Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Calculation of operating levrage

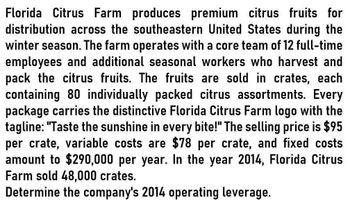

Transcribed Image Text:Florida Citrus Farm produces premium citrus fruits for

distribution across the southeastern United States during the

winter season. The farm operates with a core team of 12 full-time

employees and additional seasonal workers who harvest and

pack the citrus fruits. The fruits are sold in crates, each

containing 80 individually packed citrus assortments. Every

package carries the distinctive Florida Citrus Farm logo with the

tagline: "Taste the sunshine in every bite!" The selling price is $95

per crate, variable costs are $78 per crate, and fixed costs

amount to $290,000 per year. In the year 2014, Florida Citrus

Farm sold 48,000 crates.

Determine the company's 2014 operating leverage.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Answer this question .arrow_forwardGulf Coast Berry Farms harvests early-season blueberries for shipment throughout the southern United States in April. The blueberry farm is maintained by a permanent staff of 12 employees and seasonal workers who pick and pack the blueberries. The blueberries are sold in crates containing 80 individually packaged one-quart containers. Affixed to each one-quart container is the distinctive Gulf Coast Berry Farms logo inviting buyers to "Taste the Freshest Blueberries in the South!" The selling price is $95 per crate, variable costs are $78 per crate, and fixed costs are $300,000 per year. In the year 2023, Gulf Coast Berry Farms sold 60,000 crates. Determine the company's 2023 operating leverage.arrow_forwardDetermine the company's 2014 operating leverage.arrow_forward

- Citrus Girl Company (CGC) purchases quality citrus produce from local growers and sells the produce via the Internet across the United States. To keep costs down, CGC maintains a warehouse but no showroom or retail sales outlets. CGC has the following information for the second quarter of the year: Expected monthly sales for April, May, June, and July are $160,000, $ 130,000, $250,000, and $70,000, respectively. Cost of goods sold is 50 percent of expected sales. CGC's desired ending inventory is 60 percent of the following month's cost of goods sold. Monthly operating expenses are estimated to be: Salaries: $35,000. Delivery expense: 5 percent of monthly sales. Rent expense on the warehouse: $3,500. Utilities: $700. Insurance: $360. Other expenses: $460. Required: Compute the budgeted cost of purchases for each month in the second quarter. Complete the budgeted income statement for each month in the second quarter.arrow_forwardIllion Soy Products (ASP) buys soybeans and processes them into other soy products. Each ton of soybeans that ASP purchases for $250 can be converted for an additional $180 into 700 lbs of soy meal and 80 gallons of soy oil. A pound of soy meal can be sold at splitoff for $1.08 and soy oil can be sold in bulk for $4 per gallon. ASP can process the 700 pounds of soy meal into 800 pounds of soy cookies at an additional cost of $370. Each pound of soy cookies can be sold for $2.08 per pound. The 80 gallons of soy oil can be packaged at a cost of $200 and made into 320 quarts of Soyola. Each quart of Soyola can be sold for $1.45. Read the requirements. Requirement 1. Allocate the joint cost to the cookies and the Soyola using the (a) Sales value at splitoff method and (b) NRV method. a. First, allocate the joint cost using the Sales value at splitoff method. (Round the weights to three decimal places and joint costs to the nearest dollar.) Sales value of total production at splitoff…arrow_forwardFull Belly Farm grows organic vegetables and sells them to distributors and local restaurants after processing. Assume the farm's leading product for restaurant customers is a mixture of organic green salad ingredients prepared and ready to serve. The company sells a large bag to restaurants for $30. It calculates the variable cost per bag at $20 (including $1 for local delivery), and the average total cost per bag is $24. Growing conditions have been very good this season and Full Belly has extra capacity. A representative of a restaurant association in another city has offered to buy fresh salad stock from the company to augment its regular supply during an upcoming international festival. The restaurant association wants to buy 2,700 bags during the next month for $22 per bag. Delivery to restaurants in the other city will cost the company $0.75 per bag. It can meet most of the order with excess capacity but would sacrifice 180 bags of regular sales to fill this special order.…arrow_forward

