FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please do not provide soltion in image format thank you!

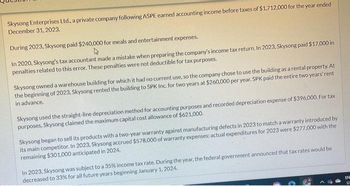

Transcribed Image Text:Skysong Enterprises Ltd., a private company following ASPE earned accounting income before taxes of $1,712,000 for the year ended

December 31, 2023.

During 2023, Skysong paid $240,000 for meals and entertainment expenses.

4

In 2020, Skysong's tax accountant made a mistake when preparing the company's income tax return. In 2023, Skysong paid $17,000 in

penalties related to this error. These penalties were not deductible for tax purposes.

Skysong owned a warehouse building for which it had no current use, so the company chose to use the building as a rental property. At

the beginning of 2023, Skysong rented the building to SPK Inc. for two years at $260,000 per year. SPK paid the entire two years' rent

in advance.

Skysong used the straight-line depreciation method for accounting purposes and recorded depreciation expense of $396,000. For tax

purposes, Skysong claimed the maximum capital cost allowance of $621,000,

Skysong began to sell its products with a two-year warranty against manufacturing defects in 2023 to match a warranty introduced by

its main competitor. In 2023, Skysong accrued $578,000 of warranty expenses: actual expenditures for 2023 were $277,000 with the

remaining $301,000 anticipated in 2024.

In 2023, Skysong was subject to a 35% income tax rate. During the year, the federal government announced that tax rates would be

decreased to 33% for all future years beginning January 1, 2024.

EN

LE

Transcribed Image Text:Calculate the amount of any temporary differences for 2023.

Temporary differences $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardhelp please, the answers I put are not correctarrow_forwardWhat is Contiguous data?arrow_forward

- How do you get a report into PDF format? Select an answer: You need to email the report and then convert it to PDF. Click on the Export button and Click on Export as PDF. You cannot export reports into PDF. You have to print the report and then scan it as a PDF.arrow_forwardPension Plan Entries Yuri Co. operates a chain of gift shops. The company maintains a defined contribution pension plan for its employees. The plan requires quarterly installments to be paid to the funding agent, Whims Funds, by the fifteenth of the month following the end of each quarter. Assume that the pension cost is $174,700 for the quarter ended December 31. a. Journalize the entry to record the accrued pension liability on December 31. Dec. 31 fill in the blank e66661fef043ffe_2 fill in the blank e66661fef043ffe_3 fill in the blank e66661fef043ffe_5 fill in the blank e66661fef043ffe_6 Journalize the entry to record the accrued pension liability payment to the funding agent on January 15. Jan. 15 fill in the blank cdac31fd9fc3ffd_2 fill in the blank cdac31fd9fc3ffd_3 fill in the blank cdac31fd9fc3ffd_5 fill in the blank cdac31fd9fc3ffd_6 b. The pension plan where a company pays the employee a fixed annual amount based on a…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education