FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

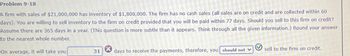

Transcribed Image Text:Problem 9-18

A firm with sales of $21,000,000 has inventory of $1,800,000. The firm has no cash sales (all sales are on credit and are collected within 60

days). You are willing to sell inventory to the firm on credit provided that you will be paid within 77 days. Should you sell to this firm on credit?

Assume there are 365 days in a year. (This question is more subtle than it appears. Think through all the given information.) Round your answer

to the nearest whole number.

On average, it will take you

31

days to receive the payments, therefore, you should not v

sell to the firm on credit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A large retailer obtains merchandise under the credit terms of 2/15, net 30, but routinely takes 50 days to pay its bills. (Because the retailer is an important customer, suppliers allow the firm to stretch its credit terms.) What is the retailer's effective cost of trade credit? Assume a 365-day year. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardIngraham Inc. currently has $500,000 in accounts receivable, and its days sales outstanding (DSO) is 44 days. It wants to reduce its DSO to 20 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 10%. What will be the level of accounts receivable following the change? Assume a 365-day year. Do not round intermediate calculations. Round your answer to the nearest centarrow_forwardRangling Company, buys goods from A.J. Stop Company that gives sales terms of 2.5/10, net 30 days. Rangling has annual gross purchases of $1,000,000. Calculate the maximum amount of costly trade credit that Rangling could get, assuming it abides by the A.J.’s credit terms? (Assume a 365-day year.)arrow_forward

- Nonearrow_forwardA large retailer obtains merchandise under the credit terms of 3/10, net 40, but routinely takes 55 days to pay its bills. (Because the retailer is an important customer, suppliers allow the firm to stretch its credit terms.) What is the retailer's effective cost of trade credit? Assume a 365-day year. Do not round intermediate calculations. Round your answer to two decimal places.arrow_forwardYou are considering investing in Dakota's Security Services. You have been able to locate the following information on the firm: Total assets are $32.6 million, accounts receivable are $4.46 million, ACP is 25 days, net income is $4.83 million, and debt-to-equity is 1.3 times. All sales are on credit. Dakota's is considering loosening its credit policy such that ACP will increase to 30 days. The change is expected to increase credit sales by 6 percent. Any change in accounts receivable will be offset with a change in debt. No other balance sheet changes are expected. Dakota's profit margin will remain unchanged. How will this change in accounts receivable policy affect Dakota's net income, total asset turnover, equity multiplier, ROA, and ROE? Note: Do not round intermediate calculations. Enter your answer in millions of dollars. Round your answers to 2 decimal places. Use 365 days a year. Net income Total asset turnover Equity multiplier ROA ROE million times times % %arrow_forward

- Your company received a $7 million order on the last day of the year. You filled the order with $3 million worth of inventory. The customer picks up the order the same day and pays $2 million up front in cash; you also issue a bill for the customer to pay the remaining balance of $5 million within 40 days. Suppose your firm’s tax rate is 0% (ignore taxes). Based on this information, complete the table below: Account Account Increase/Decrease/ No effect Value of effect ($) Revenues Earnings Receivables Inventory Casharrow_forwardSunny Manufacturing is considering extending trade credit to some customers previously considered poor risks. Sales would increase by $220,000 if credit is extended to these new customers. Of the new accounts receivable generated, 10 percent will prove to be uncollectible. Additional collection costs will be 5 percent of sales, and production and selling costs will be 70 percent of sales. a. Compute the incremental income before taxes. $ Incremental income before taxes b. What will the firm's incremental return on sales be if these new credit customers are accepted? (Round the final answer to 2 decimal place.) Incremental return on sales % c. If the receivable turnover ratio is 4 to 1, and no other asset buildup is needed to serve the new customers, what will Sunny Manufacturing's incremental return on new average investment be? (Do round intermediate calculations. Round the final answer to the nearest whole percentage.) Incremental return on new average investment %arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education