FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:-

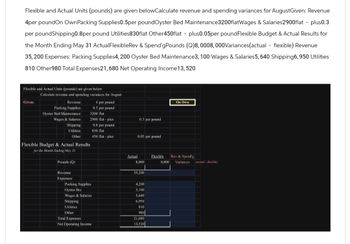

Flexible and Actual Units (pounds) are given belowCalculate revenue and spending variances for AugustGiven: Revenue

4per poundOn OwnPacking Supplies0.5per poundOyster Bed Maintenance3200flatWages & Salaries2900flat plus0.3

per poundShipping0.8per pound Utilities830flat Other450flat plus0.05per poundFlexible Budget & Actual Results for

the Month Ending May 31 ActualFlexibleRev & Spend'gPounds (Q)8, 0008,000Variances(actual flexible) Revenue

35,200 Expenses: Packing Supplies4, 200 Oyster Bed Maintenance3, 100 Wages & Salaries5, 640 Shipping6, 950 Utilities

810 Other980 Total Expenses21, 680 Net Operating Income13, 520

Flexible and Actual Units (pounds) are given below

Given:

Calculate revenue and spending variances for August

Revenue

Packing Supplies

Oyster Bed Maintenance

4 per pound

0.5 per pound

3200 flat

Wages & Salaries

2900 flat-plus

0.3 per pound

Shipping

Utilities

Other

0.8 per pound

830 flat

450 flat-plus

0.05 per pound

Flexible Budget & Actual Results

for the Month Ending May 31

Pounds (Q)

On Own

Actual

Flexible

Rev & Spend'g

8,000

8,000

Variances

(actual-flexible)

Revenue

35,200

Expenses:

Packing Supplies

4,200

Oyster Bec

3,100

Wages & Salaries

5,640

Shipping

6,950

Utilities

810

Other

980

Total Expenses

21,680

Net Operating Income

13,520

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- what is the formula or equations on how to calculate for spending variance for March 31arrow_forward4. Prepare a direct labor cost budget for August. Newport Inc. Direct Labor Cost Budget For the First Quarter Ending August 31 June July August First Quarter hr. hr. hr. hr. hrs. hrs. hrs. hrs. X$ X$ X$ 5. Prepare a factory overhead cost budget for August. Newport Inc. Factory Overhead Cost Budget For the First Quarter Ending August 31 June July August First Quarter Variable factory overhead: hrs. hrs. hrs. hrs. X$ X$ X$ X$ Fixed factory overhead: Total factory overhead costarrow_forwardhello, help pleasearrow_forward

- Marla Baldwin was a blt anxlous as she created the year-end performance reports. She remembered how management had hoped the economy would make a favorable turn, taking pressure off consumers so they'd feel more comfortable spending on the company's splurge Item-a luxurious hooded cotton robe. Alas, actual production and sales ended at 5,100 units, a whopping 1,000 units shy of the company's original budget. The following Information presents the company's actual Income statement and other key Information for Marla. Sales Varlable costs: DM Actual Income DL Varlable-MOH Contribution margin Fixed costs: Fixed-MOH Fixed SG&A Operating Income Standards are as follows. Direct materials Direct labor Variable-MOH Fixed-MOH $800,700 Selling price Fixed SGSA expense 172,125 (for 11,475 yards purchased and used) 75,276 (for 3,672 hours used) 45,900 O Search 507,399 170,978 243,100 Standard Quantity per Unit 2.30 yards 0.70 DL hours $93.321 Additional master budget Information: 2.30 yards 2.30…arrow_forwardVulcan Flyovers offers scenic overflights of Mount Saint Helens. Data concerning the company's operations in July appear below: Vulcan Flyovers Operating Data For the Month Ended July 31 Flights (q) Revenue ($350.00q) Expenses: Wages and salaries ($3,200 + $88.00q) Fuel ($32.00g) Airport fees ($830 + $34.00q) Aircraft depreciation ($10.00q) Office expenses ($230 + $1.00q) Total expenses Net operating income Actual Results 54 $ 16,300 7,916 1,894 2,546 540 452 13,348 $ 2,952 Flexible Planning Budget Budget 54 $ 18,900 7,952 1,728 2,666 540 284 13,170 $ 5,730 52 $ 18, 200 7,776 1,664 2,598 520 282 12,840 $5,360 The company measures its activity in terms of flights. Customers can buy individual tickets for overflights or hire an entire plane at a discount.arrow_forwardJake's Roof Repair has provided the following data concerning its costs Cost per Repair Hour $15.00 $ 7.70 $0.50 $ 3.50 $ 0.60 Wages and salaries Parts and supplies Equipeent depreciation Truck operating expenses Rent Administrative expenses Fixed Cost per Month $ 21,000 $2,730 $ 5,709 $ 4,020 $3,050 For example, wages and salaries should be $21,000 plus $15.00 per repair-hour. The company expected to work 2.900 repair-hours in May, but actually worked 2.800 repair-hours. The company expects its sales to be $52.00 per repair-hour Required: Compute the company's activity variances for May (Indicate the effect of each variance by selecting "F" for favorable. "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)arrow_forward

