Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

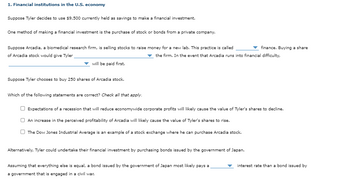

Transcribed Image Text:1. Financial institutions in the U.S. economy

Suppose Tyler decides to use $9,500 currently held as savings to make a financial investment.

One method of making a financial investment is the purchase of stock or bonds from a private company.

Suppose Arcadia, a biomedical research firm, is selling stocks to raise money for a new lab. This practice is called

finance. Buying a share

of Arcadia stock would give Tyler

the firm. In the event that Arcadia runs into financial difficulty,

will be paid first.

Suppose Tyler chooses to buy 250 shares of Arcadia stock.

Which of the following statements are correct? Check all that apply.

Expectations of a recession that will reduce economywide corporate profits will likely cause the value of Tyler's shares to decline.

An increase in the perceived profitability of Arcadia will likely cause the value of Tyler's shares to rise.

The Dow Jones Industrial Average is an example of a stock exchange where he can purchase Arcadia stock.

Alternatively, Tyler could undertake their financial investment by purchasing bonds issued by the government of Japan.

Assuming that everything else is equal, a bond issued by the government of Japan most likely pays a

a government that is engaged in a civil war.

interest rate than a bond issued by

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Pretend for a moment you owned a business but had no cash and your business was about to close because of no operating funds. You approach a Venture Capitalist and an Angel Investor, and both are willing to provide you with the necessary financing; however, you can only go with one. First part of the question is: Who would you choose and why? Second part of the question is: Where does Risk and Return fit in with both Venture Capitalists and Angot Inarrow_forwardThe company's bank won't lend it any more money than it already has, and investment bankers have said that debentures are out of the question. The treasurer has asked you to do some research and suggest a few ways in which bonds might be made attractive enough to allow the company to borrow. Explain how to secure the bonds with owned assets in great detial. In what ways does it make the bonds more attractive to allow the company to borrow?arrow_forward8. You work for a financial services company. The company is unsure how to interpret the hype in the market about the implications of digital innovation and disintermediation for its own future. You recall having studied some podcasts about the use of digital currency & the use of satellite imaging to disburse financial support during pandemic. Explain to your financial services company: How the digital currency is likely to impact the financial services industry? How the introduction of digital currency is likely to impact the conduct of monetary policy for a country? What is the potential role and prospects for Canada in its attempt to introduce digital currency?arrow_forward

- Hi I need help with this problem fill in options for blank 1 is debt or equity fill in options for blank 2 is a claim to partial ownership In or an IOU, or promise to pay, from fill in options for blank 3 is the stock holders or Osvaldo and the other bondholders fill in options for blank 4 is higher or lowerarrow_forward1. Interactions between financial market participants Financial markets facilitate the transfer of excess funds from those who have them to those who need them. In the following table, determine whether each financial market participant is a surplus unit or deficit unit. Financial Market Participant A state that is constantly running a budget deficit A firm that issues equity securities to expand operations A consumer that purchases equity securities from a new tech company Surplus Unit Deficit Unit S An angel investor Suppose Moonlit Productions needs to raise money to finance its new manufacturing facility, but their CFO does not want to part with any of the firm's equity. In this case, Moonlit Productions would likely issue securities to obtain the funding. Which of the following are ways that Moonlit Productions could obtain funds to finance the expansion of its operations, given its stated preference in the previous question? Check all that apply. Issue common stocks Issue…arrow_forwardYou're an analyst in the finance department of Flyover Corp., a new firm in a profitable but risky high-tech business. Several growth opportunities have presented themselves recently, but the company doesn't have enough capital to undertake them. Stock prices are down, so it doesn't make sense to try to raise new capital through the sale of equity. The company's bank won't lend it any more money than it already has, and investment bankers have said that debentures are out of the question. The treasurer has asked you to do some research and suggest a few ways in which bonds might be made attractive enough to allow Flyover to borrow. Write a thorough, concise and analytical document reflecting what you have learned during the term from the various chapters especially from the knowledge gained about valuation and characteristics of Bonds.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education