FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Based on the given data, prepare the

a. 2020

b. 2021

c. 2022

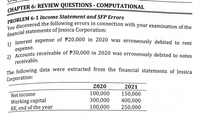

Transcribed Image Text:PROBLEM 6-1 Income Statement and SFP Errors

financial statements of Jessica Corporation:

1) Interest expense of P20,000 in 2020 was erroneously debited to rent

CHAPTER 6: REVIEW QUESTIONS - COMPUTATIONAL

2) Accounts receivable of P30,000 in 2020 was erroneously debited to notes

You discovered the following errors in connection with your examination of the

Enancial statements of Jessica Corporation:

еxpense.

receivable.

aa fellowing data were extracted from the financial statements of Jessica

Corporation:

2020

2021

Net income

Working capital

RE, end of the year

100,000

300,000

100,000

150,000

400,000

250,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company made a material error in calculating and reporting amortization expense in Year 1. The error was discovered in Year 2. The item should be reported as a prior period adjustment:arrow_forward42arrow_forwardQUESTION (b) Calculate the working capital cycle for both years. Year ended 31st December 2019 2018 Inventory - raw materials 108/751 х 365 53 days 145/971 х 365 55 days Inventory - work in progress 75/751 x 365 37 days 90/971 x 365 34 days Inventory - finished goods 86/751 x 365 42 days 125/971 x 365 47 days Receivables 171.2/868 x 365 72 days 255/999 х 365 93 days Payables 85/511 x 365 (61 days) 102.3/700 x 365 (53 days) Total working capital cycle 143 days 176 daysarrow_forward

- Use 2018 Form 990 and the 2019 audited financial statements for Feeding America. Although Form 990 indicates it is for 2018, it is actually for the period July 1, 2018, to June 30, 2019, the same time period as the 2019 audited financial statements. Required Compute the following performance measures using the Form 990. Using the annual financial statements, calculate the following performance measures. Compute the following performance measures using the Form 990. (Round your answers to two decimal places and the Going Concern ratio to three decimal places.) This is what I had come up with but they are all incorrect amounts. Let me know how I can sent the Form 990 to give you the figures. Liquidity Choose Numerator ÷ Choose Denominator = Ratio Current Assets Current Liabilities $106,955,173 ÷ $15,171,035 = 7.05 Going Concern Choose Numerator ÷ Choose Denominator = Ratio Revenue over expenses Total Expenses…arrow_forwardProvide the 2020 adjusting journal entry (both accounts and amounts) that Newell Brands made to record amortization on its finite-lived Intangible Assets. Assume that Newell Brands makes one adjusting journal entry for amortization expense at the end of each fiscal year as part of its adjusting entriesarrow_forwardD- Please solve all sub-part questions with all steps. Thanksarrow_forward

- . In determining the amount of a provision, a company using IFRS should generally measure: a. using the midpoint of the range between the lowest possible loss and the highest possible loss. b. using the minimum amount of the loss in the range. c. using the best estimate of the amount of the loss expected to occur. d. using the maximum amount of the loss in the range.arrow_forwardQuestion 14 what give rises to the changes in PBO balance? A- service cost and interest cost B- prior service cost that is caused by a change in pension formula C- changes in life expectancy estimates D- all of the above O A O C ODarrow_forwardWhen researching retirement obligations in the FASB Accounting Standards Codification you would look under section 210 310 410 510arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education