Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

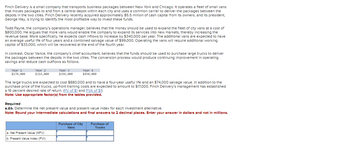

Transcribed Image Text:**Finch Delivery's Investment Analysis**

**Background:**

Finch Delivery is a small company managing package transportation between New York and Chicago. They recently secured $5.5 million in cash capital and are exploring investment opportunities to expand their operations.

**Investment Proposals:**

1. **City Vans Expansion:**

- **Proposed by:** Todd Payne, Operations Manager

- **Cost:** $800,000

- **Expected Revenue Increase:** $340,000/year

- **Useful Life:** 4 years

- **Salvage Value:** $99,000

- **Working Capital Requirement:** $33,000 (recoverable at the end of 4 years)

2. **Large Trucks Purchase:**

- **Proposed by:** Oscar Vance, Chief Accountant

- **Cost:** $880,000

- **Useful Life:** 4 years

- **Salvage Value:** $74,000

- **Training Costs:** $17,000

- **Cash Flow Savings (by year):**

- Year 1: $170,000

- Year 2: $314,000

- Year 3: $396,000

- Year 4: $450,000

**Financial Evaluation:**

Finch Delivery is considering a 16% desired rate of return to determine the Net Present Value (NPV) and Present Value Index (PVI) for both investment options.

**Required Analysis:**

- Calculate the NPV and PVI for both the city vans and large trucks.

- Use the given cash flows and costs to evaluate which proposal offers a better financial return.

- Round calculations and express answers in dollars for precision.

**Instructions:**

Use the appropriate present value factors for evaluation. Calculations should consider desired returns and cash flow specifics for precise financial assessments.

**Tables/Diagrams:**

- The table at the bottom indicates fields to record the NPV and PVI for each investment option: "Purchase of City Vans" and "Purchase of Trucks".

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Recently, you were contacted by a friend who was thinking of signing a Joint Venture agreement to fund a new shopping center to be built in Melbourne. Along with several other investors, each party will invest $25,000 to the venture in order to pay for the building and construction work. Your friend knows several of the other investors and is looking forward to working closely with the other investors on this new project, however your friend feels very strongly about keeping his business affairs completely separate from those of other investors. Required: What advice and/ or warning would you give your friend before signing the Joint Venture contract? You must refer to legislation and/ or case law and clearly define all business structures that may impact on the advice you give your friend.arrow_forwardAccountingarrow_forwardGibson Delivery is a small company that transports business packages between New York and Chicago. It operates a fleet of small vans that moves packages to and from a central depot within each city and uses a common carrier to deliver the packages between the depots in the two cities. Gibson Delivery recently acquired approximately $7.0 million of cash capital from its owners, and its president, George Hay, is trying to identify the most profitable way to invest these funds. Todd Payne, the company's operations manager, believes that the money should be used to expand the fleet of city vans at a cost of $820,000. He argues that more vans would enable the company to expand its services into new markets, thereby increasing the revenue base. More specifically, he expects cash inflows to increase by $260,000 per year. The additional vans are expected to have an average useful life of four years and a combined salvage value of $101,000. Operating the vans will require additional working…arrow_forward

- Mega Corporation has been operating successfully for a number of years and needs additional capital to meets its expansion strategy. Warren Tuffett, a wealthy businessman, contributes $100 million of cash in exchange for shares in Mega. Mega will need to recognize income for the contribution. True or False?arrow_forwardGreenGrow Limited is a local landscaping company that does household and commercial landscaping. Primarily, they help business select plants and manage the plants. They also have regular maintenance contracts such as watering, weeding, and mowing. In the winter, they have some contracts for managing the indoor plants of shopping malls, and do snow clearing to help boost that low income season. Joey, the majority shareholder of GreenGrow is ecstatic. He has managed to come in as the low bidder for a new type of contract. He bid on the construction of a track for the track and field area of a local college. A piece of land on the north end of the college is being cleared and GreenGrow will be leveling the land and placing a bed of crushed stone for the track. Joey has just the right person to be in charge. Jack has previous experience working as an assistant on a road crew and knows how to use the surveying equipment needed to keep the track level. This is a big contract, representing…arrow_forwardVishnuarrow_forward

