FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

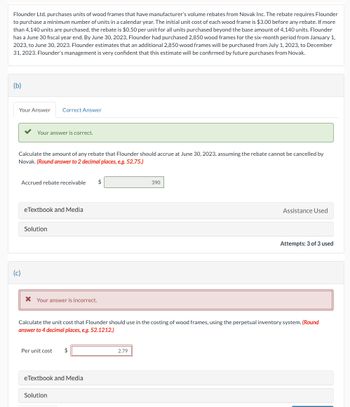

Transcribed Image Text:Flounder Ltd. purchases units of wood frames that have manufacturer's volume rebates from Novak Inc. The rebate requires Flounder

to purchase a minimum number of units in a calendar year. The initial unit cost of each wood frame is $3.00 before any rebate. If more

than 4,140 units are purchased, the rebate is $0.50 per unit for all units purchased beyond the base amount of 4,140 units. Flounder

has a June 30 fiscal year end. By June 30, 2023, Flounder had purchased 2,850 wood frames for the six-month period from January 1,

2023, to June 30, 2023. Flounder estimates that an additional 2,850 wood frames will be purchased from July 1, 2023, to December

31, 2023. Flounder's management is very confident that this estimate will be confirmed by future purchases from Novak.

(b)

Your Answer Correct Answer

Your answer is correct.

Calculate the amount of any rebate that Flounder should accrue at June 30, 2023, assuming the rebate cannot be cancelled by

Novak. (Round answer to 2 decimal places, e.g. 52.75.)

(c)

Accrued rebate receivable $

eTextbook and Media

Solution

* Your answer is incorrect.

Per unit cost

Calculate the unit cost that Flounder should use in the costing of wood frames, using the perpetual inventory system. (Round

answer to 4 decimal places, e.g. 52.1212.)

$

eTextbook and Media

Solution

390

2.79

Assistance Used

Attempts: 3 of 3 used

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Waterway Company sells televisions at an average price of $ 934 and also offers to each customer a separate 3-year warranty contract for $ 87 that requires the company to perform periodic services and to replace defective parts. During 2020, the company sold 294 televisions and 214 warranty contracts for cash. It estimates the 3-year warranty costs as $21 for pa and accounts for warranties separately. Assume sales occurred on December 31.2020, and parts and $41 for labor, straight-line recognition of warranty revenues ocurs. Part 1 Record any necessary journal entries in 2020. (f no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account tities are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer Part 2 What liability relative to these transactions would appear on the December 31, 2020,…arrow_forwardPronghorn Computer Company sells computers for $1,800 each, which includes a three-year warranty that requires the company to perform periodic services and to replace defective parts. During 2023, Pronghorn sold 580 computers on account. Based on past experience, the company has estimated the total three-year warranty costs at $80 for parts and $100 for labour. (Assume sales all occur at December 31, 2023.) In 2024, Pronghorn Computer Company incurred actual warranty costs relative to 2023 computer sales of $9,800 for parts and $13,000 for labour. (a) Using the expense warranty approach, prepare the entries to reflect the above transactions (accrual method) for 2023 and 2024. Use Salaries and Wages Payable. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation 2023 (To…arrow_forwardOn March 10, 2020, Pharoah Company sold to Barr Hardware 180 tool sets at a price of $51 each (cost $29 per set) with terms of n/60, f.o.b. shipping point. Pharoah allows Barr to return any unused tool sets within 60 days of purchase. Pharoah estimates that (1) 10 sets will be returned, (2) the cost of recovering the products will be immaterial, and (3) the returned tools sets can be resold at a profit. On March 25, 2020, Barr returned 6 tool sets and received a credit to its account. (a) Prepare journal entries for Pharoah to record (1) the sale on March 10, 2020, (2) the return on March 25, 2020, and (3) any adjusting entries required on March 31, 2020 (when Pharoah prepares financial statements). Pharoah believes the original estimate of returns is correct. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Your answer is correct. No.…arrow_forward

- Splish Company sells goods to Blossom Company during 2020. It offers Blossom the following rebates based on total sales to Blossom. If total sales to Blossom are 10,500 units, it will grant a rebate of 2%. If it sells up to 21,200 units, it will grant a rebate of 5%. If it sells up to 30,800 units, it will grant a rebate of 6%. In the first quarter of the year, Splish sells 10,600 units to Blossom at a sales price of $106,000. Splish, based on past experience, has sold over 37,600 units to Blossom, and these sales normally take place in the third quarter of the year.What amount of revenue should Splish report for the sale of the 10,600 units in the first quarter of the year. Revenue $arrow_forwardThe Moustache Company is replacing most of the windows in its Alden factory by purchasing them under a note agreement with the Blattner Window Design Company on January 1, 2019. Moustache financed $37,908,000, and the note agreement will require $10 million in annual payments starting on December 31, 2019 and continuing for a total of four more years(final payment December 31, 2023). Blattner will charge Moustache the market interest rate of 10% compounded annually. What is the amount of the 2020 interest expense? A. $3,290,800 B. $2,790,800 C. $4,000,000 D. $3,169,880arrow_forwardTamarisk Company sells a machine for $6,720 with a 12-month warranty agreement that requires the company to replace all defective parts and to provide the repair labor at no cost to the customers. With sales being made evenly throughout the year, the company sells 440 machines in 2020 (warranty expense is incurred half in 2020 and half in 2021). As a result of product testing, the company estimates that the warranty cost is $355 per machine ($160 parts and $195 labor). Use "Inventory" account to record the warranty expense.Assuming that actual warranty costs are incurred exactly as estimated, what journal entries would be made relative to the following facts? Part 1 Sale of machinery and warranty expense incurred in 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Warranty accrual on December 31, 2020. (If no entry is…arrow_forward

