FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

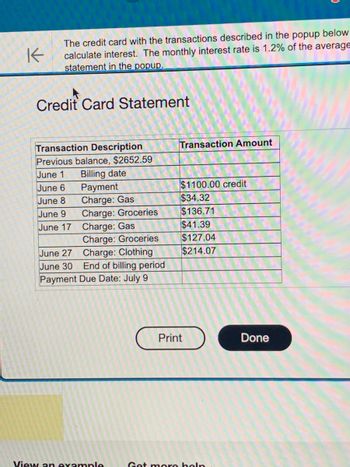

The credit card with the transactions described in the popup below uses the average daily balance method to calculate interest. The monthly interest rate is 1.2% of the average daily balance.

a. Find the average daily balance for the billing period. Round to the nearest cent

The average daily balance for the billing period is $__

Transcribed Image Text:K

The credit card with the transactions described in the popup below

calculate interest. The monthly interest rate is 1.2% of the average

statement in the popup.

Credit Card Statement

Transaction Description

Previous balance, $2652.59

June 1 Billing date

June 6

June 8

June 9

June 17

June 27

June 30

Payment

Charge: Gas

Charge: Groceries

Charge: Gas

Charge: Groceries

Charge: Clothing

End of billing period

Payment Due Date: July 9

View an example

Transaction Amount

$1100.00 credit

$34.32

$136.71

$41.39

$127.04

$214.07

Print

Get more help

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Millennial Manufacturing has net credit sales for 2018 in the amount of $1,463,630, beginning accounts receivable balance of $588,900, and an ending accounts receivable balance of $626,450. A. Compute the accounts receivable turnover ratio and the number of days' sales in receivables ratio for 2018. Round answers to two decimal places. Accounts receivable turnover ratio fill in the blank 1 times Sales in receivables ratio fill in the blank 2 days B. What do the outcomes tell a potential investor about Millennial Manufacturing if industry average is 2.6 times and number of day’s sales ratio is 180 days? a. Millennial Manufacturing collects its accounts more quickly than its competitors. b. A lender may favour Millennial Manufacturing over its competitors because of its faster collection period. c. Without prior years’ data it is hard to tell if Millennial Manufacturing is really more efficient than its competitors. d. All of the above statements may be correct.arrow_forwardThe following interest-bearing promissory note was discounted at a bank by the payee before maturity. Use the ordinary interest method, 360 days, to calculate the missing information. (Round dollars to the nearest cent.) Face Interest Value Rate (6) $1,200 Need Help? Read Date of Note Date of Discount Dec. 7 Term of Note (days) 130 Discount Period (days) Maturity Date Seled Discount Rate (6) LEA Maturity Value (in $) Proceeds (in 5)arrow_forwardThe credit card with the transactions described in the popup below uses the average daily balance method to calculate interest. The monthly interest rate is 1.5% of the average daily balance. A. Find the interest to be paid on july 1, the next billing date. Round to the nearest cent. The interest to be paid on july 1 $__arrow_forward

- A credit card issuer calculates interest using the average daily balance method. The monthly interest rate is 1.1% of the average daily balance. The following transactions occurred during the November 1 – November 30 billing period. Transaction Description Transaction Amount Previous balance, $4620.80 November 1 Billing date November 7 Payment $650.00 credit November 11 Charge: Airline Tickets $350.25 November 25 Charge: Groceries $125.70 November 28 Charge: Gas $38.25 November 30 End of billing period Payment Due Date: December 9 Find the average daily balance for the billing period. Round to the nearest cent. Find the interest to be paid on December 1, the next billing date. Round to the nearest cent. Find the balance due on December 1. This credit card requires a $10 minimum monthly payment if the balance due at the end of the billing period is less than $360. Otherwise, the…arrow_forwardAt December 1, 2021, Vaughn Company's accounts receivable balance was $1860. During December, Vaughn had credit revenues on account of $7080 and collected accounts receivable of $6070. At December 31, 2021, the accounts receivable balance is $850 credit. Ⓒ $850 debit Ⓒ $2870 debit. O $2870 credit.arrow_forwardAlexis Monroe, a biologist from Dyersburg, Tennessee, is curious about the accuracy of the interest charges shown on her most recent credit card billing statement. Interest Charged Interest Charge on Purchases $6.40 Interest Charge on Cash Advances $4.65 TOTAL INTEREST FOR THIS MONTH $11.05 Use the average daily balances provided to recalculate the interest charges, and compare the result with the amount shown on the statement. Round your answers to the nearest cent. Annual Percentage Balances Subject to Type of Balance Rate (APR) Interest Rate Interest Charge Purchases 15.14% (V) $513.39 $ Cash Advances 22.43% (V) $252.98 $ Balance Transfers 0.00% $637.50 $ Penalty APR 28.99% $ 0.00 $arrow_forward

- Master Card and other credit card issuers must by law print the Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 19.00%, with interest paid monthly, what is the card's EFF%? a.18.58% b. 19.52% с. 20.75% d. 21.94% e. 22.65%arrow_forwardThe previous statement for your credit card had a balance of $570. You make purchases of $130 make a payment of $80. The credit card had an APR of 24%. What is the finance charge for this month?arrow_forwardExport PDF as long image without watermark Export FUNDAMENTALS OF ACCOUNTANCY BUSINESS AND MANAGEMENT 2 Self-Learning Activity 9 Name Year/Block: Date Direction: Write your answers on the space provided at the back of this Self Learning Activity. Learning Objective: After reading the module, the learners shall be able to: 4. Describe the nature of a bank reconciliation statement. 5. Identify common reconciling items and describe each of them. 6. Analyze the effects of the identified reconciling items. Reference: Quarter 1 Module 9 – Fundamentals of Accountancy, Business and Management 2 LEARNING ACTIVITY 9:1 Presented hereunder are the details of your Cash Receipts Journal, Cash Disbursements Journal and the Bank Statement of Banco de Oro. Cash Receipts Journal O.R. Number Amount Payor Odessa Alera Date 0001 P 30,000 June 3 0002 0003 20,000 5,000 20 Arnold Navales 29 Juanita Nambatac 0004 10,000 30 Kyle Jamora Cash Disbursements Journal Check Number Amount Payee Star 5 Grocery DX…arrow_forward

- Calculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous month's balance. (Round dollars to the nearest cent.) Monthly Annual Finance Purchases Payments and New Previous Periodic Percentage Rate (APR) Charge (in $) and Cash Balance Balance Rate Advances Credits (in $) (as a %) $1,027.61 % 1% $322.20 $400.00arrow_forwardCalculate the missing information on the revolving credit account. Interest is calculated on the unpaid or previous mo th's balance. (Round dollars to the nearest cent.) Annual Monthly Finance Purchases Payments New Previous Percentage Rate (APR) (as a %) Periodic Charge and Cash and Balance Balance Rate (in $) Advances Credits (in $) 1-% $ 31.12 $2,490.00 15 % $1,354.98 $300.00 3576.1 4arrow_forwardPlease fill all requirementsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education