- Mr. Don is the director of A-Design Inc., a federally incorporatedcompany in Canada, specializing in the design and manufacturing of armrests for the wheelchair industry. A-Design invested $100,000 in a production machine, which has a useful life of 10 years, and put $10,000 in its bank account. In an attempt to improve company sales and profits, Mr. Don planned tooffer two purchasing options to the clients of his company. Option 1:$250 deposit upfront$500 yearly fee for 5 years Option 2:$1300 deposit upfront$300 yearly fee for 3 years Do a discounted cash flow analysis and determine the best option offered by Mr. Don to his clients, assuming a 10 % per year compound interest rate.arrow_forwardDonatello Metals Limited is a privately owned firm that manufactures various metal products and components. Most of their customers are in the computing industry. Donatello, the owner, would like to expand the business so that he can bid on larger contracts. This requires an investment of about $500 000 to finance capital assets and about $300 000 for additional working capital. Donatello has managed the firm without debt so far. His bank suggested: A loan guarantee by Donatello Metals based on specific business assets and a personal guarantee of the debt by Donatello. The bank also stated that if there is a personal guarantee, the company will only require a review engagement. If the loan is only secured by corporate assets, an audit of the company will be required. Donatello understands the differences between the guarantees but is not sure about the difference between a review and an audit engagement. Presently, the company financial statements are prepared using a compilation…arrow_forwardZeven Properties Limited (‘ZPL’) is a housebuilding contractor based in England specialising in building affordable private housing. ZPL’s shares are floated on the London Stock Exchange and are currently priced at £5 per share. The Board of Directors is planning an expansion, which will involve raising £10 million but has not decided on what form of finance should be raised. The Board is considering either a bank loan from the company’s existing bank (the Bank of Alba) or an equity investment from new shareholders. On a completely different topic, at a recent Board meeting one of the non-executive directors suggested that ZPL’s remuneration committee should consider scrapping the company’s current share option scheme, since executive directors could be rewarded by the scheme even when they did not perform well. A second non-executive director disagreed, saying the problem was that even when directors acted in ways which decreased the agency problem, they might not be rewarded by the…arrow_forward

- Flyers plc operates public transport services in major cities in the United Kingdom (UK). The company uses the accounting rate of return (ARR) and payback methods to support investment decision making. You are a Senior Finance Manager at Flyers plc.The company intends to bid for new five-year contracts to operate bus services in either Edinburgh, UK, or Newcastle upon Tyne, UK. Both contracts require the successful bidder to pay a franchise fee to secure the contract and to invest in a new fleet of buses. Sufficient funding is available to finance only one of these options. Assume that all cash flows occur at the end of the respective year.7,950 3,890 953,500 3,850 4,200 5,150 4,950 The company’s approach to investment appraisal was discussed at a recent meeting of Flyers plc’s senior executive team. Chang Ying Simmonds, Director of Marketing at Flyers plc, is keen to understand the nature of investment decisions. Chang Ying has commented:These decisions…arrow_forwardHarold McWilliams owns and manages a general merchandise store in a rural area of Virginia. Harold sells appliances, clothing, auto parts, and farming equipment, among a wide variety of other types of merchandise. Because of normal seasonal and cyclical fluctuations in the local economy, he knows that his business will also have these fluctuations, and he is planning to use CVP analysis to help him understand how he can expect his profits to change with these fluctuations. Harold has the following information for his most recent year. Cost of goods sold represents the cost paid for the merchandise he sells, while operating costs represent rent, insurance, and salaries, which are entirely fixed. Sales $ 740,000 Cost of merchandise sold 407,000 Contribution margin 333,000 Operating costs 153,900 Operating profit $ 179,100 Required: What is Harold’s margin of safety (MOS) in dollars? (Do not round intermediate calculations.) What is the margin of safety (MOS) ratio?…arrow_forwardYou are the chief financial officer (CFO) of Gaga Enterprises, an edgy fashion design firm. Your firm needs $11 million to expand production. How do you think the process of raising this money will vary if you raise it with the help of a financial institution versus raising it directly in the financial markets? ... The process of raising the money will vary if you raise it with the help of a financial institution versus raising it directly in the financial markets. Select all the statements below which support this statement: (Select all the answers that apply.) A. Raising the money directly in the financial markets will allow the Gaga Enterprises CFO to avoid the investment bank's commissions and thus raise more money at a lower cost per dollar raised. B. The investment banking institution will allow the Gaga Enterprises CFO to raise more money at a lower cost per dollar raised. C. Financial institutions, such as investment banks, provide expertise in the acquisition of funds. D.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education