FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

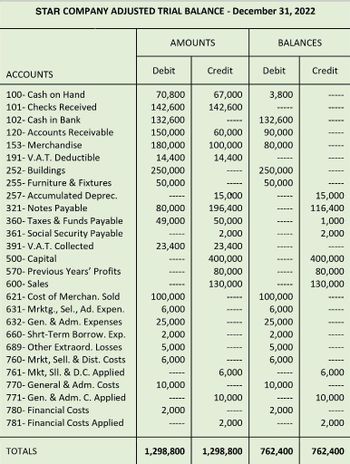

Find year-end closing entries (journal and ledger).

Transcribed Image Text:STAR COMPANY ADJUSTED TRIAL BALANCE - December 31, 2022

ACCOUNTS

100- Cash on Hand

101- Checks Received

102- Cash in Bank

120- Accounts Receivable

153- Merchandise

191- V.A.T. Deductible

252- Buildings

255- Furniture & Fixtures

257- Accumulated Deprec.

321- Notes Payable

360- Taxes & Funds Payable

361- Social Security Payable

391- V.A.T. Collected

500- Capital

570- Previous Years' Profits

600- Sales

621- Cost of Merchan. Sold

631- Mrktg., Sel., Ad. Expen.

632- Gen. & Adm. Expenses

660- Shrt-Term Borrow. Exp.

689- Other Extraord. Losses

760- Mrkt, Sell. & Dist. Costs

761- Mkt, SII. & D.C. Applied

770- General & Adm. Costs

771- Gen. & Adm. C. Applied

780- Financial Costs

781- Financial Costs Applied

TOTALS

AMOUNTS

Debit

70,800

142,600

132,600

150,000

180,000

14,400

250,000

50,000

80,000

49,000

23,400

-----

=====

100,000

6,000

25,000

2,000

5,000

6,000

‒‒‒‒‒

10,000

2,000

Credit

67,000

142,600

=====

-----

132,600

60,000 90,000

100,000

80,000

14,400

=====

15,000

196,400

50,000

2,000

23,400

400,000

80,000

130,000

=====

-----

6,000

-----

10,000

2,000

BALANCES

1,298,800 1,298,800

Debit

3,800

250,000

50,000

-----

‒‒‒‒‒

100,000

6,000

25,000

2,000

5,000

6,000

10,000

‒‒‒‒‒

2,000

Credit

-----

-----

-----

|-----

------

‒‒‒‒‒

15,000

116,400

1,000

2,000

400,000

80,000

130,000

-----

-----

--===

-----

-----

6,000

=====

10,000

2,000

762,400 762,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How to prepare the closing entries and statements? question c and d and e of the problem.arrow_forwardThe process of transferring general journal entry information to the ledger is called: a. Balancing an account. b. Journalizing. c. Posting. d. Double-entry accounting. e. Balancing. Which of the following is prepared after the preparation of the balance sheet? a. Closing entries. b. Adjusting entries. c. Adjusted trial balance. d. Statement of retained earnings. e. Ledger accounts. The posting reference column in the ledger is: A. used to record the journal and page number from the transactions originated. B. used to record the ledger number. C. used to record the date. D. not used.arrow_forwardWhat are the steps in recording closing entries?arrow_forward

- An invoice number is: a.added to the Post Ref. column of the ledger account. b.mentioned in the explanation of the related journal entry. c.added to the Post Ref. column of the journal. d.mentioned in the ledger accounts related to the journal entry.arrow_forwardComplete the statement: closing entries ________ A. Reflect the net income for the accounting period B. Are also posted in the subsidiary ledgers C. Involve all ledger accounts D. Are recorded in the special journals The process wherein transactions are recorded in the journal are transferred to the appropriate accounts in the general ledger and subsildiary ledgers, if appropriate, is called ___________ A. Ledgering B. Analyzing C. Posting D. Journalizingarrow_forwardPut the following steps in the accounting cycle in the correct order (1-9). Journalize transactions and events Three Journalize and post the adjusting journal entires Three Analyze transactions and events from source documents One Prepare the post-closing trial balance Nine Post the journal entires to the general ledger Choose. + Prepare the unadjusted trial balance Choose. Prepare the adjusted trial balance Choose. +arrow_forward

- Show a journal entry writing off an account using both the allowance method and the direct write-off method. NOTE: YOU CAN INCLUDE ANY AMOUNTS AS LONG AS THEY MAKE SENSE, BUT DO NOT FORGET TO INCLUDE ACTUAL NUMBERS FOR THIS JOURNAL SHOWING BOTH METHODS AS STATED ABOVE. THIS CAN BE MADE UP BUT DO NOT FORGET THE NUMBERS.arrow_forwardHow to adjust entries for refunds allowances and returnsarrow_forwardClosing Accountsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education