FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

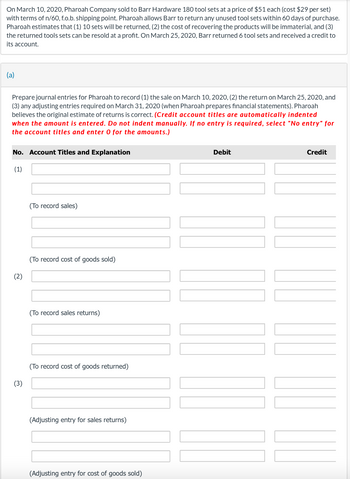

Transcribed Image Text:On March 10, 2020, Pharoah Company sold to Barr Hardware 180 tool sets at a price of $51 each (cost $29 per set)

with terms of n/60, f.o.b. shipping point. Pharoah allows Barr to return any unused tool sets within 60 days of purchase.

Pharoah estimates that (1) 10 sets will be returned, (2) the cost of recovering the products will be immaterial, and (3)

the returned tools sets can be resold at a profit. On March 25, 2020, Barr returned 6 tool sets and received a credit to

its account.

(a)

Prepare journal entries for Pharoah to record (1) the sale on March 10, 2020, (2) the return on March 25, 2020, and

(3) any adjusting entries required on March 31, 2020 (when Pharoah prepares financial statements). Pharoah

believes the original estimate of returns is correct. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for

the account titles and enter 0 for the amounts.)

No. Account Titles and Explanation

(1)

(2)

(3)

(To record sales)

(To record cost of goods sold)

(To record sales returns)

(To record cost of goods returned)

(Adjusting entry for sales returns)

(Adjusting entry for cost of goods sold)

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 2, 2021, Oriole Hospital purchased a $94,800 special radiology scanner from Bella Inc. The scanner had a useful life of 4 years and was estimated to have no disposal value at the end of its useful life. The straight-line method of depreciation is used on this scanner. Annual operating costs with this scanner are $106,000. Approximately one year later, the hospital is approached by Dyno Technology salesperson, Jacob Cullen, who indicated that purchasing the scanner in 2021 from Bella Inc. was a mistake. He points out that Dyno has a scanner that will save Oriole Hospital $26,000 a year in operating expenses over its 3-year useful life. Jacob notes that the new scanner will cost $111,000 and has the same capabilities as the scanner purchased last year. The hospital agrees that both scanners are of equal quality. The new scanner will have no disposal value. Jacob agrees to buy the old scanner from Oriole Hospital for $40,500. (a) If Oriole Hospital sells its old scanner on…arrow_forwardPlease do not give solution in image format ?arrow_forwardProtection Company develops a patent on a new fingerprint security technology. On January 1, 2018, this patent is registered for a cost of $30,000,000 for a period of 10 years. The company does not expect this technology to be obsolete over at least the next 15 years and intends to use it over this period. At the end of 2020, the fair value of the patent is $15,000,000. The discounted value of future cash flows (value-in-use) is $16,000,000. The Company adopts the cost model. 1. What will the cost of patent be? 2. What will the useful life be? Justify your answer. 3. Prepare the entries for 2018, 2019 and 2020. Please show the workings. Dont provide handwritten or image based answers thank youarrow_forward

- On January 2, 2021, Twilight Hospital purchased a $92,000 special radiology scanner from Blossom Inc. The scanner had a useful life of 4 years and was estimated to have no disposal value at the end of its useful life. The straight-line method of depreciation is used on this scanner. Annual operating costs with this scanner are $104,000. Approximately one year later, the hospital is approached by Dyno Technology salesperson, Jacob Cullen, who indicated that purchasing the scanner in 2021 from Blossom Inc. was a mistake. He points out that Dyno has a scanner that will save Twilight Hospital $24,000 a year in operating expenses over its 3-year useful life. Jacob notes that the new scanner will cost $109,000 and has the same capabilities as the scanner purchased last year. The hospital agrees that both scanners are of equal quality. The new scanner will have no disposal value. Jacob agrees to buy the old scanner from Twilight Hospital for $43,000. (a) If Twilight Hospital sells its old…arrow_forwardIf Lew's Steel Forms purchases $632,000 of new equipment, they can lower annual operating costs by $300,000. The equipment will be depreciated straight-line to a zero book value over its 3-year life. Ignore bonus depreciation. At the end of the three years, the equipment will be sold for an estimated $25,000. The equipment will require the company to hold an extra $65,000 of inventory over the 3-year period. What is the NPV if the discount rate is 13 percent and the tax rate is 21 percent? NPV = 36491.30 X Attempt # 1: 0/1 (Score: 0/1) Allowed attempts: 3 X Incorrect Check Answerarrow_forwardOnJanuary 3,2020,GagneInc. paid $320,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of$2,500,$6,400sales tax, and $21,100 for special installation. Management estimates that the computer will remain in service for five years and have a residual value of $20,000.The computer will process 50,000 documents the first year, decreasing annually by 5,000 during each of the next four years (that is 45,000 documents in 2021,40,000 documents is 2022, and so on). In trying to decide which depreciation method to use, the company president has requested a depreciation schedule for each of three depreciation methods (straight-line, units-of-production, and double-diminishing-balance). 1.Before completing the straight-line depreciation schedule, calculate the straight-line depreciation rate. First, select the labels for the formula and then compute the rate. (Round the rate to two decimal places.) 2. Complete the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education