FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

correct answer: 12,490,317

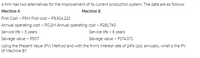

Transcribed Image Text:A firm has two alternatives for the improvement of its current production system. The data are as follows:

Machlne A

Machine B

First Cost - P5M First cost - P8,914,223

Annual operating cost - PO.2M Annual operating cost - P281,740

Service life - 5 years

Service life - 6 years

Salvage value - P50T

Salvage value - P174,071

Using the Present Value (PV) Method and with the firm's interest rate of 24% cpd. annually, what is the PV

of Machine B?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how did u get that answer in the table? the

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

how did u get that answer in the table? the

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you help me solve this step by step. Thank youarrow_forwardRequired information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Westgate recognizes revenue over time according to percentage of completion. Costs incurred during the year Estimated costs to complete as of year-end Revenue Gross profit (loss) $ $ Problem 6-10 (Algo) Part 5 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs incurred and costs to complete information. Answer is complete but not entirely correct. 2024 2024 $ 2,016,000 5,184,000 2,180,000 1,890,000…arrow_forwardIn regard to the COGS for Years 2 - 19,000 units x 51.94 + 80,000 x 52.71 = 5,203,660 and Year 3 - 5000 units x 52.71 + 77,000 x 52.55 = 4,309,900 How do you determine how to split out both years from the original sum Y2 - 99,000 (19,000 + 80,000) Y3 - 82,000 (5000 + 77,000)arrow_forward

- Part 1: Net Present Value (NPV) First, we need to calculate the annual cash flow. The net income is given, and since depreciation is a non-cash expense, we add it back to net income to find the cash flow: Annual Cash Flow = Net Income + Depreciation Annual Cash Flow = $200,000+ $200,000 Annual Cash Flow = $400,000 The project lasts for 8 years with an initial investment of $2,000,000. The NPV formula is: CE NPV - Initial Investment = t=1 where CF, is the annual cash flow, is the discount rate, and 12 is the number of years. NPV= 400,000 - 2,000,000 t=1 (1+0.10) Calculating each term: Year 1: Year 2: Year 3: 400,000 (1+0.10)1 400,000 (1+0.10)² 400,000 (1+0.10) 400,000 1.10 400,000 363, 636.36 330, 578.51 1.21 400,000 = 300, 525.98 1.331arrow_forwarda1arrow_forwardRequired information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Problem 6-10 (Algo) Part 1 Westgate recognizes revenue over time according to percentage of completion. Revenue Gross profit (loss) 2021 $2,044,000 5,256,000 2,170,000 1,885,000 X Answer is complete but not entirely correct. 2022 3,600,000 $ $ $ 2021 2,800,000 $ 756,000 $ 972,000 2022 $2,628,000 2,628,000 2,502,000 2,600,000 Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. (Do not round intermediate calculations.…arrow_forward

- That is the answer I got but it is wrong its either a. $4,590 b. $1,476.60 c. $4,180.80 or d. $3,295 I can't figure out how it's one of those answersarrow_forwardProblem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Problem 6-10 (Algo) Part 5 Westgate recognizes revenue over time according to percentage of completion. Costs incurred during the year Estimated costs to complete as of year-end Revenue Gross profit (loss) $ $ 2024 $ 2,610,000 6,390,000 2,100,000 1,850,000 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs incurred and costs to complete information. X Answer is complete but not entirely correct. 2026 3,939,962 (110,038)…arrow_forwardRequired Information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following Information applies to the questions displayed below.] In 2024, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2026. Information related to the contract is as follows: 2025 Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year 2024 2026 $ 2,490,000 5,810,000 2,030,000 $ 3,984,000 $ 2,008,600 1,826,000 в 4,444,000 3,900,000 3,526,000 4,285,000 1,815,000 Westgate recognizes revenue over time according to percentage of completion. Problem 6-10 (Algo) Part 4 4. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years, assuming the following costs Incurred and costs to complete Information. Note: Do not round Intermediate calculations and round your final…arrow_forward

- Required information Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Problem 6-10 (Algo) Part 1 Westgate recognizes revenue over time according to percentage of completion. Revenue Gross profit (loss) 2021 $2,044,000 5,256,000 2,170,000 2,502,000 1,885,000 2,600,000 2021 2022 2023 2022 $2,628,000 $2,890,800 2,628,000 Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. (Do not round intermediate calculations. Loss amounts should be indicated with a minus sign.) 2023 0 5,328,000 5,515,000arrow_forwardThe balance sheets of Butler, Incorporated and its 70%-owned subsidiary, Cassie Corporation, which Butler has owned for several years presented below: Cash Accounts Receivable (net) Inventory Plant & Equipment (net) Copyright Accounts payable Long-term Debt Noncontrolling interest Common stock, $1 par Retained earnings Additional information for 2024: 2024 $ 16,000 150,000 220,000 315,000 32,000 $ 733,000. $ 120,000 0 77,000 200,000 336, 000 $ 733,000 2 2023 $ 52,000 108,000 178,000 340,000 36,000 $714,000 $ 102,000 70,000 50,000 200,000 292,000 $714,000 • Butler & Cassie's consolidated net income was $100,000. . Cassie paid $10,000 in dividends. • There were no purchases or disposals of plant & equipment or copyright this year. Net cash flow from financing activities was ************arrow_forwardIt says 285,000 part and the (100,000) part is incorrect please fix thank you.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education