Miscellaneous Bank Fees $26,000 Allowance for Bad Debts $26,000 Accounts Receivable - James Allowance for Bad Debts $26,000 Utility Expense $26,000 $26.000 Bad Debt Revenue $26,000 Allowance for Bad Faith Unpaid Accounts $26,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education