- Full Belly Farm grows organic vegetables and sells them to distributors and local restaurants after processing. Assume the farm’s leading product for restaurant customers is a mixture of organic green salad ingredients prepared and ready to serve. The company sells a large bag to restaurants for $30. It calculates the variable cost per bag at $20 (including $1 for local delivery), and the average total cost per bag is $24. Growing conditions have been very good this season and Full Belly has extra capacity. A representative of a restaurant association in another city has offered to buy fresh salad stock from the company to augment its regular supply during an upcoming international festival. The restaurant association wants to buy 3,600 bags during the next month for $22 per bag. Delivery to restaurants in the other city will cost the company $0.75 per bag. It can meet most of the order with excess capacity but would sacrifice 240 bags of regular sales to fill this special order.…arrow_forwardNervana Soy Products (NSP) buys soybeans and processes them into other soy products. Each ton of soybeans that NSP purchases for $350 can be converted for an additional $210 into 650 lbs of soy meal and 100 gallons of soy oil. A pound of soy meal can be sold at splitoff for $1.32 and soy oil can be sold in bulk for $4.5 per gallon. NSP can process the 650 pounds of soy meal into 750 pounds of soy cookies at an additional cost of $300. Each pound of soy cookies can be sold for $2.32 per pound. The 100 gallons of soy oil can be packaged at a cost of $230 and made into 400 quarts of Soyola. Each quart of Soyola can be sold for $1.15. Read the requirements. Requirement 1. Allocate the joint cost to the cookies and the Soyola using the (a) Sales value at splitoff method and (b) NRV method. a. First, allocate the joint cost using the Sales value at splitoff method. (Round the weights to three decimal places and joint costs to the nearest dollar.) Sales value of total production at splitoff…arrow_forwardThe Laiterie de Coaticook in the Eastern Townships of Quebec produces several types of cheddar cheese. It markets this cheese in four varieties: aged 2 months, 9 months, 15 months, and 2 years. At the producer's store, 2 kg of each variety sell for the following prices: $8.50, $10.00, $11.50, and $12.50, respectively. Consider the cheese maker's decision whether to continue to age a particular 2-pound block of cheese. At 2 months, he can either sell the cheese immediately or let it age further. If he sells it now, he will receive $8.50 immediately. If he ages the cheese, he must give up the $8.50 today to receive a higher amount in the future. What is the IRR (expressed in percent per month) of the investment of giving up $85.00 today by choosing to store 20 kg of cheese that is currently 2 months old and instead selling 10 kg of this cheese when it has aged 9 months, 6 kg when it has aged 15 months, and the remaining 4 kg when it has aged 2 years? The IRR is % per month. (Enter your…arrow_forward

- Breadmaster produces organic bread that is sold by the loaf. Each loaf requires 1/2 of a pound of flour. The bakery pays $2.00 per pound of the organic flour used in its loaves. The bakery expects to produce the following number of loaves in each of the upcoming four months: E (Click the icon to view the units to be produced.) The bakery has a policy that it will have 20% of the following month's flour needs on hand at the end of each month. At the end of June, there were 154 pounds of flour on hand. Prepare the direct materials budget for the third quarter, with a column for each month and for the quarter. Begin the direct materials budget by determining the total quantity needed, then complete the budget. (Enter the pounds per unit as a decimal to two places. Round your calculations to the nearest whole number.) Breadmaster Direct Materials Budget Data Table For the Months of July through September July August September Quarter Units to be produced July... 1,540 loaves Multiply by:…arrow_forwardPlot the relationship between number of orders per week and weekly total costs.arrow_forwardThe Delmar Beverage Company produces a premium root beer that is sold throughout its chain of restaurants in the Midwest. The company is currently producing 1,700 gallons of root beer per day, which represents 80% of its manufacturing capacity. The root beer is available to restaurant customers by the mug, in bottles, or packaged in six-packs to take home. The selling price of a gallon of root beer averages $13, and cost accounting records indicate the following manufacturing costs per gallon of root beer: Raw materials Direct labor Variable overhead Fixed overhead Total absorption cost $ 1.56 1.67 1.11 1.53 $ 5.87 In addition to the manufacturing costs just described, Delmar Beverage incurs an average cost of $1.05 per gallon to distribute the root beer to its restaurants. SaveMore Incorporated, a chain of grocery stores, is interested in selling the premium root beer in gallon jugs throughout its stores in the St. Louis area during holiday periods and has offered to purchase root…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning