FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Do you have the work sheet and financial statement for the attached homework. Critical thinking problem 5.2 Worksheet and Financial Statement?

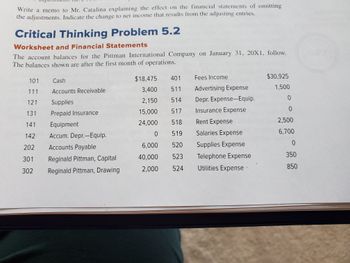

Transcribed Image Text:Write a memo to Mr. Catalina explaining the effect on the financial statements of omitting

the adjustments. Indicate the change to net income that results from the adjusting entries.

Critical Thinking Problem 5.2

Worksheet and Financial Statements

The account balances for the Pittman International Company on January 31, 20X1, follow.

The balances shown are after the first month of operations.

101

111

121

131

141

142.

202

301

302

Cash

Accounts Receivable

Supplies

Prepaid Insurance

Equipment

Accum. Depr.-Equip.

Accounts Payable

Reginald Pittman, Capital

Reginald Pittman, Drawing

$18,475

401

3,400

511

2,150 514

15,000

517

24,000

518

519

520

523

2,000 524

0

6,000

40,000

Fees Income

Advertising Expense

Depr. Expense-Equip.

Insurance Expense

Rent Expense

Salaries Expense

Supplies Expense

Telephone Expense

Utilities Expense

$30,925

1,500

0

0

2,500

6,700

0

350

850

Transcribed Image Text:of analyzing business transactions:

Accounting equation

T Accounts

Analyzing business trans

1.

2.

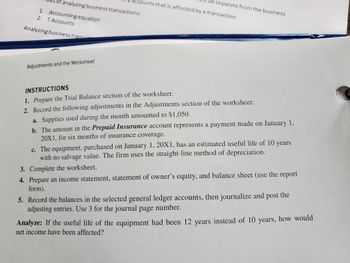

Adjustments and the Worksheet

accounts that is affected by a transaction

be separate from the business

INSTRUCTIONS

1. Prepare the Trial Balance section of the

worksheet.

2. Record the following adjustments in the Adjustments section of the worksheet:

a. Supplies used during the month amounted to $1,050.

b. The amount in the Prepaid Insurance account represents a payment made on January 1,

20X1, for six months of insurance coverage.

c. The equipment, purchased on January 1, 20X1, has an estimated useful life of 10 years

with no salvage value. The firm uses the straight-line method of depreciation.

3.

Complete the worksheet.

4. Prepare an income statement, statement of owner's equity, and balance sheet (use the report

form).

5. Record the balances in the selected general ledger accounts, then journalize and post the

adjusting entries. Use 3 for the journal page number.

Analyze: If the useful life of the equipment had been 12 years instead of 10 years, how would

net income have been affected?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What are the entries to?

- Journalize and

Post the Closing Entries - Prepare the Post Closing

Trial Balance .

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

What are the entries to?

- Journalize and

Post the Closing Entries - Prepare the Post Closing

Trial Balance .

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education