Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

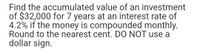

Transcribed Image Text:Find the accumulated value of an investment

of $32,000 for 7 years at an interest rate of

4.2% if the money is compounded monthly.

Round to the nearest cent. DO NOT use a

dollar sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following investment. (Round your answers to the nearest cent.) $5,600 at 6 3/4% compounded quarterly for 8 1/2 years (a) Find the future value of the given amount.$ (b) Interpret the future value of the given amount. After 8 1/2 years, the investment is worth $ .arrow_forwardYou have your choice of two investment accounts. Investment A is a 7-year annuity that features end-of-month $2,900 payments and has an APR of 6 percent compounded monthly. Investment B is an annually compounded lump-sum investment with an APR of 6 percent, also good for 7 years. How much money would you need to invest in B today for it to be worth as much as Investment A 7 years from now? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Present valuearrow_forwardFind the accumulated value of an investment of $10,000 for 3 years at an interest rate of 5.5% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly d. compounded continuously. Round answers to the nearest cent. a. What is the accumulated value if the money is compounded semiannually? (Round your answer to the nearest cent.)arrow_forward

- Compute the present value of an annuity of $621 per year for 25 years, given a discount rate of 6 percent per annum. Assume that the first cash flow will occur one year from today (that is, at t = 1). Round your answer to 2 decimal places; record your answer without commas and without a dollar sign. Your Answer: Answerarrow_forwardYou expect to have the given amount in an account with the given terms. Find how much you can withdraw periodically in order to make the account last the specified amount of time. Round your answer to the nearest cent. Account balance: $700,000 Interest rate: 4.65% monthly 17 years Frequency Time: Periodic Withdraw: $arrow_forwardAn investment will pay you $43,000 in 10 years. If the appropriate discount rate is 7 percent compounded daily, what is the present value? (Use 365 days a year. Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16))arrow_forward

- Select the best answer for the question. 20. You want to invest money for three years in an account that pays nine-percent interest annually. How much would you need to invest today to reach a future goal of $12,000? (Round your answer to the nearest dollar.) A. $10,984 OB. $10,100 OC. $11,432 OD. $9,266arrow_forwardClassify the financial problem. Assume a 9% interest rate compounded annually. What annual deposit is necessary to give $10,000 in 6 years? A.future valueB.amortization C.sinking fundD.present valueE.ordinary annuity Answer the question. (Round your answer to the nearest cent.)arrow_forwardDetermine the amount of money in a savings account at the end of 4 years, given an initial deposit of $13,000 and a 4 percent annual interest rate when interest is compounded: Use Appendix A for an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Do not round intermediate calculations. Round your final answers to 2 decimal places.) a. Annually b. Semiannually c. Quarterly Future Valuearrow_forward

- You are quoted an interest rate of 6% on an investment of $10 million. What is the value of your investment after four years if interest is compounded as follows? Note: Enter your answers in dollars, not millions of dollars. Do not round intermediate calculations. Round your answers to the nearest whole dollar amount. a. Annually b. Monthly c. Continuously a. Future value b. Future value c. Future valuearrow_forwardFind the future values of these ordinary annuities. Compounding occurs once a year. Do not round intermediate calculations. Round your answers to the nearest cent. $300 per year for 8 years at 10%. $ $150 per year for 4 years at 5%. $ $200 per year for 4 years at 0%. $ Rework parts a, b, and c assuming they are annuities due. Future value of $300 per year for 8 years at 10%: $ Future value of $150 per year for 4 years at 5%: $ Future value of $200 per year for 4 years at 0%: $arrow_forwardAn investment promises two payments of $570, on dates three and six months from today. If the required rate of return on the investment is 4.7%:What is the value of the investment today? (Do not round intermediate calculations and round your final answer to 2 decimal places.Value today $.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education