- Required: Prepare Shadee's budgeted income statement for the months of May and June. Note: Do not round your intermediate calculations. Round your answers to 2 decimal places. Budgeted Gross Margin SHADEE CORPORATION Budgeted Income Statement Budgeted Net Operating Income May Junearrow_forwardam. 103.arrow_forwardExercise 9-4 (Algo) Prepare a Flexible Budget Performance Report [LO9-4] Vulcan Flyovers offers scenic overflights of Mount Saint Helens. Data concerning the company's operations in July appear below: Vulcan Flyovers Operating Data For the Month Ended July 31 Flights (q) Revenue ($340.00q) Expenses: Wages and salaries ($3,300 + $91.00q) Fuel ($32.00q) Airport fees ($850 + $31.00q) Aircraft depreciation ($10.00q) Office expenses ($210+ $1.00q) Total expenses Net operating income Actual Results 55 $ 16,100 8,263 1,926 2,410 550 433 13,582 $ 2,518 Flexible Planning Budget Budget 53 $ 18,020 55 $ 18,700 8,305 1,760 2,555 550 265 13,435 $ 5,265 8,123 1,696 2,493 530 263 13,105 $ 4,915 The company measures its activity in terms of flights. Customers can buy individual tickets for overflights or hire an entire plane at a discount.arrow_forward

- Quilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold 7,300 pounds of oysters in August. The company's flexible budget for August appears below: Quilcene Oysteria Flexible Budget Actual pounds (q) Revenue ($4.15q) Expenses: Packing supplies ($0.35q) Oyster bed maintenance ($3,100) Wages and salaries ($2,500 + $0.35q) Shipping ($0.60q) Utilities ($1,210) For the Month Ended August 31 Other ($400 + $0.019) Total expenses Net operating income Actual pounds Revenue The actual results for August were as follows: Expenses: Quilcene Oysteria Income Statement For the Month Ended August 31 Packing supplies Oyster bed maintenance Wages and salaries Shipping Utilities Other Total expenses Net operating income 7,300 $ 30,295 2,555 3,100 5,055 4,380 1,210 473 16,773 $ 13,522 7,300 $ 26,600 2,725 2,960 5,465 4,110 1,020 1,093 17,373 $ 9,227arrow_forwardDo not give image formatarrow_forwardOriole Industries has the following actual and master budget information for its two product lines: Volume in Units Unit Contribution Margin Sales quantity variance Gadgets Sales quantity variance Gizmos Actual Results Total sales quantity variance Gadgets Gizmos 1,150 1,870 $6 $9 Compute the Sales Quantity Variances for the Gadgets, Gizmos, and in Total. (Round intermediate calculations to 4 decimal places, eg. 2.3337 and final answers to O decimal places, e.g. 2,555.) $ $ tA Master Budget $ Gadgets 1,350 $5 Gizmos 1,770 $10 >arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education