- Shamrock Company sells a machine for $7,920 with a 12-month warranty agreement that requires the company to replace all defective parts and to provide the repair labor at no cost to the customers. With sales being made evenly throughout the year, the company sells 540 machines in 2025 (warranty expense is incurred half in 2025 and half in 2026). As a result of product testing, the company estimates that the total warranty cost is $334 per machine ($144 parts and $190 labor). Assuming that actual warranty costs are incurred exactly as estimated, what journal entries would be made relative to the following facts? Use "Inventory" account to record the parts portion of the warranty expense. (a) Sale of machinery and warranty expense incurred in 2025. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.)…arrow_forwardMajik Corporation offers a variety of electronic instruments, tooling equipment, technical reference books, and audio training manuals. Majik uses warranties and premiums as sales promotion techniques to attract customers. Electronic instruments and tooling equipment are sold with a 1-year warranty for replacement of parts and labor. Estimated warranty cost, based on past experience, is 1.5% of sales. The premium offered on technical reference books and audio training manuals allows customers receive an MP3 player in exchange 250 for coupons and $25. Customers receive 1 coupon for each dollar spent on technical reference books and audio training manuals. Each MP3 player costs $35 and Makjik estimates 65% of the coupons given to customers will be redeemed. Majik's total 2020 sales totaled $8,250,000 with $6,500,000 from electronic instruments and tooling equipment and $1,750,000 from technical reference books and audio training manuals. Warranty replacement parts and labor costs totaled…arrow_forwardOn March 10, 2020, Pharoah Company sold to Barr Hardware 180 tool sets at a price of $51 each (cost $29 per set) with terms of n/60, f.o.b. shipping point. Pharoah allows Barr to return any unused tool sets within 60 days of purchase. Pharoah estimates that (1) 10 sets will be returned, (2) the cost of recovering the products will be immaterial, and (3) the returned tools sets can be resold at a profit. On March 25, 2020, Barr returned 6 tool sets and received a credit to its account. (a) Prepare journal entries for Pharoah to record (1) the sale on March 10, 2020, (2) the return on March 25, 2020, and (3) any adjusting entries required on March 31, 2020 (when Pharoah prepares financial statements). Pharoah believes the original estimate of returns is correct. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) No. Account Titles and…arrow_forward

- Oriole Frosted Flakes Company offers its customers a pottery cereal bowl if they send in 4 boxtops from Oriole Frosted Flakes boxes and $2. The company estimates that 60% of the boxtops will be redeemed. In 2021, the company sold 795000 boxes of Frosted Flakes and customers redeemed 356000 boxtops receiving 89000 bowls. If the bowls cost Oriole Company $4 each, how much liability for outstanding premiums should be recorded at the end of 2021?arrow_forwardMoon Co. sells food blenders. During 2019, Moon made 37,000 blenders at an average cost of $80. It sold out 25,000 food blenders at an average price of $130. Moon provides a 2-year warranty for each blender sold and estimates 9% of blenders will be returned for warranty with an estimated cost of $36 each. By the end of 2019, Moon has spent $44,000 servicing the warranty repairs. All the above transactions have been settled in cash. During 2019, Moon has 50 employees who work 5-day per week and get paid each other Friday. Salaries of $324,000 and payroll expense of $37,000 have been paid until December 22. Since the business grows quickly, Moon needs cash to expand. By the end of 2018, the Board of Directors authorized the management to issue 10-year bonds with a par value of $3,000,000, annual contract interest rate of 8% and semi-annual interest payments. Moon chose to use the straight-line method to amortize discount or premium on its bonds. On January 1, 2019, management issued…arrow_forwardPresented below are two independent revenue arrangements for Colbert Company. Instructions Respond to the requirements related to each revenue arrangement. a. Colbert sells 3D printer systems. Recently, Colbert provided a special promotion of zero-interest financing for 2 years on any new 3D printer system. Assume that Colbert sells Lyle Cartright a 3D system, receiving a $5,000 zero-interest-bearing note on January 1, 2020. The cost of the 3D printer system is $4,000. Colbert imputes a 6% interest rate on this zero-interest note transaction. Prepare the journal entry to record the sale on January 1, 2020, and compute the total amount of revenue to be recognized in 2020. b. Colbert sells 20 nonrefundable $100 gift cards for 3D printer paper on March 1, 2020. The paper has a standalone selling price of $100 (cost $80). The gift cards expiration date is June 30, 2020. Colbert estimates that customers will not redeem 10% of these gift cards. The pattern of redemption is as follows.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education